FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Catena's Marketing Company has the following adjusted

| Catena’s Marketing Company | ||

| Adjusted Trial Balance | ||

| End of the Current Year | ||

| Debit | Credit | |

|---|---|---|

| Cash | $1,580 | |

| 2,360 | ||

| Interest receivable | 132 | |

| Prepaid insurance | 1,760 | |

| Long-term notes receivable | 3,600 | |

| Equipment | 16,890 | |

| $3,320 | ||

| Accounts payable | 2,720 | |

| Dividends payable | 680 | |

| Accrued expenses payable | 4,080 | |

| Income taxes payable | 1,872 | |

| Unearned rent revenue | 580 | |

| Common Stock (960 shares) | 96 | |

| Additional paid-in capital | 3,780 | |

| 1,720 | ||

| Sales revenue | 42,180 | |

| Rent revenue | 880 | |

| Interest revenue | 132 | |

| Wages expense | 21,100 | |

| Depreciation expense | 2,120 | |

| Utilities expense | 444 | |

| Insurance expense | 894 | |

| Rent expense | 9,320 | |

| Income tax expense | 1,840 | |

| Total | $62,040 | $62,040 |

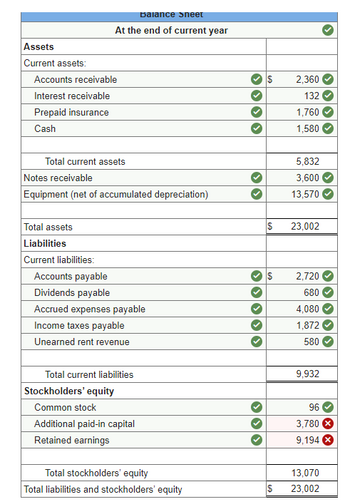

Prepare a classified

Transcribed Image Text:Assets

Current assets:

Accounts receivable

Interest receivable

Prepaid insurance

Cash

Balance sneet

At the end of current year

Total current assets

Notes receivable

Equipment (net of accumulated depreciation)

Total assets

Liabilities

Current liabilities:

Accounts payable

Dividends payable

Accrued expenses payable

Income taxes payable

Unearned rent revenue

Total current liabilities

Stockholders' equity

Common stock

Additional paid-in capital

Retained earnings

Total stockholders' equity

Total liabilities and stockholders' equity

$

$

2,360

132

1,760

1,580

$ 23,002

$

5,832

3,600

13,570

2,720

680

4,080

1,872

580

9,932

96

3,780 X

9,194

13,070

23,002

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The balance sheet for Seuss Company at the end of the current fiscal year indicated the following: Bonds payable, 10% (20-year term) $5,000,000 Preferred 10% stock, $100 par 1,000,000 Common stock, $10 par 2,000,000 Income before income tax was $1,500,000, and income taxes were $200,000 for the current year. Cash dividends paid on common stock during the current year totaled $150,000. The common stock sells for $75 per share at the end of the year. Required: Determine each of the following: Round to one decimal place except earnings per share and dividends per share, which should be rounded to two decimal places. a. Times interest earned times b. Earnings per share on common stock c. Price-earnings ratio d. Dividends per share of common stock e. Dividend yield %arrow_forwardKelley Company reports $1,875,000 of net income and declares $262,500 of cash dividends on its preferred stock for the year. At year-end, the company had 390,000 weighted-average shares of common stock. 1. What is the company's basic earnings per share (EPS)? 2. In the prior year, Kelley had a basic earnings per share (EPS) of $3.93. Did Kelly improve its earnings per share (EPS) in the current year? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the company's basic earnings per share (EPS)? Basic earnings per share Choose Numerator: I Choose Denominator: Net income available to common stockholders Weighted-average outstanding shares = Basic earnings per sharearrow_forwardMarkus Company’s common stock sold for $1.75 per share at the end of this year. The company paid a common stock dividend of $0.42 per share this year. It also provided the following data excerpts from this year’s financial statements: Ending Balance Beginning Balance Cash $ 27,000 $ 43,800 Accounts receivable $ 48,000 $ 41,300 Inventory $ 45,100 $ 48,000 Current assets $ 120,100 $ 133,100 Total assets $ 312,000 $ 263,800 Current liabilities $ 49,500 $ 34,500 Total liabilities $ 82,000 $ 73,800 Common stock, $1 par value $ 105,000 $ 105,000 Total stockholders’ equity $ 230,000 $ 190,000 Total liabilities and stockholders’ equity $ 312,000 $ 263,800 This Year Sales (all on account) $ 580,000 Cost of goods sold $ 336,400 Gross margin $ 243,600 Net operating income $ 49,500 Interest expense $ 3,000 Net income $ 32,550 6. What is the book value per share at the end of this year?arrow_forward

- Gympa reported on its income statement a net income $647,000 for the year ended December 31 before considering the following: a. During the year, Gympa purchased trading securities b. At year-end , the fair value of the investment portfolio was $50,000 lesshan the cost c. The balance of Retained Earnings was $792,000 on January 1 d. Gympa paid $67,000 in cash dividends during the year. Using the above data, calculate the balance of Retained Earnings on Decemeber 31.arrow_forwardRomney's Marketing Company has the following adjusted trial balance at the end of the current year. The company issued 420 shares at the end of the year for $4,200 cash (for a total of 840 shares at the end of the year). The effect of this transaction is included below. Cash Accounts receivable Interest receivable Prepaid insurance Notes receivable (long-term) Equipment Accumulated depreciation Accounts payable Accrued expenses payable Income taxes payable Deferred rent revenue Contributed capital (840 shares) Retained earnings Dividends declared Sales revenue Interest revenue Rent revenue Wages expense Depreciation expense Utilities expense Insurance expense Rent expense Income tax expense Total Debit $ 2,700 Credit 3,400 220 2,800 4,000 17,090 $ 4,200 3,600 4,520 3,300 1,100 4,900 3,440 720 43,300 220 1,400 20,700 2,400 500 1,350 10,200 3,900 $69,260 $69,260 Prepare a statement of financial position in good form at the end of the current year.arrow_forwardShareholders' Equity Tinman Corporation reports the following balances at the end of the current year: Common Stock, $5 par, $50,000; Retained earnings, $110,000; Additional Paid-in Capital on Common Stock, $200,000; Income Taxes Payable, $9,800; and Accumulated Other Comprehensive Income, $26,000. Prepare the shareholders' equity section of Tinman's year-end balance sheet. Tinman Corporation Partial Balance Sheet December 31 Shareholders' Equity Contributed Capital: Total contributed capital Total Shareholders' Equityarrow_forward

- Markus Company’s common stock sold for $1.75 per share at the end of this year. The company paid a common stock dividend of $0.42 per share this year. It also provided the following data excerpts from this year’s financial statements: Ending Balance Beginning Balance Cash $ 27,000 $ 43,800 Accounts receivable $ 48,000 $ 41,300 Inventory $ 45,100 $ 48,000 Current assets $ 120,100 $ 133,100 Total assets $ 312,000 $ 263,800 Current liabilities $ 49,500 $ 34,500 Total liabilities $ 82,000 $ 73,800 Common stock, $1 par value $ 105,000 $ 105,000 Total stockholders’ equity $ 230,000 $ 190,000 Total liabilities and stockholders’ equity $ 312,000 $ 263,800 This Year Sales (all on account) $ 580,000 Cost of goods sold $ 336,400 Gross margin $ 243,600 Net operating income $ 49,500 Interest expense $ 3,000 Net income $ 32,550 3. What are the dividend payout ratio and the dividend yield ratio?arrow_forwardCatena's Marketing Company has the following adjusted trial balance at the end of the current year. Cash dividends of $620 were declared at the end of the year, and 500 additional shares of common stock ($0.10 par value per share) were issued at the end of the year for $3,080 in cash (for a total at the end of the year of 840 shares). These effects are included below: Catena's Marketing Company Adjusted Trial Balance End of the Current Year Cash Accounts receivable Interest receivable Prepaid insurance. Long-term notes receivable Equipment Accumulated depreciation Accounts payable Dividends payable Accrued expenses payable Income taxes payable. Unearned rent revenue Common Stock (840 shares) Additional paid-in capital Retained earnings Sales revenue Rent revenue Interest revenue Wages expense Depreciation expense Utilities expense Insurance expense Rent expense Income tax expense Total Debit $1,520 2,240 108 1,640 3,000 15,690 19,900 1,880 396 786 Credit $3,080 2,480 620 3,960 1,728…arrow_forwardPlease answer competely and properlyarrow_forward

- Helio Co. has retained earnings at the beginning of the current year of $400,000. During the current year net income of $70,000 was earned, and a cash dividend of $1.00 per share was declared and paid on the 50,000 shares of common stock outstanding. Prepare a statement of retained earnings as of the end of the current year.arrow_forwardThe following information was taken from the financial statements of Tolbert Inc. for December 31 of the current fiscal year: Common stock, $30 par value (no change during the year) $5,400,000 Preferred $5 stock, $100 par (no change during the year) 2,000,000 The net income was $604,000 and the declared dividends on the common stock were $45,000 for the current year. The market price of the common stock is $22.40 per share. For the common stock, determine (a) the earnings per share, (b) the price-earnings ratio, (c) the dividends per share, and (d) the dividend yield. If required, round your answers to two decimal places. a. Earnings per Share $fill in the blank 1 b. Price-Earnings Ratio fill in the blank 2 c. Dividends per Share $fill in the blank 3 d. Dividend Yield fill in the blank 4 %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education