FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

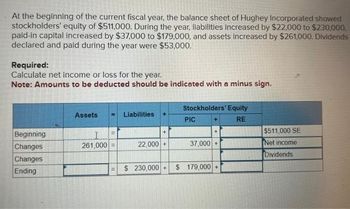

Transcribed Image Text:At the beginning of the current fiscal year, the balance sheet of Hughey Incorporated showed

stockholders' equity of $511,000. During the year, liabilities increased by $22,000 to $230,000,

paid-in capital increased by $37,000 to $179,000, and assets increased by $261,000. Dividends

declared and paid during the year were $53,000.

Required:

Calculate net income or loss for the year.

Note: Amounts to be deducted should be indicated with a minus sign.

Beginning

Changes

Changes

Ending

Assets

261,000 =

11

Liabilities

22,000+

Stockholders' Equity

RE

PIC

37,000+

$ 230,000+ $ 179,000+

$511,000 SE

Net income

Dividends

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Required information [The following information applies to the questions displayed below.] Lone Star Company is a calendar-year corporation, and this year Lone Star reported $148,000 in current E&P that accrued evenly throughout the year. At the beginning of the year, Lone Star's accumulated E&P was $17,760. Lone Star declared $44,400 in cash distributions on each of the following dates: April 1, July 1, October 1, and December 31. Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. c. If Matt's basis in the Lone Star shares was $10,360 at the beginning of the year, how much capital gain will he recognize on the sale and distributions from Lone Star? Capital gain recognized on the sale and distribution 32arrow_forwardNonearrow_forwardFor the current year, Vidalia Company reported revenues of $250,000 and expenses of $225,000. At the beginning of the year, its retained earnings had a balance of $95,000. During the year, Vidalia paid $11,000 dividends to shareholders. Its contributed capital was $56,000 at the beginning of the year, and it did not issue any new stock during the year. Vidalia's assets total $237,500 on December 31 of the current year. What are Vidalia's total liabilities on December 31 of the current year?arrow_forward

- WD Corporation reports the following year-end balance sheet data. The company's debt-to-equity ratio equals: Cash $ 42,000 Current liabilities $ 77,000 Accounts receivable 57,000 Long-term liabilities 28,000 Inventory 62,000 Common stock 102,000 Equipment 147,000 Retained earnings 101,000 Total assets $ 308,000 Total liabilities and equity $ 308,000arrow_forwardNeed help with this questionarrow_forward[The following information applies to the questions displayed below.] Markus Company’s common stock sold for $5.25 per share at the end of this year. The company paid a common stock dividend of $0.63 per share this year. It also provided the following data excerpts from this year’s financial statements: EndingBalance BeginningBalance Cash $ 49,000 $ 44,200 Accounts receivable $ 92,000 $ 68,700 Inventory $ 76,300 $ 92,000 Current assets $ 217,300 $ 204,900 Total assets $ 801,000 $ 875,400 Current liabilities $ 85,500 $ 90,000 Total liabilities $ 206,000 $ 185,400 Common stock, $1 par value $ 165,000 $ 165,000 Total stockholders’ equity $ 595,000 $ 690,000 Total liabilities and stockholders’ equity $ 801,000 $ 875,400 This Year Sales (all on account) $ 1,095,000 Cost of goods sold $ 635,100 Gross margin $ 459,900 Net operating income $ 313,875 Interest expense $ 15,500 Net income $ 208,862 10. What is the…arrow_forward

- The following are selected account balances of Rule Corporation at the end of the current year: Debit Credit Operating Expenses $3,200 Sales Revenue $17,780 Cost of Goods Sold 8,500 Interest Expense 790 Gain on Sale of Land 590 Rule is subject to a 30% income tax rate, and shareholders own 1,200 shares of its capital stock. Required: Prepare the income statement for Rule. RULE CORPORATION Income Statement For the Year Ended December 31, Current Year Other items: Earnings per sharearrow_forwardThe income statement for Cullumber, Inc. is as follows: CULLUMBER, INC. Income Statement For the Year Ended December 31, 2021 Sales revenue $442,000 Cost of goods sold 264,000 Gross profit 178,000 Expenses (including $19,000 interest and $36,700 income taxes) 114.000 Net income $64,000 Additional information: 1 2 Common stock outstanding January 1, 2021 was 44,000 shares and 54,000 shares were outstanding at December 31, 2021. The market price of Cullumber, Inc., stock was $16 in 2021. 3. Cash dividends of $17,130 were paid, $1,770 of which were to preferred stockholders. Compute the following measures for 2021: (Round Earnings per share to 2 decimal places, eg. 52.75. Round other answers to 1 decimal place, e.g. 52.7.) (a) Earnings per share $ (b) Price-earnings ratio (c) Payout ratio (d) Times interest earned 1.31 12.2 times 26.7 % timesarrow_forwardThe year-end balance sheet of Star Inc. shows total assets of $12,407 million, operating assets of $9,849 million, operating liabilities of $5,291 million, and shareholders’ equity of $5,532 million.The company's year-end net operating assets are: Select one: a. $9,849 million b. $17,698 million c. $15,140 million d. None of these are correct. e. $4,558 millionarrow_forward

- Examine the following selected financial information for Best Value Corporation and Modern Stores, Inc., as of the end of their fiscal years ending in 2018: Data table (In millions) Best Value Corporation Modern Stores, Inc. 1. Total assets. . . . . . . . . . . . . . . . . . . . . . . . . . $15,256 $203,110 2. Total common stockholders' equity. . . . . $3,075 $71,460 3. Operating income. . . . . . . . . . . . . . . . . . . . $1,350 $26,820 4. Interest expense. . . . . . . . . . . . . . . . . . . . . . $88 $2,020 5. Leverage ratio. . . . . . . . . . . . . . . . . . . . . . . . 6. Total debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. Debt ratio. . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. Times interest earned. . . . . . . . . . . . . . . . . Requirements…arrow_forwardBalance Sheet Jack and Jill Corporation's year-end 2009 balance sheet lists current assets of $257,000, fixed assets of $807,000, current liabilities of $188,000, and long-term debt of $293,000. What is Jack and Jill's total stockholders' equity? Multple Cholce $583.000 $1,064,000 $481,000 There Is not enough Information to calculate total stockholder's equity. Prev 1 of 8 Score answer> 9:43 AM 42°F Mostly sunny ype here to search 11/5/2021 21 DELLarrow_forwardA company's balance sheet showed the following amounts for liabilities and stockholders' equity accounts: Current Liabilities, $50,000; Bonds Payable, $600,000; Long-Term Lease Obligations, $120,000; and Deferred Income Tax Liability, $20,000. Total stockholders' equity was $520,000. What is the debt to equity ratio?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education