Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

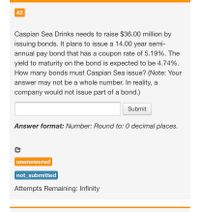

Transcribed Image Text:#2

Caspian Sea Drinks needs to raise $36.00 million by

issuing bonds. It plans to issue a 14.00 year semi-

annual pay bond that has a coupon rate of 5.19%. The

yield to maturity on the bond is expected to be 4.74%.

How many bonds must Caspian Sea issue? (Note: Your

answer may not be a whole number. In reality, a

company would not issue part of a bond.)

Submit

Answer format: Number: Round to: 0 decimal places.

unanswered

not_submitted

Attempts Remaining: Infinity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please solve it in excel with Formulas explanationarrow_forward(Immunization of FI) Consider a financial institution whose asset and liability both consist of coupon bonds only. The asset is a 10-year bond with face value $100 million, coupon rate 9.8% and yield 4%, while the liability is a 15-year bond with face value $100 million, coupon rate 8.2% and yield 4%. Both bonds pay coupon semiannually. Assume parallel yield shift. Required precision: 4 digits after decimal point for duration calculation; 2 digits after decimal point for dollar amount in million, e.g. $12.34 million; 4 digits after decimal point for percentage (coupon) rates, e.g. 1.2345%. (a) What are the market values of asset, liability and equity of this FI? What is its leverage-adjusted modified duration gap? (b) According to the duration model, what would the market value of equity be for a 10 basis points decrease in the yield? (c) To immunize itself from interest rate risk, the FI plans to restructure its asset bond by adjusting its face value and coupon rate, while keeping the…arrow_forwardDesert Trading Company has issued $100 million worth of long-term bonds at a fixed rate of 10%. The firm then enters into an interest rate swap where it pays SOFR and receives a fixed 5% on notional principal of $100 million. What is the firm's effective interest rate on its borrowing? Only typing answer Please answer explaining in detail step by step without table and graph thankyouarrow_forward

- ReNew Corporation raises funds to build renewable energy systems by issuing 3-year bonds with a coupon rate of 6% and a face value of $1,300. Assume that the market interest rate for a 3-year bond issued by a firm like ReNew is currently the same as the coupon rate. The price of each of these bonds is Suppose that the market interest rate for bonds that are similar to the ReNew bond has increased to 8%. The price of the ReNew bond changes toarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardA company is trying to issue a 15-year, BB-rated, semi-annual paying bond with 6% annual coupon rate. If the appropriate annual discount rate for the bond issuance is 3% and the current credit risk premium for BB-rated bond is 3.5%, what is the current market price of this bond? $952.55 $852.25 $1011.36 $1213.25arrow_forward

- A company is going to undertake an issue of $100 million of high yield bonds, with a maturity of 5 years. The bonds are rated BB. The coupon on the bonds is 5%, paid semi-annually. The underwriter is charging a commission of 2%. What is the effective yield on the bonds, from the company's point of view? Group of answer choices 5.46 % 7.00% 5.75% 2.73%arrow_forward(Related to Checkpoint 9.2) (Yield to maturity) Abner Corporation's bonds mature in 17 years and pay 8 percent interest annually. If you purchase the bonds for $825, what is your yield to maturity? Question content area bottom Part 1 Your yield to maturity on the Abner bonds is enter your response here%. (Round to two decimal places.)arrow_forwardCreate an essay using the following information: Assume you are evaluating whether to purchase the following $1,000 face value bonds: Co. X bond with a 6% coupon rate that matures in 9 years. Co. Y bond with an 11% coupon rate that matures in 7 years. Also, you may wish to review https://t.ly/wJqNM and https://t.ly/2EX2k about corporate junk (junk bonds). Given the scenario and information about junk bonds, address the following: Value these bonds assuming a market rate on similar risk bonds is 7% and interest is paid annually. Value these bonds assuming a market rate on similar risk bonds is 7% and interest is paid semi-annually. Value these bonds assuming a market rate on similar risk bonds is 12% and interest is paid annually. Assuming both bonds were issued at the same time, why would the Co. Y bond pay a higher coupon rate?arrow_forward

- An insurance company is analyzing the following three bonds, each with five years to maturity, annual interest payments, and is using duration as its measure of interest rate risk. What is the duration of each of the three bonds? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) a. $10,000 par value, coupon rate=9.7%, r 0.17 b. $10,000 par value, coupon rate 11.7%, r= 0.17 c. $10,000 par value, coupon rate = 13.7%, p=0.17 Duration of the bond yearsarrow_forwardHello, How do i solve this corporate finanace question without the use of excel. A financial calculator can be used if required. Can you please show each step in the calculation process? Find the annual rate of this coupon bond: A corporate bond with a face value of $1,000 and coupons paid semi-annually, sells for $1,058.39. The term to maturity is 15 years. The yield to maturity of similar bonds is 9.5%.arrow_forwardAm. 335.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education