Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

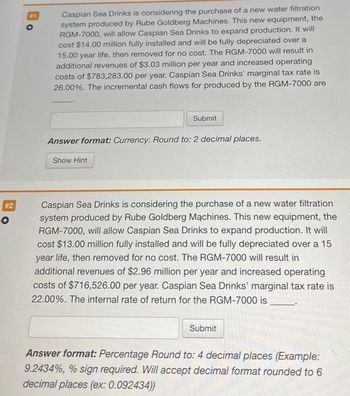

Transcribed Image Text:# 2

✪

Caspian Sea Drinks is considering the purchase of a new water filtration

system produced by Rube Goldberg Machines. This new equipment, the

RGM-7000, will allow Caspian Sea Drinks to expand production. It will

cost $14.00 million fully installed and will be fully depreciated over a

15.00 year life, then removed for no cost. The RGM-7000 will result in

additional revenues of $3.03 million per year and increased operating

costs of $783,283.00 per year. Caspian Sea Drinks' marginal tax rate is

26.00%. The incremental cash flows for produced by the RGM-7000 are

Submit

Answer format: Currency: Round to: 2 decimal places.

Show Hint

Caspian Sea Drinks is considering the purchase of a new water filtration

system produced by Rube Goldberg Machines. This new equipment, the

RGM-7000, will allow Caspian Sea Drinks to expand production. It will

cost $13.00 million fully installed and will be fully depreciated over a 15

year life, then removed for no cost. The RGM-7000 will result in

additional revenues of $2.96 million per year and increased operating

costs of $716,526.00 per year. Caspian Sea Drinks' marginal tax rate is

22.00%. The internal rate of return for the RGM-7000 is

Submit

Answer format: Percentage Round to: 4 decimal places (Example:

9.2434%, % sign required. Will accept decimal format rounded to 6

decimal places (ex: 0.092434))

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Lukow Products is investigating the purchase of a piece of automated equipment that will save $150,000 each year in direct labor and inventory carrying costs. This equipment costs $800,000 and is expected to have a 5-year useful life with no salvage value. The company’s required rate of return is 12% on all equipment purchases. Management anticipates that this equipment will provide intangible benefits such as greater flexibility and higher-quality output that will result in additional future cash inflows. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the net present value of the piece of equipment before considering its intangible benefits? (Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount.) 2. What minimum dollar value per year must be provided by the equipment’s intangible benefits to justify the $800,000 investment? (Do not round intermediate…arrow_forwardDomesticarrow_forwardCarson Trucking is considering whether to expand its regional service center in Mohab, UT. The expansion requires the expenditure of $10,500,000 on new service equipment and would generate annual net cash inflows from reduced costs of operations equal to $2,000,000 per year for each of the next 9 years. In year 9 the firm will also get back a cash flow equal to the salvage value of the equipment, which is valued at $1.2 million. Thus, in year 9 the investment cash inflow totals $3,200,000. Calculate the project's NPV using a discount rate of 10%. If the discount rate is 10%, then the project's NPV is $____________arrow_forward

- Lumberjack Power, operator of a nuclear power plant, is planning to replace its current equipment with some that is more environmentally friendly. The old equipment has annual operating expenses of $6750 and can be kept for 8 more years. The equipment will have a salvage value of $4000, if sold 8 years from now, and has a current market value of $24,000, if it is sold now. The new equipment has an initial cost of $62,000 and has estimated annual operating expenses of $6250 each year. The estimated market value of the new equipment is $19,000 after 8 years of operation. If the company's MARR is 16% per year, should the equipment be replaced? Use a study period of 8 years and the present worth method.arrow_forwardCarson Trucking is considering whether to expand its regional service center in Mohab, UT. The expansion requires the expenditure of $9,500,000 on new service equipment and would generate annual net cash inflows from reduced costs of operations equal to $2,000,000 per year for each of the next 6 years. In year 6 the firm will also get back a cash flow equal to the salvage value of the equipment, which is valued at $1 million. Thus, in year 6 the investment cash inflow totals $3,000,000. Calculate the project's NPV using a discount rate of 7 percent.arrow_forwardCor's Dog House is considering the installation of a new computerized pressure cooker for hot dogs. The cooker will increase sales by $10,100 per year and will cut annual operating costs by $11,750. The new system will also prompt a $4,900 increase in net working capital. The system will cost $60,200 to purchase and install. This system is expected to have a 4-year life and will be depreciated to zero using straight-line depreciation and have no salvage value. The tax rate is 21 percent and the required return is 10.5 percent. What is the NPV of purchasing the pressure cooker? OCF = $ CFO = S CF4=$ NPV = It It It It It 11 11arrow_forward

- Cameron Industries is purchasing a new chemical vapor depositor in order to make silicon chips. It will cost $6,000,000 to buy the machine and $20,000 to have it delivered and installed Building a clean room in the plant for the machine will cost an additional $3 million. The machine is expected to raise gross profits by $3,000,000 per year, starting at the end of the first year, with associated costs of $1 million for each of those years. The machine is expected to have a working life of six years and will be depreciated over those six years. The marginal tax rate is 20%. What are the incremental free cash flows associated with the new machine in year 0? OA-$6,000,000 OB. -$8,118,000 C. $1,003,333 OD. -$9.020,000arrow_forwardLukow Products is investigating the purchase of a piece of automated equipment that will save $130,000 each year in direct labor and inventory carrying costs. This equipment costs $780,000 and is expected to have a 6-year useful life with no salvage value. The company's required rate of return is 10% on all equipment purchases. Management anticipates that this equipment will provide intangible benefits such as greater flexibility and higher-quality output that will result in additional future cash inflows. Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the net present value of the piece of equipment before considering its intangible benefits? Note: Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount. 2. What minimum dollar value per year must be provided by the equipment's intangible benefits to justify the $780,000 investment? Note: Do not round…arrow_forwardThe Baltic Company is considering the purchase of a new machine tool to replace an obsolete one. The machine being used for the operation has a current book value of $80,000, with an annual depreciation expense of $8,000. It has a resale value today of $40,000, is in good working order, and will last, physically, for at least 10 more years. The proposed machine will perform the operation so much more efficiently that Baltic engineers estimate that labor, material, and other direct costs of the operation will be reduced $60,000 a year if it is installed. The proposed machine costs $240,000 delivered and installed, and its economic life is estimated at 10 years, with zero salvage value. The company expects to earn 14 percent on its investment after taxes (14 percent is the firm's cost of capital). The tax rate is 22 percent, and the firm uses straight-line depreciation. Any gain or loss on the sale of the machine at retirement is subject to tax at 40 percent. Would it be better…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education