Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

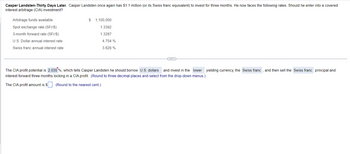

Transcribed Image Text:Casper Landsten-Thirty Days Later. Casper Landsten once again has $1.1 million (or its Swiss franc equivalent) to invest for three months. He now faces the following rates. Should he enter into a covered

interest arbitrage (CIA) investment?

Arbitrage funds available

Spot exchange rate (SFr/$)

3-month forward rate (SFr/$)

U.S. Dollar annual interest rate

Swiss franc annual interest rate

$ 1,100,000

1.3392

1.3287

4.754 %

3.628 %

The CIA profit potential is 2.035%, which tells Casper Landsten he should borrow U.S. dollars and invest in the lower yielding currency, the Swiss franc, and then sell the Swiss franc principal and

interest forward three months locking in a CIA profit. (Round to three decimal places and select from the drop-down menus.)

The CIA profit amount is $

(Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- On April 1, 2017, Mendoza Company borrowed 508,000 euros for one year at an interest rate of 5 percent per annum. Mendoza must make its first interest payment on the loan on October 1, 2017 and will make a second interest payment on March 31, 2018 when the loan is repaid. Mendoza prepares U.S.-dollar financial statements and has a December 31 year-end. Prepare all journal entries related to this foreign currency borrowing assuming the following exchange rates for 1 euro: April 1, 2017 $ 1.10 October 1, 2017 1.20 December 31, 2017 1.24 March 31, 2018 1.28arrow_forwardThe treasurer of a major U.S. firm has $38 million to invest for three months. The interest rate in the United States is .55 percent per month. The interest rate in Great Britain is .59 percent per month. The spot exchange rate is £.76, and the three-month forward rate is £77. Ignore transaction costs. a. If the treasurer invested the company's funds in the U.S., how much would the investment be worth after three months? Note: Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89. b. If the treasurer invested the company's funds in Great Britain, how much would the investment be worth after three months in U.S. dollars? Note: Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89. a. U.S. investment b. Great Britain investmentarrow_forwardAnnual interest rate on 90-day U.S. asset is 4%, annual interest rate on 90-day UK asset is 8%, and the spot rate is $1=1,000 pound a) If you expect the spot rate to be $1=1075 after three months, where do you invest? b) If you also expect the U.S. interest rate to increase to 5% in 90 days, where do you invest?arrow_forward

- Star Alien (US company) sold equipment to Heavy Metal Industry (Italian company) for 1-million-euro receivable in one year. The current spot rate is $1.15/€ and the one-year forward rate is $1.20/€. The annual interest rate is 5 percent in Italy and 8 percent in the United States. Star Alien can also purchase a one-year put option on the euro at the strike price of $1.18 per euro for a premium of 9 cents per Euro. What is the future dollar proceeds of this sale using the money market hedge? Question 1 options: $1,180,000. $1,102,800. $1,150,000. $1,118,056. $1,200,000. $1,182,857.arrow_forwardOn April 1, 2017, Mendoza Company borrowed 500,000 euros for one year at an interest rate of 5 percent per annum. Mendoza must make its first interest payment on the loan on October 1, 2017, and will make a second interest payment on March 31, 2018, when the loan is repaid. Mendoza prepares U.S.-dollar financial statements and has a December 31 year-end. Prepare all journal entries related to this foreign currency borrowing assuming the following exchange rates for 1 euro:arrow_forwardStar Alien (US company) sold equipment to Heavy Metal Industry (Italian company) for 1-million-euro receivable in one year. The current spot rate is $1.15/€ and the one-year forward rate is $1.20/€. The annual interest rate is 5 percent in Italy and 8 percent in the United States. Star Alien can also purchase a one-year put option on the euro at the strike price of $1.18 per euro for a premium of 9 cents per Euro. Assuming that the forward exchange rate is the best predictor of the future spot rate, what is the expected future dollar revenue when the option hedge is used? $1,200,000. $1,150,000. $1,297,200. $1,180,000. $1,180,000. $1,082,800. $1,102,800.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education