Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

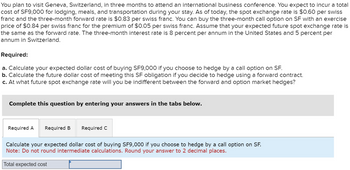

Transcribed Image Text:You plan to visit Geneva, Switzerland, in three months to attend an international business conference. You expect to incur a total

cost of SF9,000 for lodging, meals, and transportation during your stay. As of today, the spot exchange rate is $0.60 per swiss

franc and the three-month forward rate is $0.83 per swiss franc. You can buy the three-month call option on SF with an exercise

price of $0.84 per swiss franc for the premium of $0.05 per swiss franc. Assume that your expected future spot exchange rate is

the same as the forward rate. The three-month interest rate is 8 percent per annum in the United States and 5 percent per

annum in Switzerland.

Required:

a. Calculate your expected dollar cost of buying SF9,000 if you choose to hedge by a call option on SF.

b. Calculate the future dollar cost of meeting this SF obligation if you decide to hedge using a forward contract.

c. At what future spot exchange rate will you be indifferent between the forward and option market hedges?

Complete this question by entering your answers in the tabs below.

Required A Required B Required C

Calculate your expected dollar cost of buying SF9,000 if you choose to hedge by a call option on SF.

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

Total expected cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Select all of the following statements that accurately compare or contrast forwards and options: Group of answer choices Taking naked long positions in either a call or forward will lead to an overall long position in the underlying security. Options and forwards always have identical payoffs if the spot price remains the same. Both options and forwards can be used to reduce exposure to foreign exchange risk. Going long a naked put option and going short a naked forward both cause unlimited liability. Both options and forwards require the payment of a premium at the initiation of the contract. Forward contracts impose obligations on both parties in the transaction. Options contracts only impose an obligation on one party.arrow_forwardAssume a company needs to hedge payables. Which of the following conditions has to be met so a company would choose the options hedge? The break-even spot exchange rate is greater than the forward exchange rate. The break-even spot exchange rate is less than the forward exchange rate. The break-even spot exchange rate is less than the spot exchange rate. The break-even spot exchange rate is greater than the spot exchange rate.arrow_forwardGiven the following information, predict the European call option's new price after the risk free rate changes. Initial call option price = $3 Initial risk free rate = 9.9% Rho = 9 New risk free rate = 9.5% (required precision 0.01 +/- 0.01) Greeks Reference Guide: Delta = ∂π/∂S Theta = ∂π/∂t Gamma = (∂2π)/(∂S2) Vega = ∂π/∂σ Rho = ∂π/∂r Recall that rho is defined as the partial derivative of the option's price with respect to the risk free rate. (i.e. rho = ∂π / ∂r).arrow_forward

- h) discuss the relationship between the prices of puts, calls, and forward/futures contracts on the same underlying asset using the put-call-forward/futures parity. i) discuss the boundary conditions on the prices of American and European call option contracts on futures. j) explain and discuss the use of interest rate parity in pricing foreign currency forwards and futures. k) describe how spot prices are determined using the cost-of-carry model.arrow_forwardQ9. How would you hedge the risk of a price rise using a derivative? Group of answer choices 1. You would take out a spot contract to sell the underlying. 2. You would take out a forward contract to sell the underlying. 3. You would take out a spot contract to buy the underlying. 4. You would take out a forward contract to buy the underlying.arrow_forwardA(n). OOO futures hedge is most likely to result in ongoing payments over the life of the foreign exchange instrument. options money market forwardarrow_forward

- Which one of the following statements is true? Multiple Choice O O O O A call with a strike price of $25 and a stock price of $23 has positive intrinsic value. A European style option is more valuable than an American style option. An American style out-of-the-money call option can have a positive value. A $40 put option has more intrinsic value than a $50 put option on the same underlying asset. The time value of an option is equal to the intrinsic value minus the option premium.arrow_forwardi)identify, analyze and discuss the following characteristics of an American put option: maximum value, intrinsic value, time value, lower bound, and payoff at expiration. ii) analyze and discuss the following factors on an American put option: time to expiration, exercise price, interest rate, volatility, and dividends. iii) identify, analyze, and discuss the following characteristics of a European call option: maximum value, intrinsic value, time value, lower bound, and payoff at expiration. iv) analyze and discuss the following factors on a European call option: time to expiration, exercise price, interest rate,arrow_forwardAssume that K=61, St =65, t = 0.25 (i.e. time to expiry is 3 months), and the risk-free rate is 0.04. The current price of the put option is p = 4. What would the price of the call option ‘c’ need to be for put-call parity to hold?arrow_forward

- To hedge payables, the firm will purchase a currency call option on the payable foreign currency. The firm can use the call option to buy foreign currency at a specified price. Why should the company, in this case, purchase a call option than a Forward contract? Maybe to make it easy on me, you can illustrate the answer by highlighting the situations suitable for options and Forward contracts. For example, "when this situation occurs....., then that hedging we should use .... because of XYZ reasons/effects on profitability".arrow_forwardConsider a call and a put options with the same strike price and time to expiry. Given that the strike price is exactly equals to the forward price, then: A. Put and call have same premium B. The premium of the put is equal to the forward price C. The premium of the put is equal to the premium of the call plus the present value of the strike D. The premium of the call is equal to the forward pricearrow_forward26. Suppose an investor buy a European call option at price c, K is the strike price and ST is the spot price of the asset at maturity of the contract, when ( ),the investor will exercise the option.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education