Accounting Information Systems

10th Edition

ISBN: 9781337619202

Author: Hall, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

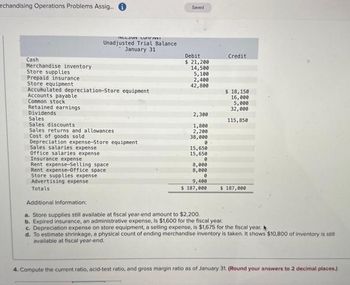

Transcribed Image Text:rchandising Operations Problems Assig....

Cash

Merchandise inventory

Store supplies

Prepaid insurance

Store equipment

RELOUN LUPIENVE

Unadjusted Trial Balance

January 31

Accumulated depreciation-Store equipment

Accounts payable

Common stock

Retained earnings

Dividends

Sales

Sales discounts

Sales returns and allowances

Cost of goods sold

Depreciation expense-Store equipment

Sales salaries expense

Office salaries expense

Insurance expense

Rent expense-Selling space

Rent expense-Office space

Store supplies expense

Advertising expense

Totals

Saved

Debit

$ 21,200

14,500

5,100

2,400

42,800

2,300

1,800

2,200

38,000

0

15,650

15,650

0

8,000

8,000

0

9,400

$ 187,000

Credit

$ 18,150

16,000

5,000

32,000

115,850

$ 187,000

Additional Information:

a. Store supplies still available at fiscal year-end amount to $2,200.

b. Expired insurance, an administrative expense, is $1,600 for the fiscal year.

c. Depreciation expense on store equipment, a selling expense, is $1,675 for the fiscal year.

d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $10,800 of inventory is still

available at fiscal year-end.

4. Compute the current ratio, acid-test ratio, and gross margin ratio as of January 31. (Round your answers to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lancer, Inc. (a U.S.-based company). establishes a subsidiary in Croatia on January 1, 2019. The following account balances for the year ending December 31, 2020, are stated in kuna (K), the local currency: Sales 200,000 100,000 60,000 12,000 K Inventory (bought on 3/1/20) Equipment (bought on 1/1/19) Rent expense Dividends (declared on 10/1/20) Notes receivable (to be collected in 2023) Accumulated depreciation-equipment Salary payable Depreciation expense 22,000 36,000 18,000 5,000 6,000 The following U.S.S per kuna exchange rates are applicable: January 1, 2019 Average for 2019 January 1, 2020 March 1, 2020 s0.19 0.20 0.24 0.25 0.27 October 1, 2020 December 31, 2020 Average for 2020 0.28 0.26 Lancer is preparing account balances to produce consolidated financial statements. a. Assuming that the kuna is the functional currency, what exchange rate would be used to report each of these accounts in U.S. dollar consolidated financial statements? b. Assuming that the U.S. dollar is the…arrow_forwardWhat document signals that a company should record thepurchase of goods on account?a. Purchase requisitionb. Purchase orderc. Receiving reportd. Supplier invoicearrow_forwardTerminology Match each phrase with its definition. A. Sales discount B. Credit period C. Discount period D. FOB destination E. FOB shipping point F. Gross profit G. Merchandise inventory H. Purchases discount 1. 2. 3. 4. 5. 6. 7. 8. Goods a company owns and expects to see to its customers. Time period that can pass before a customer's full payment is due. Seller's description of a cash discount granted to buyers in return for early payment. Ownership of goods is transferred when the seller delivers goods to the carrier. Purchaser's description of a cash discount received from a supplier of goods. Difference between net sales and the cost of goods sold. Time period in which a cash discount is available. Ownership of goods is transferred when delivered to the buyer's place of business. 1arrow_forward

- When does the cost of inventory become an expense?a. When cash is collected from the customerb. When inventory is delivered to a customerc. When payment is made to the supplierd. When inventory is purchased from the supplierarrow_forwardIarrow_forwardC. As the auditor of STUVWXYZ Partnership Ltd., you discovered the following transaction entries made in 2022 to the Cost and Expense Account control ledger. The respective contra accounts used by the accountant are indicated respectively. The company uses periodic method of recording inventories. Cost and Expense Account Purchase of raw materials P357,657 Purchase discount on purchase of raw Payment of utility bills Salaries of administrative personnel Salaries of sales personnel Commission paid to personnel Payment of machine maintenance Depreciation of building Wages of factory workers Loss incurred on sale of inventories (value of impaired inventories P70,0000 20,000 Sales discount granted to customers 27,300 materials P2,750 29,430 Gain on sale of raw materials, on account 5,000 35,785 22,570 10,530 85,200 Purchase return for defective items 22,470 77,800 15,320 Notes: 1. For debit transactions, the accountant used cash or accounts payable as the credit or contra account 2. For…arrow_forward

- How do retail companies correctly match expenses with revenue for the period to get an accurate net income? a. With a modern POS system. b. With the consistency principle. c With a goods-on-hand estimate from the Controller. d. With a physical inventory. please provide me a corect asnwer option and step by expalnaationarrow_forwardThe adjusting entry to account for estimated customer returns and allowances involves a a. credit to Estimated Returns Inventory b. credit to Customer Refunds Payable c. debit to Customer Refunds Payable d. debit to Estimated Returns Inventorarrow_forwardwhich of the following account will be least likely involved in the purhasing sub-process of the purchasing and disbursement cycle? a. inventory b. prepaid expenses c. accounts payable d. cash in bankarrow_forward

- Changing the method of inventory valuation should be reported in the financial statements under what enhancing quality of accounting information?A. TimelinessB. VerifiabilityC. ComparabilityD. Understandabilityarrow_forwardData table Account Title Cash Accounts Receivable Merchandise Inventory Quality Service Systems Adjusted Trial Balance March 31, 2018 Office Supplies Equipment Accumulated Depreciation Equipment Accounts Payable Salaries Payable Notes Payable, long-term Miller, Capital Miller, Withdrawals Sales Revenue Cost of Goods Sold Selling Expense Administrative Expense Interest Expense Total S $ Debit Balance 2,600 12,800 31,200 6,800 42,400 45,500 Credit 13,600 9,500 500 8,500 22,050 239,000 107,550 27,700 14,100 2,500 293,150 $ 293,150 Xarrow_forwardQuestion:When recording a purchase of inventory on credit, which accounts are typically affected? A) Debit Accounts Payable, Credit CashB) Debit Inventory, Credit Accounts PayableC) Debit Accounts Receivable, Credit SalesD) Debit Cash, Credit Inventoryarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning