FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

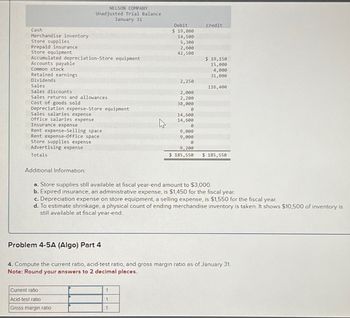

Transcribed Image Text:Cash

Merchandise inventory.

Store supplies

Prepaid insurance

Store equipment

Accumulated depreciation-Store equipment

Accounts payable

Common stock

Retained earnings

Dividends

Sales

Sales discounts

Sales returns and allowances

Cost of goods sold

Depreciation expense-Store equipment

Sales salaries expense

office salaries expense

NELSON COMPANY

Unadjusted Trial Balance

January 31

Insurance expense

Rent expense-Selling space

Rent expense-office space

Store supplies expense

Advertising expense

Totals

Additional Information:

Problem 4-5A (Algo) Part 4

Current ratio

Acid-test ratio

Gross margin ratio

Debit

$ 19,800

14,500

5,300

2,600

42,500

2,250

1

2,000

2,200

38,000

0

14,600

14,600

0

9,000

9,000

0

9,200

$ 185,550

1

Credit

$ 19,150

15,000

a. Store supplies still available at fiscal year-end amount to $3,000.

b. Expired insurance, an administrative expense, is $1,450 for the fiscal year.

4,000

31,000

c. Depreciation expense on store equipment, a selling expense, is $1,550 for the fiscal year.

d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $10,500 of inventory is

still available at fiscal year-end.

116,400

$ 185,550

4. Compute the current ratio, acid-test ratio, and gross margin ratio as of January 31.

Note: Round your answers to 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journal Entries for Merchandise Transactions on Seller’s and Buyer’s Records—Periodic System The following are selected transactions for Jefferson, Inc., during the month of April: April 20 Sold and shipped on account to Lind Stores merchandise for $3,000, with terms of 1/10, n/30. April 27 Lind Stores returned defective merchandise billed at $300 on April 20. April 29 Received from Lind Stores a check for full settlement of the April 20 transaction. Required Prepare the necessary journal entries for (a) Jefferson, Inc., and (b) Lind Stores. Both companies use the periodic inventory system. Sellers journal entries Buyer's journal entries JEFFERSON, INC. GENERAL JOURNAL Date Description Debit Credit Apr. 20 Answer Answer Answer Answer Answer Answer Sold merchandise to Lind Stores terms 1/10, n/30. 27 Answer Answer Answer Answer Answer Answer Merchandise returned by Lind Stores. 29…arrow_forwardalculation of Cost of Goods Sold: Periodic Inventory System with Sales Returns and Allowances The following amounts are known for Adams Gift Shop: Beginning merchandise inventory $27,000 Ending merchandise inventory 22,000 Purchases 78,000 Purchases returns and allowances 3,900 Purchases discounts 6,000 Freight-in 350 Assume the business makes estimates for sales returns and allowances at year-end. The balances for estimated returns inventory are shown. Beginning estimated returns inventory $2,000 Ending estimated returns inventory 1,600 Prepare the cost of goods sold section of the income statement. Adams Gift ShopIncome StatementFor Year Ended December 31, 20-- Cost of goods sold: $- Select - - Select - $- Select - $- Select - $- Select - - Select - - Select - $- Select - - Select - - Select - $- Select - $- Select - -…arrow_forwardMultiple-Step Income Statement Use the following information to prepare a multiple-step income statement, including the revenue section and the cost of goods sold section, for Sauter Office Supplies for the year ended December 31, 20--. Sales $159,700 Sales Returns and Allowances 2,070 Sales Discounts 4,171 Interest Revenue 424 Merchandise Inventory, January 1, 20-- 27,500 Estimated Returns Inventory, January 1, 20-- 500 Purchases 110,000 Purchases Returns and Allowances 4,540 Purchases Discounts 2,710 Freight-In 885 Merchandise Inventory, December 31, 20-- 33,900 Estimated Returns Inventory, December 31, 20-- 1,100 Wages Expense 27,000 Supplies Expense 800 Phone Expense 900 Utilities Expense 7,000 Insurance Expense 1,200 Depreciation Expense—Equipment 3,900 Miscellaneous Expense 590 Interest Expense 4,600arrow_forward

- Journal Entries-Periodic Inventory Paul Nasipak owns a business called Diamond Distributors. The following transactions took place during January of the current year. Jan. 5 Purchased merchandise on account from Prestigious Jewelers, $3,190. 8 Paid freight charge on merchandise purchased, $340. 12 Sold merchandise on account to Diamonds Unlimited, $4,380. 15 Received a credit memo from Prestigious Jewelers for merchandise returned, $660. 22 Issued a credit memo to Diamonds Unlimited for merchandise returned, $900. Journalize the transactions in a general journal using the periodic inventory method. Page: DOC. POST. NO. REF. DATE ACCOUNT TITLE DEBIT CREDIT 20-- 1. Jan. 5 2 3. 4 4 6. 7. 12 10 15 10 11 11 12 12 13 22 13 14 14 15 15 I II II 1I |arrow_forwardMultiple-Step Income Statement Use the following information to prepare a multiple-step income statement, including the revenue section and the cost of goods sold section, for Sauter Office Supplies for the year ended December 31, 20--. Sales $160,000 Sales Returns and Allowances 2,300 Sales Discounts 4,175 Interest Revenue 425 Merchandise Inventory, January 1, 20-- 28,400 Estimated Returns Inventory, January 1, 20-- 600 Purchases 109,000 Purchases Returns and Allowances 4,560 Purchases Discounts 2,670 Freight-In 895 Merchandise Inventory, December 31, 20-- 30,100 Estimated Returns Inventory, December 31, 20-- 900 Wages Expense 27,400 Supplies Expense 800 Phone Expense 800 Utilities Expense 8,000 Insurance Expense 1,200 Depreciation Expense—Equipment 3,900 Miscellaneous Expense 590 Interest Expense 4,700 Sauter Office Supplies Income Statement For Year Ended December 31, 20-- Revenue from sales: $ $…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education