FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Transcribed Image Text:Qmyncwu-Search

lomework

//ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%

Cash

arch

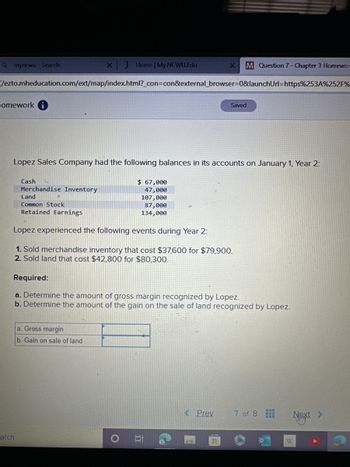

Lopez Sales Company had the following balances in its accounts on January 1, Year 2:

Merchandise Inventory

X J Home | My NCWU.Edu

Land

Common Stock

Retained Earnings

a. Gross margin

b. Gain on sale of land

$ 67,000

47,000

107,000

87,000

134,000

Lopez experienced the following events during Year 2:

1. Sold merchandise inventory that cost $37,600 for $79,900.

2. Sold land that cost $42,800 for $80,300.

Required:

a. Determine the amount of gross margin recognized by Lopez.

b. Determine the amount of the gain on the sale of land recognized by Lopez.

O

M Question 7 - Chapter 3 Homewo

JI

< Prev

Saved

H

7 of 8

WEB

BA

Next >

W

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Portions of the financial statements for Peach Computer are provided below. PEACH COMPUTER Income Statement For the year ended December 31, 2024 Net sales Expenses: Cost of goods sold Operating expenses Depreciation expense Income tax expense Total expenses Net income Cash Accounts receivable Inventory Prepaid rent Accounts payable Income tax payable $1,100,000 610,000 55,000 45,000 PEACH COMPUTER Selected Balance Sheet Data December 31 2024 $107,000 45,500 80,000 3,500 50,000 5,500 2023 $87,500 51,500 57,500 6,000 39,500 12,500 $1,925,000 1,810,000 $115,000 Increase (I) or Decrease (D) $19,500 (I) (D) 6,000 22,500 (I 2,500 (D) 10,500 (I) 7,000 (D)arrow_forwardes Lopez Sales Company had the following balances in its accounts on January 1, Year 2: Cash Merchandise Inventory Land Common Stock Retained Earnings $ 66,000 46,000 106,000 86,000 132,000 Lopez experienced the following events during Year 2: 1. Sold merchandise inventory that cost $36,800 for $78,200. 2. Sold land that cost $42,400 for $79,500. Required: a. Determine the amount of gross margin recognized by Lopez. b. Determine the amount of the gain on the sale of land recognized by Lopez. a. Gross margin b. Gain on sale of landarrow_forwardUsing the following information, what is the amount of net income? Purchases $32,000 Selling expenses $ 960 Merchandise inventory, September 1 5,700 Merchandise inventory,September 30 6,370 Administrative expenses 910 Sales 63,000 Rent revenue 1,200 Interest expense 1,040 a. $28,760 b. $29,960 c. $31,670 d. $29,800arrow_forward

- jjarrow_forwardLopez Sales Company had the following balances in its accounts on January 1, Year 2 Cash Merchandise Inventory Land Common Stock Retained Earnings $ 53,000 33,000 93,000 73,000 106,000 Lopez experienced the following events during Year 2: 1. Sold merchandise inventory that cost $26,400 for $56,100. 2. Sold land that cost $37,200 for $69,800. Required: a. Determine the amount of gross margin recognized by Lopez. b. Determine the amount of the gain on the sale of land recognized by Lopez. a. Gross margin b. Gain on sale of landarrow_forwardI need help with thisarrow_forward

- 10. Preparing a funds statement; cash flow from operations. You have the following information about the financial affairs of the XYZ Company: 1. Balance sheets: Current Assets: Cash..... Accounts receivable Inventories.. Total Current Assets Beginning of Year $ 2 235 End of Year $ 1 4 6 $10 Land, plant, and equipment, cost. $20 $11 $29 Less: Accum. depreciation Total Assets... Current Liabilities: Accounts payable Taxes payable.... Notes payable.. 8 12 $22 $ 4 1 2 ; 8「: སནྡྷ། 20| $31 $ 3 Total Current Liabilities $ 5arrow_forwardQuestion: Use the information given below. Accounts Payable $125,000 Accounts Receivable $175,000 Accrued Expenses $80,000 Cash $50,000 Common Stock $20,000 Cost of Goods Sold $400,000 Depreciation Expense $30,000 Gross PPE $700,000 Inventory $250,000 Long Term Debt $150,000 Net PPE $250,000 Note Payable $30,000 Operating Expenses $200,000 Sales Tax Expense Total Equity $950,000 $25,000 $340,000 What is the value of total assets?arrow_forwardRa Subject: acountingarrow_forward

- prepare a balance sheet and income statement from the following information: Cash $625.00 Revenue $21,000.00 Note Payable $5,000.00 Retained Earnings $10,600.00 Expenses $7,000.00 Issued Capital Stock $500.00 Accounts Receivable $2,500.00 Inventory $6,900.00 Accounts Payable $1,000.00 Cost of Goods Sold $10,500.00 Accrued Sales Tax $1,425.00 Prepaid Insurance $12,000.00 Plz answer fast without plagiarism i give up votearrow_forwardUse the following information to answer this question: Net sales Windswept, Incorporated 2021 Income Statement Cost of goods sold Depreciation ($ in millions) Earnings before interest and taxes Interest paid Taxable income Taxes Net income $ 9,050 7,540 430 $ 1,080 96 $ 984 344 $ 640 Windswept, Incorporated 2020 and 2021 Balance Sheets ($ in millions) 2020 Cash $ 180 2021 $ 210 2020 Accounts payable $ 1,190 Accounts received Inventory 900 1,670 800 1,610 Long-term debt Common stock 1,070 3,280 2021 $ 1,335 1,285 2,970 Total $ 2,750 $ 2,620 Retained earnings 560 810 Net fixed assets. Total assets 3,350 $6,100 3,780 $6,400 Total liabilities & equity $ 6,100 $ 6,400 What is the days' sales in receivables for 2021?arrow_forwardSubject: acountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education