FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

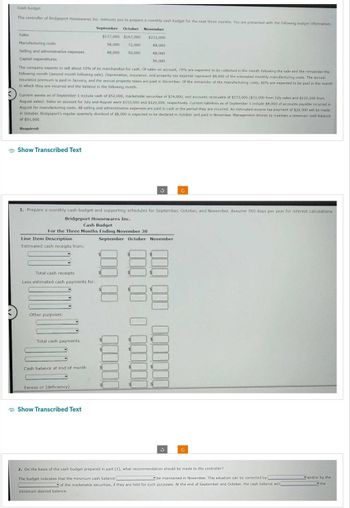

Transcribed Image Text:Cash budget

The controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information:

September October November

$137,000 $167,000 $232,000

84,000

58,000 72,000

48,000 50,000

88,000

56,000

Sales

Manufacturing costs

Selling and administrative expenses

Capital expenditures

The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the

following month (second month following sale). Depreciation, insurance, and property tax expense represent $8,000 of the estimated monthly manufacturing costs. The annual

insurance premium is paid in January, and the annual property taxes are paid in December. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month

in which they are incurred and the balance in the following month.

Current assets as of September 1 include cash of $52,000, marketable securities of $74,000, and accounts receivable of $153,000 ($33,000 from July sales and $120,000 from

August sales), Sales on account for July and August were $110,000 and $120,000, respectively. Current liabilities as of September 1 include $8,000 of accounts payable incurred in

August for manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. An estimated income tax payment of $20,000 will be made

in October. Bridgeport's regular quarterly dividend of $8,000 is expected to be declared in October and paid in November. Management desires to maintain a minimum cash balance

of $51,000.

Required:

Show Transcribed Text

Line Item Description

Estimated cash receipts from:

1. Prepare a monthly cash budget and supporting schedules for September, October, and November. Assume 360 days per year for interest calculations.

Bridgeport Housewares Inc.

Cash Budget

For the Three Months Ending November 30

Total cash receipts

Less estimated cash payments for:

Other purposes:

Total cash payments

Cash balance at end of month

Excess or (deficiency)

Show Transcribed Text

3

September October November

$

0000000

0000000000

C

3

C

2. On the basis of the cash budget prepared in part (1), what recommendation should be made to the controller?

The budget indicates that the minimum cash balance

be maintained in November. This situation can be corrected by

of the marketable securities, if they are held for such purposes. At the end of September and October, the cash balance will l

minimum desired balance.

and/or by the

the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: October September October November $125,000 $154,000 $201,000 53,000 66,000 72,000 76,000 48,000 44,000 46,000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, Insurance, and property tax expense represent $6,000 of the estimated monthly manufacturing costs. The annual Insurance premium is paid in January, and the annual property taxes are paid in December. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Sales Manufacturing costs Selling and administrative expenses Capital expenditures Current assets as of September 1 include…arrow_forwardCash Budget Wilson's Retail Company is planning a cash budget for the next three months. Estimated sales revenue is as follows: Month Sales Revenue Month Sales Revenue $300,000 March 245,000 April $200,000 155,000 January February All sales are on credit; 60 percent is collected during the month of sale, and 40 percent is collected during the next month. Cost of goods sold is 70 percent of sales. Payments for merchandise sold are made in the month following the month of sale. Operating expenses total $40,000 per month and are paid during the month incurred. The cash balance on February 1 is estimated to be $30,000. Prepare monthly cash budgets for February, March, and April. Use negative signs only with beginning and ending cash balances, when appropriate. Do not use negative signs with disbursement answers. Wilson's Retail Company Cash Budgets February, March, and April February March Cash balance, beginning $ Total Cash receipts Cash available Total disbursements Cash balance, ending…arrow_forwardPreparing a Cash Budget La Famiglia Pizzeria provided the following information for the month of October: Sales are budgeted to be $158,000. About 85% of sales is cash; the remainder is on account. La Famiglia expects that, on average, 70% of credit sales will be paid in the month of sale, and 28% will be paid in the following month. Food and supplies purchases, all on account, are expected to be $106,000. La Famiglia pays 25% in the month of purchase and 75% in the month following purchase. Most of the work is done by the owners, who typically withdraw $6,000 a month from the business as their salary. (Note: The $6,000 is a payment in total to the two owners, not per person.) Various part-time workers cost $7,300 per month. They are paid for their work weekly, so on average 90% of their wages are paid in the month incurred and the remaining 10% in the next month. Utilities average $5,950 per month. Rent on the building is $4,100 per month. Insurance is paid quarterly; the next…arrow_forward

- Cash Budget The controller of Stanley Yelnats Inc. asks you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: January February March Sales Manufacturing costs 42,000 $101,000 $121,000 $171,000 52,000 62,000 Selling and administrative expenses Capital expenditures 29,000 33,000 38,000 41,000 The company expects to sell about 15% of its merchandise for cash. Of sales on account, 65% are expected to be collected in full in the month following the sale and the remainder in the following month. Depreciation, Insurance, and property tax expense represent $8,000 of the estimated monthly manufacturing costs. The annual Insurance premium is paid in June, and the annual property taxes are paid in October. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. All selling and administrative expenses are paid in the month incurred.…arrow_forwardThe controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: Line Item Description Sales September October November $103,000 $122,000 $166,000 Manufacturing costs 43,000 52,000 60,000 Selling and administrative expenses Capital expenditures 36,000 37,000 63,000 40,000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $10,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in January, and the annual property taxes are paid in December. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of…arrow_forwardThe controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: September October November $89,000 $109,000 $146,000 37,000 47,000 31,000 33,000 Sales Manufacturing costs Selling and administrative expenses Capital expenditures The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $7,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in January, and the annual property taxes are paid in December. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of September 1 include cash of $34,000, marketable…arrow_forward

- The controller of Sonoma Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: May June July Sales $132,000 $164,000 $210,000 Manufacturing costs 55,000 71,000 76,000 Selling and administrative expenses 38,000 44,000 46,000 Capital expenditures _ _ 111,000 The company expects to sell about 12% of its merchandise for cash. Of sales on account, 65% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $8,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in September, and the annual property taxes are paid in November. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as…arrow_forwardCash Budget The controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: September October November Sales $120,000 $145,000 $192,000 Manufacturing costs 50,000 62,000 69,000 Selling and administrative expenses 42,000 44,000 73,000 Capital expenditures _ _ 46,000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $9,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in January, and the annual property taxes are paid in December. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following…arrow_forwardeBook Cash Budget The controller of Shoe Mart Inc. asks you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: January February March Sales $148,000 $179,000 $238,000 Manufacturing costs 62,000 77,000 86,000 Selling and administrative expenses 43,000 48,000 52,000 Capital expenditures _ _ 57,000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 65% are expected to be collected in full in the month following the sale and the remainder the following month. Depreciation, insurance, and property tax expense represent $7,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in June, and the annual property taxes are paid in October. Of the remainder of the manufacturing costs, 85% are expected to be paid in the month in which they are incurred and the balance in the following month. All sales and administrative…arrow_forward

- Assume a company is preparing a budget for its first two months of operations. During the first and second months it expects credit sales of $45,000 and $65,000, respectively. The company expects to collect 30% of its credit sales in the month of the sale and the remaining 70% in the following month. What is the expected cash collections from credit sales during the first month? Multiple Choice $13,500 $31,500 $25,500 $49,000arrow_forwardRefer to the picture for the problem and template. 1 picture has the info and prompt. The other picture has the template.arrow_forwardAssume a company is preparing a budget for its first two months of operations. During the first and second months it expects credit sales of $42,000 and $78,000, respectively. The company expects to collect 35% of its credit sales in the month of the sale, 55% in the following month, and 10% is deemed uncollectible. What amount of cash collections from credit sales would the company include in its cash budget for the second month? Multiple Choice $50, 400 $42,900 $27,300 $58, 200arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education