Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

please do this typewritten for upvote

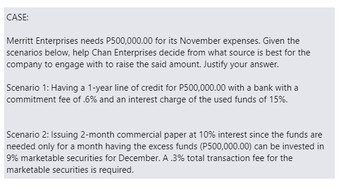

Transcribed Image Text:CASE:

Merritt Enterprises needs P500,000.00 for its November expenses. Given the

scenarios below, help Chan Enterprises decide from what source is best for the

company to engage with to raise the said amount. Justify your answer.

Scenario 1: Having a 1-year line of credit for P500,000.00 with a bank with a

commitment fee of .6% and an interest charge of the used funds of 15%.

Scenario 2: Issuing 2-month commercial paper at 10% interest since the funds are

needed only for a month having the excess funds (P500,000.00) can be invested in

9% marketable securities for December. A .3% total transaction fee for the

marketable securities is required.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- All the following are reporting views found in Tableau, except: O a. Dashboard. O b. Story. O c. Worksheet. O d. Element.arrow_forwardClicking Generate at the bottom of the A/P Create Payment Batch form creates a payment batch. Group of answer choices. True Falsearrow_forwardExplain how the E-R diagrams is used to prepare database tables. Also, include explanation of cardinalities.arrow_forward

- I have attached the table please do the same table to answer the questionsarrow_forwardSelect the letter of the item below that best matches the definitions that follow. a. Data Files CD ________ b. Lists ________ c. Forms ________ d. Registers ________ e. Reports and graphs ________ f. Restoring a backup ________ g. Icon bar ________ h. Home page ________ i. Backing up a file ________ 1. One click access to QuickBooks Accountant Centers and Home page. 2. The process of rebuilding a backup file to a full QuickBooks Accountant file ready for additional input. 3. Electronic representations of paper documents used to record business activities such as customer invoices, vendor bills, and checks. 4. A big-picture approach of how your essential business tasks fit together organized by logical groups such as customers, vendors, and employees. 5. Groups of names such as customers, vendors, employees, items, and accounts. 6. Contains backups of all the practice files needed for chapter work and completion of assignments. 7. The process of creating a copy of a…arrow_forwardClicking Generate at the bottom of the A/P Create Payment Batch form creates a payment batch. Group of answer choices. True Falsearrow_forward

- Suppose you inherit $100,000 at age 25 and immediately invested in a growth fund who’s annual rate of return average is 13%. Five years later, you transfer all proceeds from the scrubs fun into a long-term IRA that pays an average annual rate of 8%. Immediately you start making additional contributions of $7000 per year to the same IRA. Assuming continuous interest, steady interest rates, and a perfect record of making annualcontributions, how much is this IRA worth when you reach the age of 65? The formula that will need to be used is A = P e^r*t + D/r (e^r*t - 1). Hint: use the continuous interest formula to find the accumulated amount for the first five years, which is then the annual investment, P, into the IRA. arrow_forwardClicking Generate at the bottom of the A/P Create Payment Batch form creates a payment batch. Group of answer choices. True Falsearrow_forwardTyping clearly urjentarrow_forward

- I need answer typing clear urjent no chatgpt used i will give upvotesarrow_forwardRequired information [The following information applies to the questions displayed below.] Consider the following narrative describing the process of filling a customer's order at a Starbucks branch: Identify the start and end events and the activities in the following narrative, and then draw the business process model using BPMN: the Starbucks customer entered the drive-through lane and stopped to review the menu. He then ordered a Venti coffee of the day and a blueberry muffin from the barista. The barista recorded the order in the cash register. While the customer drove to the window, the barista filled a Venti cup with coffee, put a lid on it, and retrieved the muffin from the pastry case and placed it in a bag. The barista handed the bag with the muffin and the hot coffee to the customer. The customer has an option to pay with cash, credit card, or Starbucks gift card. The customer paid with a gift card. The barista recorded the payment and returned the card along with the…arrow_forwardhow do you calculat mpg in excel?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education