FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

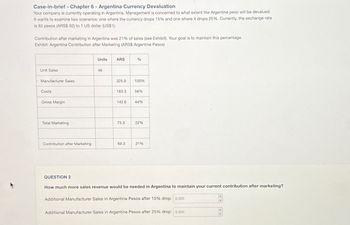

Transcribed Image Text:Case-in-brief - Chapter 6 - Argentina Currency Devaluation

Your company is currently operating in Argentina. Management is concerned to what extent the Argentine peso will be devalued.

It wants to examine two scenarios: one where the currency drops 15% and one where it drops 25%. Currently, the exchange rate

is 92 pesos (ARS$ 92) to 1 US dollar (US$1).

Contribution after marketing in Argentina was 21% of sales (see Exhibit). Your goal is to maintain this percentage.

Exhibit: Argentina Contribution after Marketing (ARS$ Argentine Pesos)

Unit Sales

Manufacturer Sales

Costs

Gross Margin

Total Marketing

Units

ARS

%

46

325.9

100%

183.3

56%

142.6

44%

73.3

22%

Contribution after Marketing

69.3

21%

QUESTION 2

How much more sales revenue would be needed in Argentina to maintain your current contribution after marketing?

Additional Manufacturer Sales in Argentine Pesos after 15% drop: 0.000

Additional Manufacturer Sales in Argentine Pesos after 25% drop: 0.000

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Without Using Excel: ABC Company wants to possibly expand its plant in Europe. The current spot exchange rate is for Euro is €0.83. The initial investment is €2.1, with projected cash flows for three years at €950,000. The discount rate is 10%. The risk-free rate in the US is 5 percent and the risk-free rate in Europe is 7 percent. Calculate the NPV of the project into US Dollars, rounding to the nearest cent, format as "XXX,XXX.XX"arrow_forwardSuppose your company imports computer motherboards from Singapore. The exchange rate is $1.4073 per Singapore dollar. You have just placed an order for 35,062 motherboards at a cost to you of S158 Singapore dollars each. You will pay for the shipment when it arrives in 90 days. You can sell the motherboards for $113 each. Calculate your profit if the exchange rates goes down by 14.51% over the next 90 days.arrow_forwardIBM purchased computer chips from NEC, a Japanese electronics concern, and was billed ¥250 million payable in three months. Currently, the spot exchange rate is #105/$ and the three-month forward rate is ¥100/$. The three-month money market interest rate is 8 percent per annum in the United States and 7 percent per annum in Japan. The management of IBM decided to use a money market hedge to deal with this yen account payable. a. Explain the process of a money market hedge and compute the dollar cost of meeting the yen obligation. b. Conduct a cash flow analysis of the money market hedge.arrow_forward

- Suppose your company imports computer motherboards from Singapore. The exchange rate is $1.3595 per Singapore dollar. You have just placed an order for 39328 motherboards at a cost to you of S146 Singapore dollars each. You will pay for the shipment when it arrives in 90 days. You can sell the motherboards for $118 each. Calculate your profit if the exchange rates goes down by 12.23% over the next 90 days. NOTE: Enter the number rounding to four DECIMALS. If your decimal answer is 0.034576arrow_forwardGiven the following information, take advantage of the triangular arbitrage opportunity and calculate the US dollar profit for an investment of $1,000,000. Keep at least two decimals in your calculations and round at the very end to enter your answer with no decimals (i.e, if your final answer is 9.98, you will enter 10). Singapore dollar in US dollars (USD/SGD) 0.73 US dollars in British pounds (GBP/USD) 0.83 Singapore dollar in British pounds (GBP/SGD) 0.71arrow_forwardA1arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education