FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

What’s the journal, ledger, worksheet, adjustments, closing entries , post-closing trial balance , and statements?

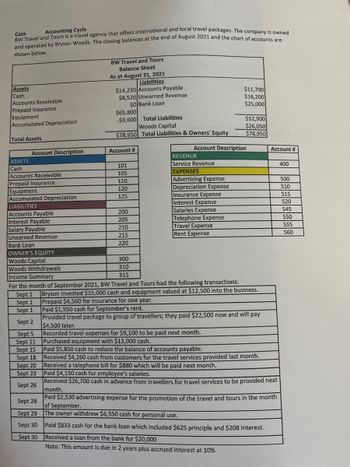

Transcribed Image Text:Case

Accounting Cycle

and operated by Bryson Woods. The closing balances at the end of August 2021 and the chart of accounts are

BW Travel and Tours is a travel agency that offers international and local travel packages. The company is owned

shown below.

BW Travel and Tours

Balance Sheet

As at August 31, 2021

Liabilities

Assets

Cash

$14,230 Accounts Payable

$11,700

$16,200

Accounts Receivable

$8,520 Unearned Revenue

$0 Bank Loan

$25,000

Prepaid Insurance

$65,800

Equipment

-$9,600 Total Liabilities

Accumulated Depreciation

$52,900

Woods Capital

$26,050

Total Assets

$78,950 Total Liabilities & Owners' Equity

$78,950

Account Description

Account #

REVENUE

ASSETS

Cash

101

Service Revenue

105

EXPENSES

Accounts Receivable

Prepaid Insurance

110

Advertising Expense

Equipment

120

Depreciation Expense

Accumulated Depreciation

125

Insurance Expense

LIABILITIES

Interest Expense

Accounts Payable

200

Salaries Expense

Interest Payable

205

Telephone Expense

Salary Payable

210

Travel Expense

Unearned Revenue

215

Rent Expense

Bank Loan

220

OWNER'S EQUITY

Woods Capital

300

Woods Withdrawals

310

Income Summary

315

For the month of September 2021, BW Travel and Tours had the following transactions:

Sept 1

Bryson invested $15,000 cash and equipment valued at $12,500 into the business.

Prepaid $4,500 for insurance for one year.

Sept 1

Sept 1

Paid $1,950 cash for September's rent.

Sept 2

Provided travel package to group of travellers; they paid $22,500 now and will pay

$4,500 later.

Sept 5

Recorded travel expenses for $9,100 to be paid next month.

Purchased equipment with $13,000 cash.

Sept 11

Sept 15

Paid $5,850 cash to reduce the balance of accounts payable.

Sept 18

Received $4,260 cash from customers for the travel services provided last month.

Received a telephone bill for $880 which will be paid next month.

Sept 20

Sept 23

Paid $4,150 cash for employee's salaries.

Received $26,700 cash in advance from travellers for travel services to be provided next

Sept 26

month.

Sept 28

Paid $2,530 advertising expense for the promotion of the travel and tours in the month

of September.

Sept 29

The owner withdrew $6,550 cash for personal use.

Sept 30

Paid $833 cash for the bank loan which included $625 principle and $208 interest.

Sept 30

Received a loan from the bank for $20,000

Note: This amount is due in 2 years plus accrued interest at 10%

Account Description

Account #

400

500

510

515

520

545

550

555

560

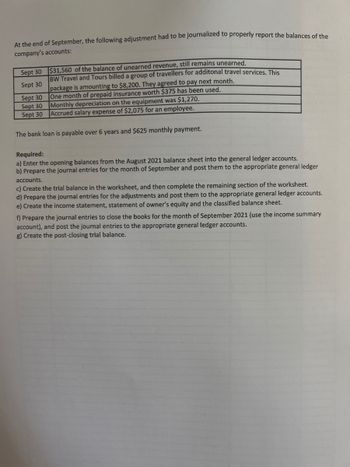

Transcribed Image Text:At the end of September, the following adjustment had to be journalized to properly report the balances of the

company's accounts:

Sept 30

$31,560 of the balance of unearned revenue, still remains unearned.

Sept 30

BW Travel and Tours billed a group of travellers for additonal travel services. This

package is amounting to $8,200. They agreed to pay next month.

One month of prepaid insurance worth $375 has been used.

Sept 30

Sept 30

Monthly depreciation on the equipment was $1,270.

Sept 30 Accrued salary expense of $2,075 for an employee.

The bank loan is payable over 6 years and $625 monthly payment.

Required:

a) Enter the opening balances from the August 2021 balance sheet into the general ledger accounts.

b) Prepare the journal entries for the month of September and post them to the appropriate general ledger

accounts.

c) Create the trial balance in the worksheet, and then complete the remaining section of the worksheet.

d) Prepare the journal entries for the adjustments and post them to the appropriate general ledger accounts.

e) Create the income statement, statement of owner's equity and the classified balance sheet.

f) Prepare the journal entries to close the books for the month of September 2021 (use the income summary

account), and post the journal entries to the appropriate general ledger accounts.

g) Create the post-closing trial balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What are the steps in recording closing entries?arrow_forwardWhich of the following items is considered an original source document? Select one: a. accounts receivable b. company expense account c. purchase order d. general ledgerarrow_forwardWhat account type are included in a post-closing trial balancearrow_forward

- How does the data flow from the transaction (e.g. MRI scan) to financial statements? Use the following key terms in your response: transaction, journal entry, general ledger, financial statement.arrow_forwardIs Warehouse included in a post closing trial balance?arrow_forwardWhich of these accounts IS included in the post-closing trial balance?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education