Question

am.121.

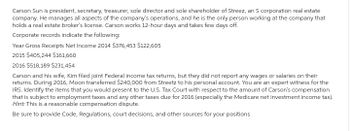

Transcribed Image Text:Carson Sun is president, secretary, treasurer, sole director and sole shareholder of Streez, an S corporation real estate

company. He manages all aspects of the company's operations, and he is the only person working at the company that

holds a real estate broker's license. Carson works 12-hour days and takes few days off.

Corporate records indicate the following:

Year Gross Receipts Net Income 2014 $376,453 $122,605

2015 $405,244 $161,660

2016 $518,189 $231,454

Carson and his wife, Kim filed joint Federal income tax returns, but they did not report any wages or salaries on their

returns. During 2016, Moon transferred $240,000 from Streetz to his personal account. You are an expert witness for the

IRS. Identify the items that you would present to the U.S. Tax Court with respect to the amount of Carson's compensation

that is subject to employment taxes and any other taxes due for 2016 (especially the Medicare net investment income tax).

Hint: This is a reasonable compensation dispute.

Be sure to provide Code, Regulations, court decisions, and other sources for your positions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Question 35 In a Goal Program formulation, what statement below best represents a situation in which the Weight factor for a particular % Deviation is given a particularly high value? Cannot be determined (subject to problem data) It begins to approach a Hard Constraint It will distort the Decision Variable solution At some value the Solver solution will be infeasiblearrow_forwardQ.15. Bring out the differences between the concepts Training, Learning & Development?arrow_forwardJarrow_forward

- Question ompletion A Moving to another question will save this response. uestion 1 If each orientation for an RPN costs approximately $3000, how many RPNS can the hospital plan to hire with an orientation budget of $96,000? O 16 O 32 O 64 O 96 A Moving to another question will save this response. tv PDF 15 MacBook Air 30 888 DII DD F4 F5 F6 F7 F8 F9 36 4 5 7 * 00 %24arrow_forwardQuestion 18 Suppose the number of buyers in a market increases and a technological advancement occurs also. What would we expect to happen in the market? O a Equilibrium price would decrease, but the impact on equilibrium quantity would be ambiguous Ob. Equilibrium price would increase, but the impact on equilibrium quantity would be ambiguous. Oo Equilibrium quantity would decrease, but the impact on equilibrium price would be ambiguous O d. Equilibrium quantity would increase, but the impact on equilibrium price would be ambiguousarrow_forwardASSIGNMENT 2D- Minimization of Profit (Graphical Method) An animal food producer mixes two types of animal food: x and y. each unit of x costs P100 and contains 40 grams of fat, 20 grams of protein and 1,600 calories. Each unit of y cost P80 and contains 60 grams of fat, 60 grams of protein and 1,200 calories. Suppose the producer wants each unit of the final product to yield at least 360 grams of fat, at least 240 grams of protein and at least 9,600 calories, how many of each type of grain should the producer use to minimize his cost. What is the cost?arrow_forward

- Qw.45.arrow_forwardOp7. Question 4. Assume you are the marketing consultant for an upscale food market that wants to focus its marketing efforts on attracting new customers. You have a choice of segmenting the market on either a demographic or a benefit basis. What is the difference between the two? Which would you recommend, and why? Type your answer............. Question 5. Differentiate between breadth and depth of a firm's product mix by choosing a familiar company and explaining how its products exemplify these two concepts. Type your answer................arrow_forwardBuckeye Department Stores, Inc., operates a chain of department stores in Ohio. The company's organization chart appears below. Operating data for 20x1 follow. Buckeye Department Stores Cleveland Division Columbus Divişion Downtown Individual Olentangy Store Scioto Store Store Stores BUCKEYE DEPARTMENT STORES, INC. Operating Data for 20x1 (in thousands) Columbus Division Scioto Store $2,500 Olentangy Store $5,000 Downtown Store $12,000 Cleveland Division (all stores) $ 22,000 Sales revenue Variable expenses: Cost of merchandise sold Sales personnel-salaries Sales commissions Utilities Other Fixed expenses: Depreciation-buildings Depreciation-furnishings Computing and billing Warehouse Insurance Property taxes 3,000 500 60 80 70 2,100 310 50 70 35 6,000 760 90 160 13,000 1,700 220 320 270 130 130 90 90 50 30 70 25 20 260 150 480 310 180 460 220 190 40 80 40 75 210 90 35 80 MacBook Pro %23 % 4 & * 5 6. 7 8. Y D F K C V L.arrow_forward

arrow_back_ios

arrow_forward_ios