FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

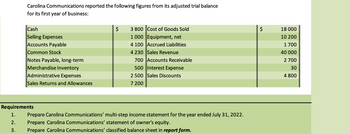

Transcribed Image Text:Carolina Communications reported the following figures from its adjusted trial balance

for its first year of business:

Cash

Selling Expenses

Accounts Payable

Common Stock

Notes Payable, long-term

Merchandise Inventory

Administrative Expenses

Sales Returns and Allowances

Requirements

1.

2.

3.

$

3 800 Cost of Goods Sold

1 000 | Equipment, net

4 100 Accrued Liabilities

4 230 Sales Revenue

700 Accounts Receivable

500 Interest Expense

2 500 Sales Discounts

7 200

Prepare Carolina Communications' multi-step income statement for the year ended July 31, 2022.

Prepare Carolina Communications' statement of owner's equity.

Prepare Carolina Communications' classified balance sheet in report form.

es

18 000

10 200

1 700

40 000

2 700

30

4 800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The financial statements of the Sunland Company report net sales of $384000 and accounts receivable of $50400 and $33600 at the beginning of the year and the end of the year, respectively. What is the average collection period for accounts receivable in days?arrow_forwardDuring its first year of operations, Purple Company recorded sales of $4,000,000. Based on industry statistics, Purple estimates 5% of all sales will be returned. Actual returns during the year totaled $160,000. The year-end adjusting journal entry to account for estimated sales returns would include a: Credit to Refund Liability of $40,000 Debit to Sales Returns of $200,000 Credit to Sales Returns of $40,000 Debit to Refund Liability of $200,000 7 DOarrow_forwardThe following data were extracted from the income statement of Keever Inc.:Current YearPrevious YearSales$919,800$959,200Beginning inventories64,46254,430Cost of goods sold459,900532,900Ending inventories58,26264,462a. Determine for each year (1) the inventory turnover and (2) the number of days' sales in inventory. Round interim calculations to the nearest dollar and the final answers to one decimal place. Assume 365 days a year.Current YearPrevious Year1. Inventory turnover 2. Number of days' sales in inventory days daysarrow_forward

- A company reports the following amounts at the end of the year: Total sales revenue = $560,000; sales discounts = $17,000; sales returns = $34,000; sales allowances = $20,000. Compute net revenues. Net revenuesarrow_forwardAB Ltd. has MCC has prepared the Income statement including the following data (all sales are on account): Sales $80,000 Cost of Goods Sold Gross Profit Expenses Net Profit $50,000 $ 25,000 $ 10,000 $15,000 The comparative balance sheet shows the following data (by definition, accounts payable relates to merchandise purchases only): End of Year Beginning of Year Accounts Receivables (net) Inventory Prepaid Expenses Accounts Payable $7,000 $3,000 $2,000 $1,140 $5,280 $2,000 $1,000 $1,500 Required 1: What is the amount of Cash received from Customers? $ Required 2: What is the amount of Cash paid for merchandise purchase? $arrow_forwardFreedman Company estimates that sales this year of $12,000 will be returned next year and customers will be granted a full refund. Which of the following journal entries would Freedman Company record as part of its year-end adjustments assuming it uses the perpetual inventory system? a.Debit Estimated Returns Inventory for $12,000 and credit Income Summary for $12,000 b.Debit Sales Returns and Allowances for $12,000 and credit Cost of Goods Sold for $12,000 c.Debit Inventory Short and Over for $12,000 and credit Merchandise Inventory for $12,000 d.Debit Sales Returns and Allowances for $12,000 and credit Customer Refunds Payable for $12,000arrow_forward

- Use the following to answer questions 6 – 7 MC, Inc., reported the following amounts at the end of the year: Total sales $888,000 Accounts receivable Sales allowances 60,000 3,500 Allowance for Uncollectible accounts 1,400 Sales discounts 18,000 9,000 Sales returns Determine total contra revenues for $ the company 6. 7. $ Determine net sales for the companyarrow_forwardAyayai Company had the following account balances at year-end: Cost of Goods Sold $63,840; Inventory $14,610; Operating Expenses $30,650; Sales Revenue $121,130; Sales Discounts $1,130; and Sales Returns and Allowances $1,850. A physical count of inventory determines that merchandise inventory on hand is $13,080.arrow_forward1. During December, A Company started doing business and had gross credit trade sales of $800,000, terms 2/10 Net 30. The cost of goods sold of $480,000, selling general administration costs of $100,000, Interest Expense of $10,000; and an income tax rate of 30%. a. Prepare an income statement b. Prepare journal entries Assuming gross method and all payments for the trade sales were made within 10 days.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education