FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

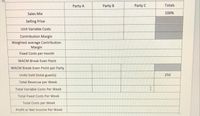

Transcribed Image Text:Party A

Party B

Party C

Totals

Sales Mix

100%

Selling Price

Unit Variable Costs

Contribution Margin

Weighted average Contribution

Margin

Fixed Costs per month

WACM Break Even Point

WACM Break-Even Point per Party

Units Sold (total guests)

250

Total Revenue per Week

Total Variable Costs Per Week

Total Fixed Costs Per Week

Total Costs per Week

Profit or Net Income Per Week

Transcribed Image Text:Carol is starting a virtual craft workshop business. Currently she is planning to have 3 different

workshops to offer. Carol's Crafts plans to call each workshop a "party". She has already experimented with

Party A where she charges $45 per guest. Carol's has been hosting 40 guests per week. Her variable costs for

Party A are $600 per week. Carol has fixed costs of $7, 000 and knows that her fixed costs will not increase if

she can host more "parties" each week. Carol plans to add Party B and Party C to her weekly workshop

schedule. Party B will feature a smaller kid's craft with a Workshop fee of $25 per guest and variable costs of

$15. Party C will be a weekly craft club with a club fee of $60 guest and variable costs of $20. Carol plans a

party mix with a ratio of 1 Party B for every 2 Party Cand 7 Party A for every Party B. (7:1:2). Carol plans to

host 250 guests each week at parties. Based on this information please help Carol predict her potential net

income to see if she can make this her new full-time income.

Party A

Party B

Party C

Totals

100%

Sales Mix

Selling Price

Unit Variable Costs

Contribution Margin

Weighted average Contribution

Margin

Fixed Costs per month

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You make Fidget Spinners that you can sell for $6.50 each. The materials that go into each fidget spinner include ball bearings ($1.25/unit), and plastic ($0.15/unit). Your other costs are as follows: $0.10/unit of injection molding costs You pay your little brother 5% commission on each unit he sells. $100 per month for a social media advertising campaign $3600 per year that your parents are charging you to use the garage $3000/month to cover the salaries for you and two of your best friends who are all equal partners in this business. Because you are using the garage, you are also required to purchase car covers upfront for each of your parent's cars. This totals $750. You also need to purchase injection molds for $1500. What is the minimum number of Fidget Spinners you must sell per month to breakeven?arrow_forwardThe Parents for Better Schools of Fresno, California, collected recipes from members and published a cookbook entitled Food for Everyone. The book will sell for $20 per copy. The chairwoman of the cookbook development committee estimated that the club needed to sell 800 books to break even on its $3,600 investment. What is the variable cost per unit assumed in the Parents for Better Schools’ analysis?arrow_forwardXavi sells seashore paintings. His annual Fixed Costs are $1,000 and the Variable Costs are $8 per painting. Xavi is considering advertising his artwork in a local gallery, the cost of which is $80 per month. What would be the new annual breakeven revenue (in dollars) if he continues to sell his pieces for $15?arrow_forward

- Sylvan Creations designs, manufactures, and sells modern wood sculptures. Sandra Johnson is an artist for the company. Johnson has spent much of the past month working on the design of an intricate abstract piece. Jim Chase, product development manager, likes the design. However, he wants to make sure that the sculpture can be priced competitively. Ellen Cooper, Sylvan’s cost accountant, presents Chase with the following cost data for the expected production of 75 sculptures: Design cost $10,000 Direct materials 80,000 Direct manufacturing labor 27,500 Variable manufacturing overhead 10,000 Fixed manufacturing overhead 42,500 Fixed marketing costs 17,500 Q.Chase believes that competition will require Sylvan to reduce the price of the sculpture to $2,800. Rather than using the highest-grade wood available, Sylvan could use standard grade wood and lower the cost of direct materials by 25%. This redesign will require an additional $1,500 of design cost. Will this design change allow…arrow_forwardConny has found a new material to work with. It's a 17.9% price reduction of his original raw materials that cost $258.07. However, the new material is more delicate and he can not work as fast. This means He must work an extra 5 hours for one piece. Conny charges $20 per hour. How much will Conny be saving if he uses this new material?arrow_forwardI own a Supercuts barber shop. Up to 12 people an hour want to come get haircuts, which I charge $20 each for. I have 1 cashier that can process 20 people an hour. I have 2 barbers who can process 3 people an hour each (so 6 people an hour total). I pay barbers $17 an hour and cashiers $11 an hour. If I can't change demand, and I can hire as many people as I want, what is my maximum profit per hour? Round to the nearest dollar, and don't enter a dollar sign (so if your answer is $443.363, round to 443)arrow_forward

- Mary Walker sells homemade knit scarves for $25 each at local craft shows. Her contribution margin ratio is 60%. Currently, the craft show entrance fees cost Mary $1,500 per year. The craft shows are raising their entrance fees by 25% next year. How many extra scarves will Mary have to sell next year just to pay for rising entrance fee costs?arrow_forwardJoyce Murphy runs a courier service in downtown Seattle. She charges clients $0.48 per mile driven. Joyce has determined that if she drives 3,400 miles in a month, her total operating cost is $1,004. If she drives 5,300 miles in a month, her total operating cost is $1,308. Joyce has used the high-low method to determine that her monthly cost equation is total monthly cost $460+ $0.16 per mile driven. Required: 1. Determine how many miles Joyce needs to drive to break even. 2. Calculate Joyce's degree of operating leverage if she drives 5,500 miles. 3. Suppose Joyce took a week off and her sales for the month decreased by 22 percent. Using the degree of operating leverage. calculate the effect this will have on her profit for that month. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate Joyce's degree of operating leverage if she drives 5,500 miles. Note: Round your intermediate calculations to 2 decimal places and final answer…arrow_forwardJosé Ruiz starts a company that makes handcrafted birdhouses. Competitors sell a similar birdhouse for $275 each. Jose believes he can produce a birdhouse for a total cost of $235 per unit, and he plans a 20% markup on total cost. (a) Compute José's planned selling price. (b) Is José's price lower than competitors' price? Complete this question by entering your answers in the tabs below. Required A Required B Compute José's planned selling price. Selling price per unitarrow_forward

- Natalie is busy establishing both divisions of her business (cookie classes and mixer sales) and completing her business degree. Her goals for the next 11 months are to sell one mixer per month and to give two to three classes per week.The cost of the fine European mixers is expected to increase. Natalie has just negotiated new terms with Kzinski that include shipping costs in the negotiated purchase price (mixers will be shipped FOB destination). Assume that Natalie has decided to use a periodic inventory system and now must choose a cost flow assumption for her mixer inventory.Inventory as on January 31, 2019 represents three deluxe mixer purchased at a unit cost of $595.The following transactions occur in February to May 2019. Feb. 2 Natalie buys two deluxe mixers on account from Kzinski Supply Co. for $1,200 ($600 each), FOB destination, terms n/30. 16 She sells one deluxe mixer for $1,150 cash. 25 She pays the amount owed to Kzinski. Mar. 2 She buys one deluxe…arrow_forwardChelsea runs a factory that makes DVD players. Each S100 takes 9 ounces of plastic and 2 ounces of metal. Each D200 requires 6 ounces of plastic and 6 ounces of metal. The factory has 396 ounces of plastic, 312 ounces of metal available, with a maximum of 24 S100 that can be built each week. If each S100 generates $16 in profit, and each D200 generates $8, how many of each of the DVD players should Chelsea have the factory make each week to make the most profit? S100: D200: Best profit:arrow_forwardThe twig stands are more popular, so Bobby sells four twig stands for every one oak stand. Katie charges her husband $400 to share her booth at the craft shows (after all, she has paid the entrance fees). How many of each plant stand does Bobby need to sell to breakeven? Will this affect the number of scarves Katie needs to sell to breakeven? Explain. Bobby Arthur admired his wife's success at selling scarves at local crafts shows, so he decided to make two types of plant stands to sell at the shows. Bobby makes twig stands out of downed wood from his backyard and the yards of his neighbors, so his variable cost is minimal (wood screws, glue, and so forth). However, Bobby has to purchase wood to make his oak plant stands. His unit prices and costs are as follows: E(Click the icon to view the data.) Determine how many of each plant stand Bobby needs to sell to breakeven. Begin by computing the weighted-average contribution margin per unit. First identify the formula labels, then…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education