Based on the following infromation what would the general

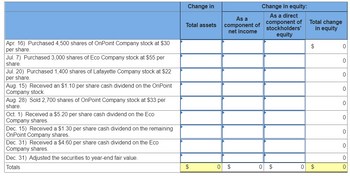

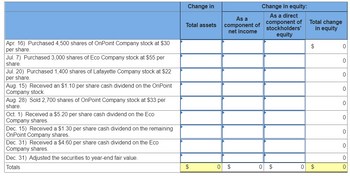

BGJ Corporation had no short-term investments prior to this year. It had the following transactions this year involving short-term stock investments with insignificant influence.

| April 16 | Purchased 4,500 shares of OnPoint Company stock at $30 per share. |

|---|---|

| July 7 | Purchased 3,000 shares of Eco Company stock at $55 per share. |

| July 20 | Purchased 1,400 shares of Lafayette Company stock at $22 per share. |

| August 15 | Received an $1.10 per share cash dividend on the OnPoint Company stock. |

| August 28 | Sold 2,700 shares of OnPoint Company stock at $33 per share. |

| October 1 | Received a $5.20 per share cash dividend on the Eco Company shares. |

| December 15 | Received a $1.30 per share cash dividend on the remaining OnPoint Company shares. |

| December 31 | Received a $4.60 per share cash dividend on the Eco Company shares. |

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

For each transaction, indicate the change, if any, in total assets and total equity. If equity changes, indicate whether the change was reflected as a component of net income, or directly within the

How would I complete the table?

For each transaction, indicate the change, if any, in total assets and total equity. If equity changes, indicate whether the change was reflected as a component of net income, or directly within the

How would I complete the table?

- On November 1 of Year 1, Drucker Co. acquired the following investments in equity securities measured at FV-NI. Kelly Corporation 400 shares of common stock (no-par) at $60 per share Keefe Corporation 240 shares preferred stock ($10 par) at $20 per share On December 31, the company's year-end, the quoted market prices were as follows: Kelly Corporation common stock, $52, and Keefe Corporation preferred stock, $24. Following are the data for the following year (Year 2). Mar. 02: Dividends per share, declared and paid: Kelly Corp., $1, and Keefe Corp., $0.50. Oct. 01: Sold 80 shares of Keefe Corporation preferred stock at $25 per share. Dec. 31: Fair values: Kelly common, $46 per share, Keefe preferred, $26 per share. Year 1 Year 2 d. Prepare the entries required in Year 2 to record dividend revenue, the sale of stock, and the fair value adjustment. Assume that the Fair Value Adjustment account needs to be adjusted for the investment portfolio on December 31, Year 2. Date Mar. 2, Year 2…arrow_forwardCoronado Corporation began its latest fiscal year on January 1, 2021, with 520,000 common shares outstanding. During the year, the following events occurred: On February 1, Coronado sold 15,400 additional common shares. The company declared and issued a 25% stock dividend on March 1. On June 1, Coronado repurchased and cancelled 3,850 common shares. ● ● ● . . An additional 4,700 common shares were issued on July 1. On September 1, Coronado declared and issued a three-for-one stock split. On December 1, Coronado issued an additional 14,400 shares. Following the fiscal year, Coronado declared and issued a two-for-one stock split on February 1, 2022. The company issued its 2021 financial statements on April 30, 2022. Calculate the weighted average number of common shares that Coronado should use for calculating its EPS numbers for 2021. Weighted average number of common shares:arrow_forwardOn June 8, Pharoah Ltd. was incorporated and issued 33,600 common shares for $336,000. On August 19, an additional 8,400 shares were issued for $100,800. On November 2, the company paid $32.256 to repurchase 3,360 common shares and on December 7 it paid $58.240 to repurchase 4,480 common shares. (a) Your answer is correct. Calculate the average cost of the common shares on places, ag. 15.25.) June 8 Aug 19 Nov. 2 Dec. 7 $ $ 5 $ Average Cost 10 10.40 10.40 10.40 hares on June 8, August 19. November 2, and December 7. (Round arewers to 2 decimalarrow_forward

- Don't provide answer in image formatarrow_forwardWaterway Corporation began business by issuing 649600 shares of $5 par value common stock for $25 per share. During its first year, the corporation sustained a net loss of $62300. The year-end balance sheet would show Common stock of $3248000. Common stock of $16240000. Total paid-in capital of $12992000. Total paid-in capital of $16177700.arrow_forward. Journal entries using the Cost and Equity Method of accounting for the for the following transtation : On 1/2/18 the Xylo Corp. purchased 8000 shares of ABC Co. Common Stock At $20 per share. ABC Co. has 40000 shares of Common Stock outstanding. On 10/31/18 Xylo Corp. received a $1.50 per share dividend from ABC Co. On 12/30/18 ABC Company announced earnings of for the year at $200000. Prepare the calculations and Journal Entries, in good form, if the Investment is classified as Available for sale Part A. The Cost Method. Part B The Equity Method of accounting is applicable.arrow_forward

- ! Required information [The following information applies to the questions displayed below.] a. On March 22, purchased 880 shares of RPI Company stock at $13 per share. Duke's stock investment results in it having an insignificant influence over RPI. b. On July 1, received a $2 per share cash dividend on the RPI stock purchased in part a. c. On October 8, sold 440 shares of RPI stock for $23 per share. Prepare journal entries to record the given transactions involving the short-term stock investments of Duke Company, all of which occurred during the current year. View transaction listarrow_forwardDo not give answer in imagearrow_forwardSubject: accountingarrow_forward

- Do not give solution in imagearrow_forwardPlease help with all answersarrow_forwardRose Company had no short-term investments prior to this year. It had the following transactions this year involving short- term stock investments with insignificant influence. April 16 Purchased 3,500 shares of Gem Company stock at $24 per share. July 7 Purchased 2,000 shares of PepsiCo stock at $49 per share. Purchased 1,000 shares of Xerox stock at $16 per share. July 20 August 15 Received a $1.00 per share cash dividend on the Gem Company stock. August 28 Sold 2,000 shares of Gem Company stock at $30 per share. $2.50 per share cash dividend on the PepsiCo shares. October 1 Received a December 15 Received a $1.00 per share cash dividend on the remaining Gem Company shares. dividend on the PepsiCo shares. December 31 Received a $1.50 per share cash The year-end fair values per share are Gem Company, $26; PepsiCo, $46; and Xerox, $13.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education