FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

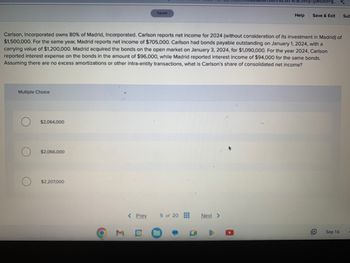

Transcribed Image Text:Multiple Choice

$2,064,000

$2,066,000

Carlson, Incorporated owns 80% of Madrid, Incorporated. Carlson reports net income for 2024 (without consideration of its investment in Madrid) of

$1,500,000. For the same year, Madrid reports net income of $705,000. Carlson had bonds payable outstanding on January 1, 2024, with a

carrying value of $1,200,000. Madrid acquired the bonds on the open market on January 3, 2024, for $1,090,000. For the year 2024, Carlson

reported interest expense on the bonds in the amount of $96,000, while Madrid reported interest income of $94,000 for the same bonds.

Assuming there are no excess amortizations or other intra-entity transactions, what is Carlson's share of consolidated net income?

$2,207,000

6

3

Saved

< Prev

5 of 20

0

0

activity/question-g...

Next >

Help

Save & Exit Sub

Sep 16

Transcribed Image Text:cation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/c

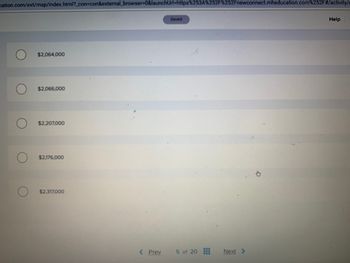

$2,064,000

$2,066,000

$2,207,000

$2,176,000

$2,317,000

< Prev

Saved

5 of 20

Next >

Help

Expert Solution

arrow_forward

Step 1: Introduction

Carlson owns 80% of Madrid Inc.

Therefore Carlson share of net income from Madrid Inc = $705,000 × 80%

= $564,000

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Several years ago Brant, Inc., sold $960,000 in bonds to the public. Annual cash interest of 9 percent ($86,400) was to be paid on this debt. The bonds were issued at a discount to yield 12 percent. At the beginning of 2019, Zack Corporation (a wholly owned subsidiary of Brant) purchased $120,000 of these bonds on the open market for $141,000, a price based on an effective interest rate of 7 percent. The bond liability had a carrying amount on that date of $820,000. Assume Brant uses the equity method to account internally for its investment in Zack. a. & b. What consolidation entry would be required for these bonds on December 31, 2019 and December 31, 2021? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate calculations and final answers to nearest whole number.) No 1 2 Answer is complete but not entirely correct. Accounts Date December 31, 201 Bonds payable Interest income Investment in bonds…arrow_forwardSeveral years ago, Brant, Incorporated, sold $1,020,000 in bonds to the public. Annual cash interest of 8 percent ($81,600) was to be paid on this debt. The bonds were issued at a discount to yield 10 percent. At the beginning of 2022, Zack Corporation (a wholly owned subsidiary of Brant) purchased $170,000 of these bonds on the open market for $191,000, a price based on an effective interest rate of 6 percent. The bond liability had a carrying amount on that date of $900,000. Assume Brant uses the equity method to account internally for its investment in Zack. Required: a. & b. What consolidation entry would be required for these bonds on December 31, 2022 and December 31, 2024? Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate calculations and final answers to nearest whole number. No 1 2 Date December 31, 202 Bonds payable Loss on retirement of debt Interest income Answer is not complete.…arrow_forwardOn November 1, 2015, Journeyman, LLC purchased 900 of the $1,000 face value, 9% bonds of Celebration Incorporated, for $948,000, including accrued interest of $13,500. The bonds matured on January 1, 2017, and interest was paid on March 1 and September 1. If Journeyman uses the straight-line method of amortization and the bonds are classified as available-for-sale, how should the net carrying value of the bonds be shown on Journeyman’s December 31, 2015 balance sheet?arrow_forward

- Panda Company acquired a $20,000 bond originally issued by its 75%-owned subsidiary on January 2, 2015. The bond was issued in a prior year for $21,250, matures January 1, 2020, and pays 8% interest at December 31. The bond's book value at January 2, 2015 is $20,625, and Panda paid $18,500 to purchase it. Straight-line amortization is used by both companies. How much interest income should be eliminated in 2015?arrow_forwardTanner-UNF Corporation acquired as a long-term investment $240 million of 6% bonds, dated July 1, on July 1, 2024. Company management has the positive intent and ability to hold the bonds until maturity. The market interest rate (yield) was 8% for bonds of similar risk and maturity. Tanner-UNF paid $200 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $210 million. Required: 1. Suppose Moody’s bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2025, for $190 million. Prepare the journal entry to record the sale.arrow_forwardTeal Corporation purchased on January 1, 2025, as a held-to-maturity investment, $58,000 of the 8%, 6-year bonds of Harrison, Inc. for $63,773, which provides a 6% return. The bonds pay interest semiannually. Prepare Teal's journal entries for (a) the purchase of the investment, and (b) the receipt of semiannual interest and premium amortization. Assume effective-interest amortization is used. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to O decimal places, e.g. 5,125.) Date Account Titles and Explanation Debit Creditarrow_forward

- Mills Corporation acquired as a long-term investment $250 million of 8% bonds, dated July 1, on July 1, 2021. Company management has the positive intent and ability to hold the bonds until maturity. The market interest rate (yield) was 6% for bonds of similar risk and maturity. Mills paid $290.0 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2021, was $270.0 million. Required: 1. & 2. Prepare the journal entry to record Mills' investment in the bonds on July 1, 2021 and interest on December 31, 2021, at the effective (market) rate. 3. At what amount will Mills report its investment in the December 31, 2021, balance sheet? 4. Suppose Moody's bond rating agency upgraded the risk rating of the bonds, and Mills decided to sell the investment on January 2, 2022, for $300 million. Prepare the journal entry to record the sale.arrow_forwardTanner-UNF Corporation acquired as a long-term investment $1 million of 10-year bonds on July 1, 2023. The purchase price of the bonds was $922,054. After receiving the first interest payment on December 31, 2023, the carrying value of the bonds was $925,106. The market price of the bonds on December 31, 2023, was $927,000. Assuming that Tanner - UNF intends to sell the bonds as soon as possible, how much will be reported as investment in bonds on Tanner - unf's balance sheet on a December 31st 2023?And in which section of the balance sheet will the investment appear?arrow_forwardMills Corporation acquired as a long-term investment $250 million of 8% bonds, dated July 1, on July 1, 2021. Company management has classified the bonds as an available-for-sale investment. The market interest rate (yield) was 6% for bonds of similar risk and maturity. Mills paid $290 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2021, was $270 million. Required:1. & 2. Prepare the journal entry to record Mills’ investment in the bonds on July 1, 2021 and interest on December 31, 2021, at the effective (market) rate.3. At what amount will Mills report its investment in the December 31, 2021, balance sheet?4. Suppose Moody's bond rating agency upgraded the risk rating of the bonds, and Mills decided to sell the investment on January 2, 2022, for $300 million. Prepare the journal entries required on the date of sale.arrow_forward

- During 2023, Culver Inc. purchased 2200, $1000, 7% bonds. The bonds mature on March 1, 2028 and pay interest on March 1 and September 1. The carrying value of the bonds at December 31, 2023 was S 1967500. on September 1, 2024, after the semi-annual interest was received, Brandon sold half of these bonds for $1007000. Culver uses straight-line amortization and has accounted for the bonds under the amortized cost mode.The gain on the sale is $23250 $41850 $0 $4650arrow_forwardTanner-UNF Corporation acquired as a long-term investment $250 million of 8% bonds, dated July 1, on July 1, 2021. Company management has classified the bonds as an available-for-sale investment. The market interest rate (yield) was 10% for bonds of similar risk and maturity. Tanner-UNF paid $210 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2021, was $220 million.Required:1. & 2. Prepare the journal entry to record Tanner-UNF’s investment in the bonds on July 1, 2021 and interest on December 31, 2021, at the effective (market) rate.3. Prepare any additional journal entry necessary for Tanner-UNF to report its investment in the December 31, 2021, balance sheet.4. Suppose Moody’s bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2022, for $200 million. Prepare the journal entries…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education