Mills Corporation acquired as a long-term investment $250 million of 8% bonds, dated July 1, on July 1, 2021. Company management has classified the bonds as an available-for-sale investment. The market interest rate (yield) was 6% for bonds of similar risk and maturity. Mills paid $290 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair

Required:

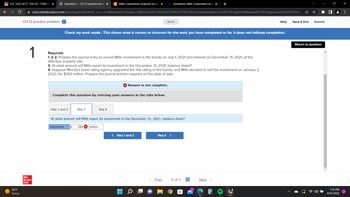

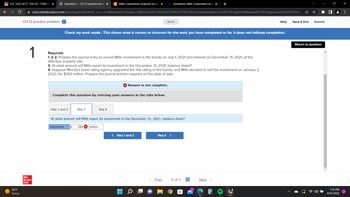

1. & 2. Prepare the

3. At what amount will Mills report its investment in the December 31, 2021,

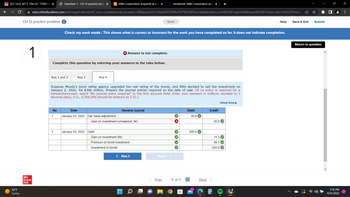

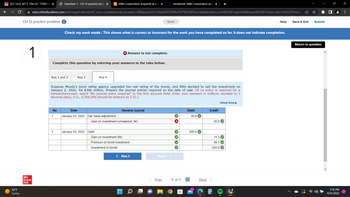

4. Suppose Moody's bond rating agency upgraded the risk rating of the bonds, and Mills decided to sell the investment on January 2, 2022, for $300 million. Prepare the journal entries required on the date of sale.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Hi it says wrong. I had 288.7 also but idk please give formula

Hi it says wrong. I had 288.7 also but idk please give formula

- An investor company purchased $427,000 of 8% bonds from the investee company on January 1, 2020, with interest payable on December 31. The bonds were classified as Available-for-Sale. The bonds sold for $706,390. Using the effective-interest method, the investor company revised the Available-for-Sale Debt Securities account on December 31, 2020 and December 31, 2021 by the amortized discount/premium of $6,470. and $8,200, respectively. At December 31, 2020, the fair value of the investee company bonds was $912,000. At December 31, 2021, the fair value of the investee company bonds was $843,000. What is the amount of unrealized holding gain/loss related to this investment in 2021? (Very important: Just enter the amount. DO NOT put a plus or minus sign in front of the amount.)arrow_forwardTanner-UNF Corporation acquired as a long-term investment $240 million of 6% bonds, dated July 1, on July 1, 2018. The market interest rate (yield) was 8% for bonds of similar risk and maturity. Tanner-UNF paid $200 million for the bonds. The company will receive interest semiannually on June 30 and December 31. Company management has classified the bonds as available-for-sale investments. As a result of changing market conditions, the fair value of the bonds at December 31, 2018, was $210 million. 1. Prepare any journal entry necessary for Tanner-UNF to report its investment in the December 31, 2018, balance sheet. 2. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2019, for $190 million. Prepare the journal entries necessary to record the sale, including updating the fair-value adjustment, recording any reclassification adjustment, and recording the sale PLEASE SHOW WORKarrow_forwardOn January 1, 2024, Rapid Airlines issued $205 million of its 6% bonds for $188 million. The bonds were priced to yield 8%. Interest is payable semiannually on June 30 and December 31. Rapid Airlines records interest at the effective rate and elected the option to report these bonds at their fair value. On December 31, 2024, the fair value of the bonds was $194 million as determined by their market value in the over-the-counter market. Rapid determined that $1,000,000 of the increase in fair value was due to a decline in general interest rates. Record entry to adjust the bonds to their fair value for presentation in the December 31, 2024, balance sheet.arrow_forward

- Mills Corporation acquired as a long-term investment $235 million of 8% bonds, dated July 1, on July 1, 2024. Company management has classified the bonds as an available-for-sale investment. The market interest rate (yield) was 6% for bonds of similar risk and maturity. Mills paid $270 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $260 million. Required: 1. & 2. Prepare the journal entry to record Mills’ investment in the bonds on July 1, 2024 and interest on December 31, 2024, at the effective (market) rate. 3. At what amount will Mills report its investment in the December 31, 2024, balance sheet? 4. Suppose Moody's bond rating agency upgraded the risk rating of the bonds, and Mills decided to sell the investment on January 2, 2025, for $280 million. Prepare the journal entries required on the date of sale.arrow_forwardTanner-UNF Corporation acquired as a long-term investment $200 million of 6% bonds, dated July 1, on July 1, 2021. Companymanagement has the positive intent and ability to hold the bonds until maturity, but when the bonds were acquired Tanner-UNFdecided to elect the fair value option for accounting for its investment. The market interest rate (yield) was 8% for bonds of similar riskand maturity. Tanner-UNF paid $170 million for the bonds. The company will receive interestsemiannually on June 30 and December31. As a result of changing market conditions, the fair value of the bonds at December 31, 2021, was $180 million. Required:1. How would this investment be classified on Tanner-UNF's balance sheet?2. to 4. Prepare the journal entry to record Tanner-UNF's investment in the bonds on July 1, 2021, interest on December 31, 2021, atthe effective (market) and fair value changes as of December 31, 2021.5. At what amount will Tanner-UNF report its investment in the December 31, 2021, balance…arrow_forwardMills Corporation acquired as a long-term investment $270 million of 8% bonds, dated July 1, on July 1, 2024. Company management has classified the bonds as an available-for-sale investment. The market interest rate (yield) was 6% for bonds of similar risk and maturity. Mills paid $310 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $290 million. Required: 1. & 2. Prepare the journal entry to record Mills' investment in the bonds on July 1, 2024 and interest on December 31, 2024, at the effective (market) rate. 3. At what amount will Mills report its investment in the December 31, 2024, balance sheet? 4. Suppose Moody's bond rating agency upgraded the risk rating of the bonds, and Mills decided to sell the investment on January 2, 2025, for $320 million. Prepare the journal entries required on the date of sale. Answer is not complete.…arrow_forward

- Tanner-UNF Corporation acquired as a long-term investment $260 million of 6% bonds, dated July 1, on July 1, 2024. Company management has classified the bonds as an available-for-sale investment. The market interest rate (yield) was 8% for bonds of similar risk and maturity. Tanner-UNF paid $220 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $230 million. Required: 1. & 2. Prepare the journal entry to record Tanner-UNF's investment in the bonds on July 1, 2024 and interest on December 31, 2024, at the effective (market) rate. 3. Prepare any additional journal entry necessary for Tanner-UNF to report its investment in the December 31, 2024, balance sheet. 4. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2025, for $200 million. Prepare the journal entries…arrow_forwardOso Company purchased a Costco bond for $40,000 on January 1, 2020 at face value with an interest rate of 3% paid and recorded annually on 12/31. Oso Company treats the bond as an available-for-sale investment. 1. On 12/31/20, Oso Company records ALL the entries related to this investment. The fair value of the bond is $45,000. Assume no entries have been recorded to date after the 1/1/20 purchase. Answer the following questions for Oso: a. How much is the investment valued at on Oso's balance sheet? Why is it valued at this amount? b. How much does Oso's net income change by for all entries recorded on 12/31/20 related to this bond? Include the amount and direction. If no change, write no change. 2. On 12/31/21, Oso Company records ALL the entries related to this investment. The fair value of the bond is $42,000. Assume no entries have been recorded since 12/31/20. Answer the following questions for Oso: a. Record the journal entry for any fair value adjustments that are needed. If no…arrow_forwardOn January 1, 2024, Rupar Retallers purchased $100,000 of Anand Company bonds at a discount of $6,000. The Anand bonds pay 6% interest but were purchased when the market interest rate was 7% for bonds of similar risk and maturity. The bonds pay interest semiannually on June 30 and December 31 of each year. Rupar accounts for the bonds as a held-to-maturity Investment, and uses the effective interest method. In Rupar's December 31, 2024, journal entry to record the second period of Interest, Rupar would record a credit to interest revenue of Multiple Choice O O $3,000 $3,500 $1.300arrow_forward

- Fuzzy Monkey Technologies, Incorporated purchased as a long-term investment $150 million of 6% bonds, dated January 1, on January 1, 2024. Management intends to have the investment available for sale when circumstances warrant. When the company purchased the bonds, management elected to account for them under the fair value option. For bonds of similar risk and maturity the market yield was 8%. The price paid for the bonds was $133 million. Interest is received semiannually on June 30 and December 31. Due to changing market conditions, the fair value of the bonds at December 31, 2024, was $140 million. Required: 1. to 3. Prepare the relevant journal entries on the respective dates (record the interest at the effective rate). 4-a. At what amount will Fuzzy Monkey report its investment in the December 31, 2024, balance sheet? 4-b. Prepare the journal entry necessary to achieve this reporting objective. 5. How would Fuzzy Monkey’s 2024 statement of cash flows be affected by this…arrow_forwardOn January 1, 2021, Rapid Airlines issued $200 million of its 8% bonds for $184 million. The bonds were priced to yield 10%. Interest is payable semiannually on June 30 and December 31. Rapid Airlines records interest at the effective rate and elected the option to report these bonds at their fair value. On December 31, 2021, the fair value of the bonds was $188 million as determined by their market value in the over-the-counter market. Rapid determined that $1,000,000 of the increase in fair value was due to a decline in general interest rates.Required:1. Prepare the journal entry to record interest on June 30, 2021 (the first interest payment).2. Prepare the journal entry to record interest on December 31, 2021 (the second interest payment).3. Prepare the journal entry to adjust the bonds to their fair value for presentation in the December 31, 2021,balance sheet.arrow_forwardFuzzy Monkey Technologies Inc purchased as a long-term investmetn $60 million of 6% bonds, dated Jan 1, on Jan 1 2021. Management has the positive intent and ability to hold the bonds until maturity. For bonds of similar risk and maturity the market yield was 8%. The price paid for the bonds was $46 million. Interest is received semianually on June 30 and Dec 31. Due to changing market conditions the fair value of the bonds at Dec 31 2021 was $50 million. 1 to 3. Prepare the relevant journal entries on the respective dates. 4. At what amount will Fuzzy Monkey report its investment in Dec 31, 2021 balance sheet? 5. How would Fuzzy Monkey's 2021 statement of cash flows be affected by this investment?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education