FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:7:57 AM 5.3KB/s O ..

all tal

98

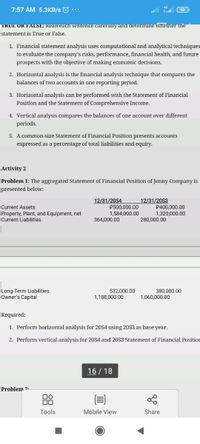

TRUE OR FALSE: Read each sentence carefully and determine whether thne

statement is True or False.

1. Financial statement analysis uses computational and analytical techniques

to evaluate the company's risks, performance, financial health, and future

prospects with the objective of making economic decisions.

2. Horizontal analysis is the financial analysis technique that compares the

balances of two accounts in one reporting period.

3. Horizontal analysis can be performed with the Statement of Financial

Position and the Statement of Comprehensive Income.

4. Vertical analysis compares the balances of one account over different

periods.

5. A common-size Statement of Financial Position presents accounts

expressed as a percentage of total liabilities and equity.

Activity 2

Problem 1: The aggregated Statement of Financial Position of Jenny Company is

presented below:

12/31/20S4

12/31/20S3

Current Assets

P500,000.00

1,584,000.00

P400,000.00

1,320,000.00

Property, Plant, and Equipment, net

Current Liabilities

364,000.00

280,000.00

Long-Term Liabilities

Owner's Capital

380,000.00

1.060,000.00

532,000.00

1,188,000.00

Required:

1. Perform horizontal analysis for 20S4 using 20S3 as base year.

2. Perform vertical analysis for 20S4 and 20S3 Statement of Financial Position

16 / 18

Problem 2.

Tools

Mobile View

Share

88

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Discuss one dimension of financial statement analysis. Explain one technique for analyzing financial statements. Describe the importance of the accounts receivable turnover ratio to a service-based business such as a hospital.arrow_forwardWhat impact does an increase in expenses have on net income?arrow_forwardThe Income Statement (P&L) is a measure of an entity's economic performance (or “report card”) for a period of time. True Falsearrow_forward

- The balance sheet contributes to financial reporting by providing a basis for all of the following except Group of answer choices evaluating the capital structure of the enterprise. assessing the liquidity and financial flexibility of the enterprise. determining the increase in cash due to operations. computing rates of return.arrow_forwardFrom curiosity, what graphs are made to indicate the financial performance of a company?arrow_forwardFor measuring the financial risk in the organisation, we can use? Select one: a. Cash flows Ratio b. Balance sheet ratios c. Earnings of the company d. All options providedarrow_forward

- Which of the following represents a form of communication through financial reporting but not tgh final A) Management Forecasts B) Notes to financial statements C) Statement of Cash Flows D) Statement of financial positionarrow_forwardQuestion: When preparing financial statements, which involve the culmination of various accounting principles and concepts, the process is crucial in portraying a company's financial health and performance. Among the key components, the income statement and the balance sheet stand as fundamental snapshots. The income statement delineates a company's revenues, expenses, and ultimately its profitability over a specific period, employing either the accrual basis or cash basis accounting. On the other hand, the balance sheet provides an overview of a company's assets, liabilities, and shareholders' equity at a given point in time, adhering to the accounting equation where assets are equal to liabilities plus shareholders' equity. Furthermore, the matching principle necessitates that expenses be recorded in the same period as the related revenues they helped generate, facilitating a more accurate representation of the company's financial performance. In the context of accounting…arrow_forwardIn a common-size analysis, the auditor compares account balances with a single line item. In a balance sheet, this line item is generally current assets. O total equity. O total liabilities. O total assets.arrow_forward

- The following sentence should be explained: The balance sheet is a snapshot of a company's financial condition at a certain moment in time, while the income statement is a long-term view of a company's financial performance.arrow_forwardThe proper sequence of financial statement preparation is the O Statement of Financial Position, the Retained Earnings Statement, the Income Statement, and then the Statement of Cash Flows. O Statement of Cash Flows, the Income Statement, the Retained Earnings Statement, and then the Statement of Financial Position. O Income Statement, the Retained Earnings Statement, the Statement of Financial Position, and then the Statement of Cash Flows. O Retained Earnings Statement, the Statement of Financial Position, the Income Statement, and then the Statement of Cash Flows.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education