Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:s the graph

?

nd standard

nd that it be

sky funds?

return 14%,

rd deviation-

4+4+3+6+6

15%; 13.94%;

10.21; 0.355;

75; GA 14.13%

W.

ent service

anagement.

arn a good

issues-A

respective

Market

0.30

50%

-0%

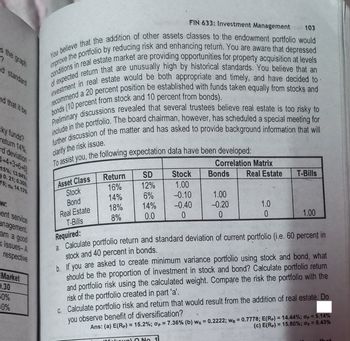

FIN 633: Investment Management 103

You believe that the addition of other assets classes to the endowment portfolio would

improve the portfolio by reducing risk and enhancing return. You are aware that depressed

conditions in real estate market are providing opportunities for property acquisition at levels

investment in real estate would be both appropriate and timely, and have decided to

of expected return that are unusually high by historical standards. You believe that an

recommend a 20 percent position be established with funds taken equally from stocks and

bonds (10 percent from stock and 10 percent from bonds).

Preliminary discussions revealed that several trustees believe real estate is too risky to

include in the portfolio. The board chairman, however, has scheduled a special meeting for

further discussion of the matter and has asked to provide background information that will

To assist you, the following expectation data have been developed:

clarify the risk issue.

Correlation Matrix

Bonds Real Estate

Asset Class

Stock

Bond

Real Estate

T-Bills

Return

16%

14%

18%

8%

SD

12%

6%

14%

0.0

Stock

1.00

-0.10

-0.40

0

1.00

-0.20

0

1.0

0

T-Bills

1.00

Required:

a. Calculate portfolio return and standard deviation of current portfolio (i.e. 60 percent in

stock and 40 percent in bonds.

b. If you are asked to create minimum variance portfolio using stock and bond, what

should be the proportion of investment in stock and bond? Calculate portfolio return

and portfolio risk using the calculated weight. Compare the risk the portfolio with the

risk of the portfolio created in part 'a'.

C. Calculate portfolio risk and return that would result from the addition of real estate. Do

you observe benefit of diversification?

Ans: (a) E(Rp) = 15.2%; p = 7.36% (b) ws = 0.2222; We = 0.7778; E(Rp) = 14.44%; p = 5.14%

(c) E(Rp) = 15.80%; p = 5.43%

Makeup) 0 No 1

Transcribed Image Text:Carefully read the following situation and data, and answer the questions that

follow:

You have recently been appointed as chief investment officer of a major charitable

foundation. Its large endowment fund is currently invested in a broadly diversified portfolio

of stocks (60 percent) and bond (40 percent). The foundation's board of trustees is a group

of prominent individuals whose knowledge of modern investment theory and practice is

superficial. You decide a discussion of basic investment principles would be helpful.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Topic: Exploring the Growing Popularity of Mutual Funds in US Capital Markets Explain why this topic is interesting in the field of business. What is the brief history of the problem? This consists of a summary and results of prior research articles Finally, the learner needs to demonstrate why this proposed study is needed for academic research. Explain why it will expand academic literature, contribute to society, or the professional environment. Who is the intended audience for this research? Dear Expect please note the topic highlighted above as a guideline for answering the questions that follow. This is a dissertation.Thank you.arrow_forwardA financial services company is considering investing in a new fintech startup that has developed a new technology platform for investment management. The company is concerned about the risks associated with the investment and wants to evaluate the potential return on investment. You have been hired as a consultant to help the company make an informed decision. Which of the following financial ratios would be most appropriate for the financial services company to evaluate the financial health and performance of the fintech startup? Gross profit margin Debt-to-equity ratio Return on investment (ROI) Price-to-earnings (P/E) ratioarrow_forwardCase Problem 1. Investment StrategyJ. D. Williams, Inc. is an investment advisory firm that manages more than $120 million in funds for its numerous clients. The company uses an asset allocation model that recommends the portion of each client’s portfolio to be invested in a growth stock fund, an income fund, and a money market fund. To maintain diversity in each client’s portfolio, the firm places limits on the percentage of each portfolio that may be invested in each of the three funds. General guidelines indicate that the amount invested in the growth fund must be between 20% and 40% of the total portfolio value. Similar percentages for the other two funds stipulate that between 20% and 50% of the total portfolio value must be in the income fund and that at least 30% of the total portfolio value must be in the money market fund. In addition, the company attempts to assess the risk tolerance of each client and adjust the portfolio to meet the needs of the individual investor. For…arrow_forward

- Which statement best defines a mutual fund? a. It is a fund set aside by a local government to lend to small firms who want to invest in projects that are beneficial to the firm and community. b. It is an institution that sells stocks and bonds on behalf of small and less known firms who would otherwise have to pay high interest to obtain credit. c. It is an institution that sells shares to the public and uses the proceeds to buy a selection of various types of stocks and bonds. d. It is a financial market where small firms agree to sell and bonds to raise funds.arrow_forwardThe largest proportion of long-term mutual fund assets is held by A) nonfinancial corporate business B) bank trusts and estates C) life insurance firms D) the household sector E) private pension fundsarrow_forwardWhich of the following organizations/entities does a mutual fund appoint to collect money received fromthe fund's purchasers and from portfolio income, as well as to arrange for cash distributions? a) A fundcustodian. b) A fund distributer c) A fund principal. d) A fund managerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education