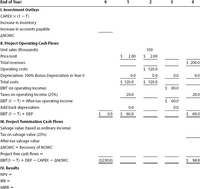

CAPITAL BUDGETING AND CASH FLOW ESTIMATION Allied Food Products is considering expanding into the fruit juice business with a new fresh lemon juice product. Assume that you were recently hired as assistant to the director of capital budgeting, and you must evaluate the new project.

The lemon juice would be produced in an unused building adjacent to Allied’s Fort Myers plant; Allied owns the building, which is fully

The project is expected to operate for 4 years, at which time it will be terminated. The

Unit sales are expected to total 100,000 units per year, and the expected sales price is $2.00 per unit. Cash operating costs for the project are expected to total 60% of dollar sales. Allied’s tax rate is 25%, and its WACC is 10%. Tentatively, the lemon juice project is assumed to be of equal risk to Allied’s other assets.

You have been asked to evaluate the project and to make a recommendation as to whether it should be accepted or rejected. Complete the table.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

|

Unrelated to the lemon juice project, Allied is upgrading its plant and must choose between two machines that are mutually exclusive. The plant is highly successful, so whichever machine is chosen will be repurchased after its useful life is over. Both machines have an after-tax cost of $50,000; however, Machine A provides after-tax savings of $17,500 per year for 4 years, while Machine B provides after-tax savings of $34,000 in Year 1 and $27,500 in Year 2.

|

|

Unrelated to the lemon juice project, Allied is upgrading its plant and must choose between two machines that are mutually exclusive. The plant is highly successful, so whichever machine is chosen will be repurchased after its useful life is over. Both machines have an after-tax cost of $50,000; however, Machine A provides after-tax savings of $17,500 per year for 4 years, while Machine B provides after-tax savings of $34,000 in Year 1 and $27,500 in Year 2.

|

- Cash flows estimation and capital budgeting:You are the head of finance department in XYZ Company. You are considering adding a new machine to your production facility. The new machine’s base price is $11,000.00, and it would cost another $2,570.00 to install it. The machine falls into the MACRS 3-year class (the applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%), and it would be sold after three years for $1,850.00. The machine would require an increase in net working capital (inventory) of $860.00. The new machine would not change revenues, but it is expected to save the firm $26,235.00 per year in before-tax operating costs, mainly labor. XYZ's marginal tax rate is 36.00%.If the project's cost of capital is 13.25%, what is the NPV of the project?Round your answer to two decimal places. For example, if your answer is $345.667 round as 345.67 and if your answer is .05718 or 5.718% round as 5.72.arrow_forwardNew-Project Analysis The president of MorChuck Enterprises has asked you to evaluate the proposed acquisition of a new chromatograph for the firm’s R&D department. The equipment’s basic price is $70,000, and it would cost another $15,000 to modify it for special use by your firm. The chromatograph, which falls into the MACRS 3-year class, would be sold after 3 years for $30,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. Use of the equipment would require an increase in net working capital (spare parts inventory) of $4,000. The machine would have no effect on revenues, but it is expected to save the firm $25,000 per year in before-tax operating costs, mainly labor. The firm’s marginal federal-plus-state tax rate is 25%. a. What is the Year-0 cash flow? b. What are the project recurring cash flows in Years 1, 2, and 3? c. What is the additional (non operating) cash flow in Year 3? d. If the project’s cost of capital is 10%, should the…arrow_forwardCash flows estimation and capital budgeting:You are the head of finance department in XYZ Company. You are considering adding a new machine to your production facility. The new machine’s base price is $10,800.00, and it would cost another $2,760.00 to install it. The machine falls into the MACRS 3-year class (the applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%), and it would be sold after three years for $2,350.00. The machine would require an increase in net working capital (inventory) of $800.00. The new machine would not change revenues, but it is expected to save the firm $23,845.00 per year in before-tax operating costs, mainly labor. XYZ's marginal tax rate is 35.00%. a. What is the initial cash outlay? b. What is the free cash flow for year 1? c. What is the additional Year-3 cash flow (i.e, the after-tax salvage and the return of working capital – also called terminal value)? (please show your work in details and highlight your answers)arrow_forward

- 不 Orchid Biotech Company is evaluating several different development projects for experimental drugs. Although the cash flows are difficult to forecast, the company has come up with the following estimates of the initial capital requirements and NPVs for the projects: Given a wide variety of staffing needs, the company has also estimated the number of research scientists required for each development project (all cost values are given in millions of dollars). a. Suppose that Orchid has a total capital budget of $60million. How should it prioritize these projects? b. Suppose that Orchid currently has 12research scientists and does not anticipate being able to hire more in the near future. How should Orchid prioritize these projects? a. Suppose that Orchid has a total capital budget of $60 million. How should it prioritize these projects? The profitability index for Project I is (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a…arrow_forwardCash flows estimation and capital budgeting:You are the head of finance department in XYZ Company. You are considering adding a new machine to your production facility. The new machine’s base price is $10,000.00, and it would cost another $2,400.00 to install it. The machine falls into the MACRS 3-year class (the applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%), and it would be sold after three years for $2,150.00. The machine would require an increase in net working capital (inventory) of $870.00. The new machine would not change revenues, but it is expected to save the firm $31,775.00 per year in before-tax operating costs, mainly labor. XYZ's marginal tax rate is 35.00%.If the project's cost of capital is 12.50%, what is the NPV of the project?Round your answer to two decimal places. For example, if your answer is $345.667 round as 345.67 and if your answer is .05718 or 5.718% round as 5.72. Group of answer choices $40,993.57 $10,000.00 $38,124.02…arrow_forwardAlternative Capital Investments The investment committee of Sentry Insurance Co. is evaluating two projects, office expansion and upgrade to computer servers. The projects have different useful lives, but each requires an investment of $860,000. The estimated net cash flows from each project are as follows: Net Cash Flow Year OfficeExpansion Server 1 $240,000 $317,000 2 240,000 317,000 3 240,000 317,000 4 240,000 317,000 5 240,000 6 240,000 The committee has selected a rate of 15% for purposes of net present value analysis. It also estimates that the residual value at the end of each project's useful life is $0, but at the end of the fourth year, the office expansion's residual value would be $300,000. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792…arrow_forward

- Calculating EAC Barry Boswell is a financial analyst for Dossman metal works, Inc and he is analyzing two alternative configurations for the firms new plasma cutter shop. The two alternatives, denoted A and B below, will perform the same task, but alternative A will cost $85,000 to purchase, while alternative B will cost only $65,000. Moreover, the two alternatives will have very different cash flows and useful lives. The after tax costs for the two projects are as follows: year alternative a alternative b 0 $(85,000) $(65,000) 1. $(19,000) $(4,000) 2 $(19,000) $(4,000) 3 $(19,000) $(4,000) 4 $(19,000) 5 $(19,000) 6 $(19,000) 7 $(19,000) calculate each projects EAC, given a discount rate of 11 percent which of the alternatives do you think Barry should select? Why? Alternatives A EAC at a discount rate of 11% isarrow_forwardWhich of the following would you NOT consider when making a capital budgeting decision? A. the change in direct labor expense due to the purchase of a new machine B. the cost of a marketing study completed last year C. the opportunity to lease out a warehouse instead of using it to house a new production line D. the additional taxes a firm would have to pay in the next yeararrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education