Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

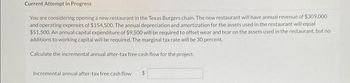

Transcribed Image Text:Current Attempt in Progress

You are considering opening a new restaurant in the Texas Burgers chain. The new restaurant will have annual revenue of $309,000

and operating expenses of $154,500. The annual depreciation and amortization for the assets used in the restaurant will equal

$51,500. An annual capital expenditure of $9,500 will be required to offset wear and tear on the assets used in the restaurant, but no

additions to working capital will be required. The marginal tax rate will be 30 percent.

Calculate the incremental annual after-tax free cash flow for the project.

Incremental annual after-tax free cash flow $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A corporation is considering purchasing a machine that will save $150,000 per year before taxes. The cost of operating the machine (including maintenance) is $30,000 per year. The machine will be needed for five years, after which it will have a zero salvage value. MACRS depreciation will be used, assuming a three-year class life. The marginal income tax rate is 25%. If the firm wants 15% return on investment after taxes, how much can it afford to pay for this machine? Click the icon to view the MACRS depreciation schedules Click the icon to view the interest factors for discrete compounding when /- 15% per year. If the firm wants 15% return on investment after taxes, it can afford to pay thousand for this machine. (Round to one decimal place.)arrow_forwardCorf's Dog House is considering the installation of a new computerized pressure cooker for hot dogs. The cooker will increase sales by $9,500 per year and will cut annual operating costs by $03.300. The system will cost $50100 to purchase and install. This system is expected to have a 5-year life and will be depreciated to zero using straight-line depreciation and have no salvage value. The tax rate is 40 percent and the required return is 30.8 percent. What is the NPV of purchasing the pressure cooker? Mutiple Choice O ● O $23,047 -40335 $5.603 -$2674 $6300arrow_forwardPlease solve it as soon as possible! . Consider an asset with an initial cost of $100,000 and no salvage value. Compute the difference in the present value of the tax shields if CCA is calculated at 20% declining balance compared to if CCA is calculated using a five-year, straight line write off. For your calculation use 30% as the tax rate and 16% as the required return. (The half-year rule applies.) The difference, to the nearest dollar, is A S1.724 B $4,129 C S4.483 d. 59,517 e.$49,969arrow_forward

- Caradoc Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $410,000 is estimated to result in $150,000 in annual pre-tax cost savings. The press falls into Class 8 for CCA purposes (CCA rate of 20% per year), and it will have a salvage value at the end of the project of $55,000. The press also requires an initial investment in spare parts inventory of $20,000, along with an additional $3,100 in inventory for each succeeding year of the project. If the shop’s tax rate is 35% and its discount rate is 9%. Calculate the NPV of this project.arrow_forwardRaiders Restaurant is considering the purchase of a $10,000,000 flat-top grill. The grill has an economic life of 6 years and will be fully depreciated using the straight-line method. The grill is expected to produce 600,000 tacos per year for the next 6 years, each taco costing $4 to make and priced at $11. Assume the discount rate is 12% and the tax rate is 21%. The restaurant expects the market value of the grill to be $0, 6 years from now. Calculate the book value of the grill at the end of year 3. (Round to 2 decimals)arrow_forwardThe management of Origami Company, a wholesale distributor of beachwear products, is considering purchasing a $30,000 machine that would reduce operating costs in its warehouse by $5,000 per year. At the end of the machine's eight-year useful life, it will have no scrap value. The company's required rate of return is 11%. (Ignore income taxes.) Required: 1. Determine the net present value of the investment in the machine. (Hint: Use Microsoft Excel to calculate the discount factor(s).) (Do not round intermediate calculations and round your final answer to the nearest dollar amount. Negative amount should be indicated by a minus sign.) Net present value 2. What is the difference between the total undiscounted cash inflows and cash outflows over the entire life of the machine? Net cash flowarrow_forward

- Raiders Restaurant is considering the purchase of a $10,000,000 flat - top grill. The grill has an economic life of 6 years and will be fully depreciated using the straight-line method. The grill is expected to produce 600,000 tacos per year for the next 6 years, each taco costing $4 to make and priced at $11. Assume the discount rate is 12% and the tax rate is 21 %. The restaurant expects the market value of the grill to be $0, 6 years from now. Calculate the net present value for the project.arrow_forwardYou are considering adding a microbrewery onto one of your firm's existing restaurants. This will entail an investment of $40,000 in new equipment. The new equipment falls under asset class 43 and has a capital cost allowance (CCA) rate of 30%. If your firm's marginal corporate tax rate is 35%, then what is the value of the microbrewery's CCA tax savings in the first year of operation? a) $2,100 b) $14,000 c) $4,200 d) $12,000arrow_forwardllana Industries, Inc., needs a new lathe. It can buy a new high-speed lathe for $0.97 million. The lathe will cost $31,300 to run, will save the firm $127,700 in labour costs, and will be useful for 10 years. Suppose that for tax purposes, the lathe will be in an asset class with a CCA rate of 25%. llana has many other assets in this asset class. The lathe is expected to have a 10-year life with a salvage value of $91,000. The actual market value of the lathe at that time will also be $91,000. The discount rate is 15% and the corporate tax rate is 35%. What is the NPV of buying the new lathe? (Round your answer to the nearest cent.) NPV $arrow_forward

- Aa 27.arrow_forwardArnold Inc. is considering a new project that requires use of an existing warehouse, which the firm acquired three years ago for $1 million and which it currently rents out for $121,000. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an upfront investment into machines and other equipment of $1.6 million. This investment can be fully depreciated straight-line over the next 10 years for tax purposes. However, Arnold Inc. expects to terminate the project at the end of eight years and to sell the machines and equipment for $471,000. Finally, the project requires an initial investment into net working capital equal to 10% of predicted first-year sales. Subsequently, net working capital is 10% of the predicted sales over the following year. Sales of protein bars are expected to be $4.6 million in the first year and to stay constant for eight years. Total manufacturing costs and operating expenses (excluding depreciation) are…arrow_forwardThe Lumber Yard is considering adding a new product line that is expected to increase annual sales by $277,000 and expenses by $184,000. The project will require $93,000 in fixed assets that will be depreciated using the straight-line method to a zero book value over the 6-year life of the project. The company has a marginal tax rate of 21 percent. What is the depreciation tax shield? Multiple Choice $19,530 $9,695 $12,245 $6,440 $3,255arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education