FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

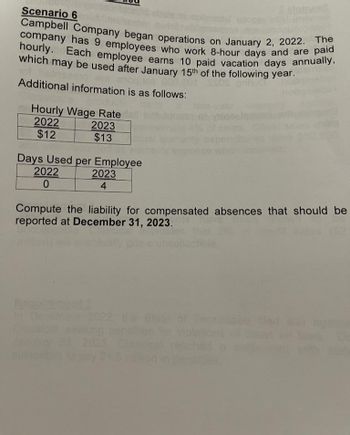

Transcribed Image Text:Scenario 6

129

Campbell Company began operations on January 2, 2022. The

company has 9 employees who work 8-hour days and are paid

hourly. Each employee earns 10 paid vacation days annually,

which may be used after January 15th of the following year.

Additional information is as follows:

Hourly Wage Rate

2022

$12

2023

$13

Days Used per Employee

2022

2023

0

4

Compute the liability for compensated absences that should be

reported at December 31, 2023.

2022, the State

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kevin Kurtz is a newly hired exempt employee who earns an annualsalary of $67,600. Since he started work on Thursday (5-day week endson Friday), his pay for the first week of work would bearrow_forwardPina Colada Limited began operations on January 2, 2022. Pina Colada employs 9 individuals who work eight-hour days and are paid hourly. Each employee earns 10 paid vacation days and 6 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows: Actual Hourly Wage Rate 2022 2023 $20.00 $22.00 2022 Vacation Days Used by Each Employee 2023 2022 Year in Which Vacation Time Was Earned 0 Liability for sick pay Liability for vacation pay Assume that Pina Colada Limited has chosen not to recognize paid sick leave until it is used, and has chosen to accrue vacation time at expected future rates of pay without discounting. Pina Colada uses the following projected rates to accrue vacation time: tA $ 2023 tA 8 $ Sick Days Used by Each Employee Calculate the amounts of any liability for vacation pay and sick days that…arrow_forwardBlue Company began operations on January 2, 2025. It employs 11 individuals who work 8-hour days and are paid hourly. Each employee earns 9 paid vacation days and 6 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual Hourly Wage Rate 2026 $11 $12 2025 Vacation Days Used by Each Employee 2025 2026 8 0 Sick Days Used by Each Employee 2025 2026 5 Blue Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. $ Compute the amounts of any liability for compensated absences that should be reported on the balance sheet at December 31, 2025 and 2026. Vacation Wages Payable Sick Pay Wages Payable $ 4 2025 $ $ 2026arrow_forward

- Percy Inc. has a calendar year-end. The following information is available regarding employee wages: • Its employees earn wages of $2,000 each day for their five-day workweek. Percy pays its employees $10,000 every Friday. • As of the end of Monday, Dec 31, its employees had worked a total of one (1) day for which they have not yet been paid. On January 4, the employees were paid a total of $10,000. Required: In the general journal below, prepare the adjusting entry needed on Dec 31, 20X1, and the regular journal entry to record wages paid on Jan 4, 20X2 Reminder: Do not use symbols, decimals, commas, or cents in your numerical responses. Date 12/31/X1 1/4/X2 Account Name: Wages Expense Wages Payable Wages Payable Wages Expense 4 Debit Credit ?arrow_forwardPina Colada Limited began operations on January 2, 2022. Pina Colada employs 9 individuals who work eight-hour days and are paid hourly. Each employee earns 10 paid vacation days and 6 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows: Actual Hourly Wage Rate 2022 $20.00 $22.00 2023 Date 2022 Year in which Vacation Time Was Earned 2023 Vacation Days Used by Each Employee 2022 2022 2023 0 2023 8 Assume that Pina Colada Limited has chosen not to recognize paid sick leave until it is used, and has chosen to accrue vacation time at expected future rates of pay without discounting. Pina Colada uses the following projected rates to accrue vacation time: Sick Days Used by Each Employee 2022 3 utomatically indented when the amount is entered. Do not indent manually. List all debit entries before credit…arrow_forwardPronghorn Company began operations on January 2, 2025. It employs 12 individuals who work 8-hour days and are paid hourly. Each employee earns 10 paid vacation days and 6 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual Hourly Sick Days Used by Each Employee Vacation Days Used Wage Rate by Each Employee 2025 2026 2025 2026 2025 2026 $6 $7 0 9 5 Pronghorn Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. Prepare journal entries to record transactions related to compensated absences during 2025 and 2026. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent…arrow_forward

- Swifty Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2022, are presented below. Employee Hours Worked Hourly Rate Federal Income Tax Withholdings United Fund Ben Abel 40 $14.00 $59.00 $5.00 Rita Hager 41 16.00 64.00 5.00 Jack Never 44 13.00 60.00 8.00 Sue Perez 46 13.00 62.00 5.00 Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, state unemployment taxes 5.4%, and federal unemployment 0.6%. 1. Prepare a payroll register for the weekly payroll. No employee has reached the Social Security limit of $132,900 or the FUTA/SUTA limit of $7,000 2. Journalize the payroll on March 15, 2022, and the accrual of employer payroll taxes. 3. Journalize the payment of the payroll on March 16,…arrow_forwardA company grants employees 8 sick days per year. Sick days may be used as soon as they are earned and unused days may be carried over to the following year. Sick time is paid at the rate in effect when the days are taken, but are accrued at the rate in effect when they are earned. The following information pertains to the 20 employees of the company, who each work 8-hour days: Year Pay rate Sick days earned/employee Sick days taken/per employee 2020 $15.00 8 5 2021 17.00 8 7 a. Prepare the journal entry to record the sick pay earned in 2020. b. Prepare the journal entry to record sick days taken in 2020. c. Determine the liability for sick pay that the company would report on 12/31/20. d. Prepare the journal entry to record the sick pay earned in 2021. e. Prepare the journal entry to record sick days taken in 2021. f. Determine the liability for sick pay that the company would report on 12/31/21..arrow_forwardAt Vision Club Company, office workers are employed for a 40-hour workweek on either an annual or a monthlysalary basis.Given on the form below are the current annual and monthly salary rates for five office workers for the weekended December 13, 2019 (50th payday of the year). In addition, with this pay, these employees are paid their slidingscale annual bonuses. The bonuses are listed on the register.For each worker, compute:1. Regular earnings for the weekly payroll ended December 13, 2019.2. Overtime earnings (if applicable).3. Total regular, overtime earnings, and bonus.4. FICA taxable wages for this pay period.5. FICA taxes to be withheld for this pay period.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education