FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

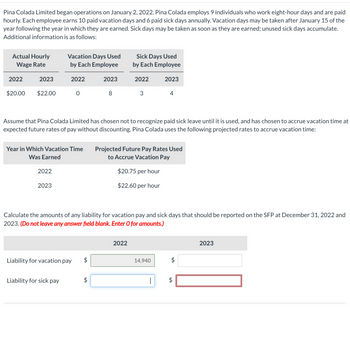

Transcribed Image Text:Pina Colada Limited began operations on January 2, 2022. Pina Colada employs 9 individuals who work eight-hour days and are paid

hourly. Each employee earns 10 paid vacation days and 6 paid sick days annually. Vacation days may be taken after January 15 of the

year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate.

Additional information is as follows:

Actual Hourly

Wage Rate

2022

2023

$20.00 $22.00

2022

Vacation Days Used

by Each Employee

2023

2022

Year in Which Vacation Time

Was Earned

0

Liability for sick pay

Liability for vacation pay

Assume that Pina Colada Limited has chosen not to recognize paid sick leave until it is used, and has chosen to accrue vacation time at

expected future rates of pay without discounting. Pina Colada uses the following projected rates to accrue vacation time:

tA

$

2023

tA

8

$

Sick Days Used

by Each Employee

Calculate the amounts of any liability for vacation pay and sick days that should be reported on the SFP at December 31, 2022 and

2023. (Do not leave any answer field blank. Enter O for amounts.)

2022

3

2022

2023

Projected Future Pay Rates Used

to Accrue Vacation Pay

$20.75 per hour

$22.60 per hour

4

14,940

|

$

LA

LA

2023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Empty fields company pays its salaried employees monthly on the last day of each month The annual salary payroll for 20-Follows. Compute the following for the payroll of December 31: Employer's OASDI Tax $____________ Employer's HI Tax $_____________arrow_forwardTake me to the text An employee had $24,300 in gross earnings up to February 20, 2021. She has the following information for her pay for the week ending February 27, 2021. Her employer contributes 100% toward CPP and 140 % toward El. Vacation pay is accrued at 4% of gross pay. Workers' Compensation is 1% of gross pay. Item Amount Hours 36 Hourly Rate $16.20 Income Tax $116.64 Canada Pension Plan $28.12 Employment Insurance $9.21 Union Dues $10.00 Charitable Donations $20.00 Do not enter dollar signs or commas in the input boxes. Round your answers to 2 decimal places. For transactions with more than one debit or more than one credit, enter the debit accounts in alphabetical order followed by credit accounts in alphabetical order.arrow_forwardnic.3 answer must be in proper format or i will give down votearrow_forward

- 1. An industry employees 450 workers during the month of Decemcber 2019.The following arethe details of Expenditure as follows .Cost of material=$ 86000, Rate of wages for each employee =$ 3 per hour of normal duty and $ 6per hour of overtime duty. Man hours per day of normal duty= 8 hours. Number of holidays per month (with out wages)=6 days. Total over head expenses = $23000.The workers were paid overtime for 375 hours. Calculate (i) Total cost/month (ii) Man hour rate on costs …..arrow_forwardrrarrow_forwardAn employee receives an hourly wage rate of $18, with time and a half for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 45; federal income tax withheld, $349; social security tax rate, 6.0%; and Medicare tax rate, 1.5% on all earnings. What is the net amount to be paid to the employee? Select the correct answer. $442 $855 $1,151 $1,207arrow_forward

- The normal wage of Anne is R200 per hour and her normal working day comprises 9 hours. The standard production time for each employee is 10 minutes per unit. On 15 April 2022, Anne's production was 60 units. Using the Halsey bonus system, a bonus of 50% of the time saved is given to employees. 1.1 Calculate Anne's remuneration for 15 April 2022.arrow_forwardDainty Ltd has an average weekly payroll of $200 000. The employees are entitled to 2 weeks', non- vesting sick leave per annum. Past experience suggests that 56% of employees will take the full 2 weeks' sick leave and 22% will take 1 week's leave each year. The rest of the employees take no sick leave. Required: Calculate the expected annual sick-leave expense for Dainty Ltd (on the basis of average salaries). Provide the journal entry necessary to recognise the sick-leave entitlement expense as it accrues each week. In the current week an employee with a weekly salary of $600 has been off sick for the first time this year. The employee took 2 days off out of her normal 5-day working week. Assuming that PAYG tax is deducted at 30%, what would the entry be to record the employee's weekly salary (round amounts to the nearest dollar)?arrow_forward1 ences Piperel Lake Resort's four employees are paid monthly. Assume an income tax rate of 20%. Required: Complete the payroll register below for the month ended January 31, 2021. (Do not round intermediate values. Round the final answers to 2 decimal places.) Click here to view the CPP Tables for 2021. Click here to view the El Tables for 2021. Employee Wynn, L Short, M. Pearl, P Quincy, B Totals $ $ Gross Pay 2,000.00 1,750.00 1,950.00 1,675.00 7,375.00 El Premium Income Taxes Medical Ins. $ Deductions $ 65.00 65.00 65.00 65.00 260.00 A CPP $ $ United Way 40.00 100.00 0.00 50.00 190.00 Total Deductions Pay Net Pay Distribution Office Salaries 1,750.00 Guide Salaries S 2.000.00 1,950.00 1,675.00arrow_forward

- Ivanhoe Company has 60 employees who work 8-hour days and are paid hourly. On January 1, 2025, the company began a program of granting its employees 10 days of paid vacation each year. Vacation days earned in 2025 may first be taken on January 1, 2026. Information relative to these employees is as follows: Hourly Year Wages Vacation Days Earned by Each Employee Vacation Days Used by Each Employee 2025 $27.50 10 0 2026 29.50 10 8 2027 32.50 10 10 Ivanhoe has chosen to accrue the liability for compensated absences at the current rates of pay in effect when the compensated time is earned. What is the amount of the accrued liability for compensated absences that should be reported at December 31, 2027?arrow_forward1. Paid $162,000 for salary up to 9th March (Tuesday). All employees work afive-day week and are paid every four weeks on the following Wednesday,based on the number of days they have worked in the last four weeks.Employees are entitled to full pay on public holidays but not on Saturdayand Sunday. The employees receive a total salary of $40,500 for a five-daywork week. 2. The employees receive a total salary of $40,500 for a five-day work week.All employees worked for the whole month of March. What are the double entries for these two point?arrow_forward5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education