ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

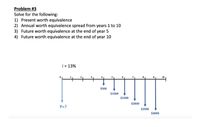

Transcribed Image Text:Problem #3

Solve for the following:

1) Present worth equivalence

2) Annual worth equivalence spread from years 1 to 10

3) Future worth equivalence at the end of year 5

4) Future worth equivalence at the end of year 10

i = 13%

10

$500

$1000

$1500

$2000

P=?

$2500

$3000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 1. Find the present worth at i = 10% per year for the cash flow series shown below. 1 5 6 7 8 Year 2 3 4 $90 $90 $90 $200 $200 S200arrow_forwardA bond with a face value of $10,000 pays interest of 4% per year. This bond will be redeemed at its face value at the end of eight years. How much should be paid now for this bond when the first interest payment is payable one year from now and a 5% yield is desired? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 4% per year. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 5% per year. The purchase price of the bond should be $ (Round to the nearest dollar.)arrow_forwardPlease find PW (present worth) for all the cash flow diagrams in the attached picture below: FOR PART 3arrow_forward

- 2. Explaining short-run economic fluctuations A majority of economists believe that in the long run, real economic variables and nominal economic variables behave independently of one another. For example, an increase in the money supply, a no long-run effect on the quantity of goods and services the economy can produce, a and nominal variables is known as variable, will cause the price level, a AL AXIS However, in the short run, most economists believe that real and nominal variables are intertwined. Economists use the model of aggregate demand and aggregate supply to examine the economy's short-run fluctuations around the long-run output level. The following graph shows an incomplete short-run aggregate demand (AD) and aggregate supply (AS) diagram-it needs appropriate labels for the axes and curves. In the questions that follow you will identify some of the missing labels. AS variable, to increase but will have variable. The distinction between real variables ?arrow_forwardQ1. Find the present worth in year o for the cash flows shown. Let -10 of per year.arrow_forwardSelf-tightening wedge grips are designed for tensile testing applications up to 1200 pounds.The cash flow associated with the product is shown below. Determine the cumulative cash flow after year 4. Year Revenue, $ Costs, $ 1 7,000 -14,000 The cumulative cash flow after year 4 is $ 2 17,000 -30,000 3 23,000 -22,000 4 19,000 -6,000arrow_forward

- what is the answer in 2 decimal placesarrow_forwardAn initial capital of P15,000 was put up for a new business that will produce an annual income of P6000 for 5 years and that will have a salvage value of P2,500 at that time. Annual expenses for its operation (salaries and wages, insurance, taxes) and maintenance amounts to P3000. If money is worth 10% compounded annually, is this investment profitable or not, if so what is the difference in the present worth of the net income to his initial capital?arrow_forwardthis are homework questions, pls explain the correct answer :arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education