Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please show work

Question 8

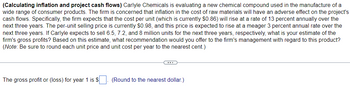

Transcribed Image Text:(Calculating inflation and project cash flows) Carlyle Chemicals is evaluating a new chemical compound used in the manufacture of a

wide range of consumer products. The firm is concerned that inflation in the cost of raw materials will have an adverse effect on the project's

cash flows. Specifically, the firm expects that the cost per unit (which is currently $0.86) will rise at a rate of 13 percent annually over the

next three years. The per-unit selling price is currently $0.98, and this price is expected to rise at a meager 3 percent annual rate over the

next three years. If Carlyle expects to sell 6.5, 7.2, and 8 million units for the next three years, respectively, what is your estimate of the

firm's gross profits? Based on this estimate, what recommendation would you offer to the firm's management with regard to this product?

(Note: Be sure to round each unit price and unit cost per year to the nearest cent.)

C..

The gross profit or (loss) for year 1 is $. (Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Plz don't copy answer without plagiarism please little different answers plz I give up votearrow_forwardcan you help me with this please.arrow_forwardples of Managerial Acco M Question 1- Comprehensive P X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252Fmhepro Comprehensive Problem 5 Saved 1 Part 1 of 6 04:02:14 eBook Print References Required information [The following information applies to the questions displayed below.] Jasper Company, a machine tooling firm, has several plants. One plant, located in Saint Cloud, Minnesota, uses a job order costing system for its batch production processes. The Saint Cloud plant has two departments through which most jobs pass. Plantwide overhead, which includes the plant manager's salary, accounting personnel, cafeteria, and human resources, is budgeted at $250,000. During the past year, actual plantwide overhead was $242,000. Each department's overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the Saint Cloud plant for the past year…arrow_forward

- red Question 11 4) Listen Use the graphs below to categorize the statements to describe either Graph A or Graph B. 3 Graph A Graph B 0 #12 " 3/2 2x 0 */2 3/2 2 -1 T graph a graph b Add an answer item! Add an answer item! Answer Bank amplitude = 1 midline is y=3 f(x)= cos(x)+3 amplitude =3 f(x)=3sin(x)+1 midline is y=1 All Changearrow_forwardUnit 1 question 16arrow_forward12:52 S ㅁ expert.chegg.com/qna/au Chegg Hide student question Student question LTE Skip Exit + 32 5G Classify the following balance sheet items under fixed assets, working capital, shareholders' equity, or net debt: overdraft, retained earnings, brands, taxes payable, finished goods inventories, bonds. Time Left: 01:59:57 Submit ||| 8 Trainingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education