FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:ngageNOWv2 | Online teachin x

Chapter 4 Corporate Financial Ac x +

/ilm/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false

☆

E

1 Welcome - Login.gov

Sign in to your acco...

Control Center

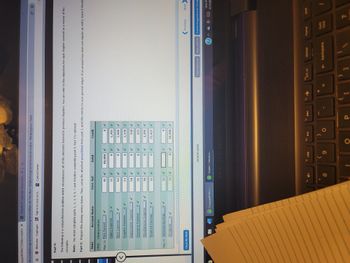

Part 9:

The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the

concepts.

Note: You must complete parts 1, 2, 3, 4, 6, 7 and 8 before completing part 9. Part 5 is optional.

Part 9: Prepare the closing entries below. Then, using the attached spreadsheet from part 2, post the entries to your general ledger. If an amount box does not require an entry, leave it blank.

Date

Account Name

Post. Ref.

Debit

Credit

20Y8 Closing Entries

May 31 Fees Earned

40,000 ✓

0

✓

1,705 ✓

0✔

0✓

1,600 ✔

0 ✓

1,370 ✔

0✓

330

0✔

275

✓

1,295 ✔

33,425 ✔

0

10,500

<

Previous

Next

Email Instructor Save and Exit Submit Assignment for Gradin

10:53 PE

--

6/13/202

WIS

V

Salary Expense

Rent Expense

Supplies Expense

Depreciation Expense

Insurance Expense

Miscellaneous Expense

Retained Earnings

May 31 Retained Earnings

Dividends

Check My Work

✓

CengageNOWv2 | ...

41 V

51 ✔

52 ✔

53

✓

54

✓

55 ✔

59

32

32

33 ✔

0

8

X

All work saved.

Chapter 1 Introduct....

HEWLETT-PACKARD

no 11

44

9

3

delete

- backspace

prt sc

G

home

end

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Solvearrow_forwardCengageNOWV2 | Online teachin x com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress%-fa 6 New Tab 6 Cookie ps Account Debit Credit No. Balances Balances Cash 11 6,530 Accounts Receivable 12 2,100 Prepaid Expenses 13 700 Equipment 18 13,700 Accumulated Depreciation 19 1,100 Accounts Payable 21 1,900 Notes Payable 22 4,300 Bob Steely, Capital 31 12,940 Bob Steely, Drawing 32 790 Fees Earned 41 9,250 Wages Expense 51 2,500 Rent Expense 52 1,960 Utilities Expense 53 76ל Depreciation Expense 54 250 Miscellaneous Expense 185 Totals 29,490 29,490 Determine the total assets.arrow_forwardDetermining Amounts to be Paid on Invoices Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period: نه ن ن ن ن a. b. C. C. d. e. a. $ b. $ 00000 d. $ Merchandise e. S Invoice Amount $18,200 9,100 5,800 2,600 3,600 Freight Paid by Seller $400 - 100 FOB destination, n/30 FOB shipping point, 2/10, n/30 FOB shipping point, 2/10, n/30 FOB shipping point, 1/10, n/30 FOB destination, 1/10, n/30 Customer Returns and Allowances $900 1,100 500 400arrow_forward

- Do not give answer in imagearrow_forwardanswer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardChart of Accounts Common Stock Cash Accounts Receivable Retained Earnings Supplies Dividends Prepaid Rent Office Equipment Accounts Payable Notes Payable Unearned Fees Fees Earned Salary Expense Rent Expense Supplies Expense Interest Expense Utility Expense During the month of June, Acme Inc. entered into the following transactions: 1 Transferred cash from a personal bank account in exchange for stock, $100,000 3 Recorded services provided on account, $9,100 5 Received cash from clients as an advance payment for services to be provided in July, $12,500 7 Purchased Office Equipment for $5,000, paying $500 cash and signing a Note for the remainder. 9 Receive cash for services provided: $5,000 10 Paid part-time receptionist for two weeks' salary $1,750 12 Purchased office supplies from Staples on account, $1,200 14 Billed clients for fees earned; $2,500 16 Paid $1,000 for 3 months rent for the months of July - September 18 Paid Staples, $600 24 Received cash from clients on account,…arrow_forward

- please provide all journal entry without image thnxarrow_forwardA Attachment-1.pdf - Adobe Acrobat Pro DC (32-bit) English File Edit View Sign Window Help Home Tools Attachment-1.pdf Subscribe 3 / 5 з /5 75% Accounts. Post the entries to the two accounts (use T-accounts), and determine the balances, Search tools (c) Prepare the journal entry to record bad debt expense for 2014, assuming that an aging of accounts receivable indicates that estimated bad debts are Tk.22,000. (d) Compute the accounts receivable turnover ratio for the year 2014, assuming the expected bad debt information presented in (c). Create PDF Question-2: Presented below is an aging schedule for Garry Owen Company Edit PDF 1 Number of Days Past Due 2 Not 3 Customer Total Yet Due 1-30 31-60 61-90 Over 90 $ 26,000 Export PDF 4 Alma $11,500 $14,500 5 Browne 45,000 $ 45,000 6 Conlon 75,000 22,500 7,500 $45,000 Comment 7 Dalton 57,000 $57,000 8 Others 189,000 138,000 22,500 19,500 9,000 F0 Organize Pages $392,000 $205,500 $41,500 $34,000 $45,000 $66,000 Estimated 10 percentage…arrow_forwardg In | Federa x M UMassD Logor X EQuickLaunch -x K myCourses Da: x Univ of Mass - X * Cengage Die education.com mework i Saved View transaction list Journal entry worksheet 1 4 6 7 8 9. 10 cearch 近arrow_forward

- please help keep getting wrong answers in blue For each case, provide the missing information. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked wrong.)arrow_forwardNeed a worksheet in excel form add interest expense - of 167.00 please.arrow_forwardNeed help with questions please. Thank youarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education