Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

I am looking for the correct answer to this general accounting problem using valid accounting standards.

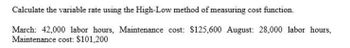

Transcribed Image Text:Calculate the variable rate using the High-Low method of measuring cost function.

March: 42,000 labor hours, Maintenance cost: $125,600 August: 28,000 labor hours,

Maintenance cost: $101,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Describe the cost formula for a strictly variable cost such as electrical power cost of 1.15 per machine hour (i.e., every hour the machinery is run, electrical power cost goes up by 1.15).arrow_forwardUsing High-Low to Calculate Predicted Total Variable Cost and Total Cost for a Time Period That Differs from the Data Period Refer to the information for Pizza Vesuvio on the previous page. Assume that this information was used to construct the following formula for monthly labor cost. TotalLaborCost=5,237+(7.40EmployeeHours) Required: Assume that 4,000 employee hours are budgeted for the coming year. Use the total labor cost formula to make the following calculations: 1. Calculate total variable labor cost for the year. 2. Calculate total fixed labor cost for the year. 3. Calculate total labor cost for the coming year. Use the following information for Brief Exercises 3-17 through 3-20: Pizza Vesuvio makes specialty pizzas. Data for the past 8 months were collected:arrow_forwardThe expected costs for the Maintenance Department of Stazler, Inc., for the coming year include: Fixed costs (salaries, tools): 64,900 per year Variable costs (supplies): 1.35 per maintenance hour Estimated usage by: Actual usage by: Required: 1. Calculate a single charging rate for the Maintenance Department. 2. Use this rate to assign the costs of the Maintenance Department to the user departments based on actual usage. Calculate the total amount charged for maintenance for the year. 3. What if the Assembly Department used 4,000 maintenance hours in the year? How much would have been charged out to the three departments?arrow_forward

- Total and Unit Product Cost Martinez Manufacturing Inc. showed the following costs for last month: Last month, 4,000 units were produced and sold. Required: 1. Classify each of the costs as product cost or period cost. 2. What is the total product cost for last month? 3. What is the unit product cost for last month?arrow_forwardAccounting problemarrow_forwardkindly help me with accounting questionarrow_forward

- Identifying the Parts of the Cost Formula; Calculating Monthly, Quarterly, and Yearly Costs Using a Cost Formula Based on Monthly Data Gordon Company's controller, Eric Junior, estimated the following formula, based on monthly data, for overhead cost: Overhead Cost = $209,000 + ($82 x Direct Labor Hours) Required: 1. Select the term in the right column that corresponds to the term in the left column. Overhead cost Dependent variable v $209,000 Fixed cost (intercept) v $82 Variable rate (slope) Direct labor hours Independent variable v 2. If next month's budgeted direct labor hours equal 19,000, what is the budgeted overhead cost? 1,767,000 V 3. If next quarter's budgeted direct labor hours equal 95,000, what is the budgeted overhead cost? 4. If next year's budgeted direct labor hours equal 380,000, what is the budgeted overhead cost? $arrow_forwardCalculate the contribution margin per unit (accounting)arrow_forwarduse the high-low method to calculate Smithson's fixed costs per month.arrow_forward

- Data below relate to the Tori Company for May and August of the current year: May 35,000 Maintenance hours Maintenance cost $ 1,247,000 August 40,000 $ 1,337,000 May and August were the lowest and highest activity levels, and Tori uses the high-low method to analyze cost behavior. Which of the following statements is true? Multiple Choice The variable maintenance cost is $18 per hour The variable maintenance cost is $20 per hour The variable maintenance cost is $22 per hourarrow_forwardCompute the variable cost per unitarrow_forwardFix costs per month?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning