Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

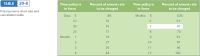

Calculate the short-rate premium and refund of the following: (Use Table 20.4.)

****TABLE ATTACHED****

|

Transcribed Image Text:TABLE

20-4

Percent of annual rate

Time policy is

in force

Time policy is

in force

Percent of annual rate

to be charged

to be charged

Fire insurance short-rate and

cancellation table

Days: 5

8%

Months: 5

52%

10

10

6

61

20

15

7

67

25

17

8.

74

Months: 1

19

9.

81

27

10

87

3

35

11

96

4

44

12

100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- PLEASE Use the correct function on EXCELarrow_forwardLoan balances $58, 744.49 monthly payment is $317.28 what is the monthly interestarrow_forwardYou have a credit card that charges an interest rate of 10.95% compounded monthly. The table below shows your activity for the month of April. Date April 1 April 3 April 9 April 20 April 24 April 26 April 30 Ending Balance Activity $ Beginning Balance Purchase $ Payment Purchase Purchase Purchase Balance 1,175.00 35.70 1,210.70 -300.00 910.70 92.00 1,002.70 15.00 1,017.70 64.70 1,082.40 1,082.40 What is the average daily balance for this account? Amount How much interest is owed this month? How much total money is owed at the end of the month?arrow_forward

- 24. SIMPLE DISCOUNT RATE A plumbing contractor receives proceeds of $4713.54 on a 12.5% simple discount note with a face value of $5000. Find the time of the note in days.arrow_forwardA consumer loan of 1000 is being repaid with 24 monthly installments of 50 at the end of each month. Rather than making payments as originally scheduled, the borrower repaid the outstanding principal immediately after the 10th regular installment. Determine the unearned finance charge recovered by the borrower. A. 200.00 B.116.65 C. 83.35 D. 73.40 E. 67.85arrow_forwardJournalize the following entries on the books of the borrower and creditor. Label accordingly. (Assume a 360-day year is used for interest calculations.) June 1 James Co. purchased merchandise on account from O’Leary Co., $90,000, terms n/30. The cost of merchandise sold was $54,000. 30 James Co. issued a 60-day, 5% note for $90,000 on account. Aug. 29 James Co. paid the amount due.arrow_forward

- Using the unpaid balance method, find the current month's finance charge on a credit card account having the following transactions. Last month's balance: $615 Last payment: $80 Annual Interest rate: 21% Purchases: $484 Returns: $545 The finance charge is $___ (Round to the nearest cent.)arrow_forwardNotes Receivable Water Closet Co. wholesales bathroom fixtures. During the current year ending December 31, Water Closet received the following notes: Date of Note Face Amount Interest Rate Term 1. March 6 $75,000 4 % 60 days 2. April 7 40,000 6 45 days 3. August 12 36,000 5 120 days 4. October 22 27,000 8 30 days 5. November 19 48,000 3 90 days 6. December 15 72,000 5 45 days Instructions Assume 360 days in a year. 1. Determine for each note (a) the due date and (b) the amount of interest due at maturity, identifying each note by number. Note (a) Due Date (b) Interest Dueat Maturity 1. $fill in the blank 2 2. fill in the blank 4 3. fill in the blank 6 4. fill in the blank 8 5. fill in the blank 10 6. fill in the blank 12 2. Illustrate the effects on the accounts and financial statements of the receipt of the amount due on Note 3 at its maturity. If no account or activity is…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education