FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

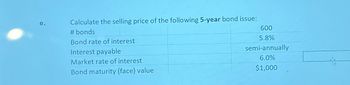

Transcribed Image Text:Calculate the selling price of the following 5-year bond issue:

e.

# bonds

Bond rate of interest

Interest payable

Market rate of interest

Bond maturity (face) value

600

5.8%

semi-annually

6.0%

$1,000

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- 5 On January 1, Ruiz Company issued bonds as follows: Face Value: Number of Years: Stated Interest Rate: Interest payments per year 7 B 9 0 1 2 AWN IC $500,000 a) Required: 1) Calculate the bond selling price given the two market interest rates below. Use formulas that reference data from this worksheet and from the appropriate future or present value tables (found by clicking the tabs at the botto this worksheet). Note: Rounding is not required. 15 7% 2 Annual Market Rate Semiannual Interest Payment: PV of Face Value: +PV of Interest Payments: Bond Selling Price: Annual Market Rate Semiannual Interest Payment: PV of Face Value: +PV of Interest Payments: = Bond Selling Price: 9% $17,500 133,500.01 285,055.55 418,555.56 6.00% $17,500 205,993.38 5343,007.72 $549,001.10 +arrow_forwardA $5000 bond bearing interest at 3.4% payable semi-annually is due in 12 years. Money is worth 8.0% compounded semi-annually. What is the bond rate? a. 8.0% compounded semi-annually b. 3.4% payable semi-annuallyarrow_forwardbond contract rate =7% semi- anual bond -$10,000 bond market =6% semi annual bond life = 10 years 1) find the selling price of this bond 2) will it be sold at a discount or premium 3) do the journal entry for the issuance 4) calculate the discount/premium authorization per period (use the slightline method ) 5) do the entry for the payment of cash interest period 6) do the entry for the amortization of the discount /premium per period 7)find total interest expense per period 8) show the balance sheet presentation of the bond after two periods have elapsedarrow_forward

- A 15-year bond issue of 4 comma 900 comma 000 and bearing interest at 3.5% payable annually is sold to yield 3.1% compounded semi dash annually. What is the issue price of the bonds?arrow_forwardUse the following tables to calculate the present value of a $375,000 @ 5%, 5-year bond that pays $18,750 interest annually, if the market rate of interest is 10%. Round to the nearest dollar. Present Value of $1 ¦ Present Value of Annuity of $1 Periods 5 % 6 % 7 % 10 % ¦ Periods 5 % 6 % 7 % 10 % 1 .95238 .94340 .93458 .90909 ¦ 1 .95238 .94340 .93458 .90909 2 .90703 .89000 .87344 .82645 ¦ 2 1.85941 1.83339 1.80802 1.73554 3 .86384 .83962 .81630 .75131 ¦ 3 2.72325 2.67301 2.62432 2.48685 4 .82270 .79209 .76290 .68301 ¦ 4 3.54595 3.46511 3.38721 3.16987 5 .78353 .74726 .71299 .62092 ¦ 5 4.32948 4.21236 4.10020 3.79079 6 .74622 .70496 .66634 .56447 ¦ 6 5.07569 4.91732 4.76654 4.35526 7 .71068 .66506 .62275 .51316 ¦ 7 5.78637 5.58238 5.38929 4.86842 8 .67684 .62741 .58201 .46651 ¦ 8 6.46321…arrow_forwardDetermine the price of a $1.9 million bond issue under each of the following independent assumptions: Maturity 10 years, interest paid annually, stated rate 6%, effective (market) rate 9%. Maturity 10 years, interest paid semiannually, stated rate 6%, effective (market) rate 9%. Maturity 10 years, interest paid semiannually, stated rate 9%, effective (market) rate 6%. Maturity 20 years, interest paid semiannually, stated rate 9%, effective (market) rate 6%. Maturity 20 years, interest paid semiannually, stated rate 9%, effective (market) rate 9%.arrow_forward

- Boxer Corp is issuing $600,000 8% 5 year bonds when bond investors want a return of 10%. Interest is payable semiannually Caculate Present Value of Bond Calculate Present Value of Interest Payments What is selling price of bond? did the bond sell at face value discount or premium?arrow_forwardNajabhaiarrow_forwardListen A $5,000 bond paying interest at j-6%, redeemable at par on April 1, 2009 is priced at $4,600 on April 1, 2002. Find the yield rate to 2 decimal places. Show your work in your workbook. Your Answer: Answerarrow_forward

- Use the following tables to calculate the present value of a $608,000 @ 6%, 6-year bond that pays $36,480 interest annually, if the market rate of interest is 7%. Round to the nearest dollar. Present Value of $1 ¦ Present Value of Annuity of $1 Periods 5 % 6 % 7 % 10 % ¦ Periods 5 % 6 % 7 % 10 % 1 .95238 .94340 .93458 .90909 ¦ 1 .95238 .94340 .93458 .90909 2 .90703 .89000 .87344 .82645 ¦ 2 1.85941 1.83339 1.80802 1.73554 3 .86384 .83962 .81630 .75131 ¦ 3 2.72325 2.67301 2.62432 2.48685 4 .82270 .79209 .76290 .68301 ¦ 4 3.54595 3.46511 3.38721 3.16987 5 .78353 .74726 .71299 .62092 ¦ 5 4.32948 4.21236 4.10020 3.79079 6 .74622 .70496 .66634 .56447 ¦ 6 5.07569 4.91732 4.76654 4.35526 7 .71068 .66506 .62275 .51316 ¦ 7 5.78637 5.58238 5.38929 4.86842 8 .67684 .62741 .58201 .46651 ¦ 8 6.46321…arrow_forwardA corporate bond has 23 years to maturity, a face value of $1,000, a coupon rate of 5.5%, and pays interest semiannually. The annual market interest rate for similar bonds is 3.3%. Part 1 What is the value of the bond? 0+ decimalsarrow_forwardDetermine the market price of a $209,000, ten-year, 8% (pays interest semiannually) bond issue sold to yield an effective rate of 10%. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 458,581.) Click here to view factor tables Market price of bond issue $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education