Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

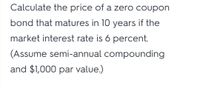

Transcribed Image Text:Calculate the price of a zero coupon

bond that matures in 10 years if the

market interest rate is 6 percent.

(Assume semi-annual compounding

and $1,000 par value.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose the 1 - year spot rate is 0.8%, and that a 2 - year 1.5% annual coupon, a 3 - year 2% annual coupon bonds are trading at par ($100). Calibrate a 2-year binomial interest rate model, assuming that interest rate volatility is 10%. What is the lowest rate at t = 2? Assume annual compounding. Round your answer to 4 decimal places. For example if your answer is 3.205%, then please write down 0.0321.arrow_forwardUsing an annual effective interest rate of 10%, the Macaulay Duration (in years) of a 10-year 100 par value bond with annual coupons of X is 6.96 years. Calculate X. Give your answer as a decimal rounded to two places (i.e. X.XX).arrow_forwardCalculate the value of a $1,000 bond which has 10 years until maturity and pays annual interest at an annual coupon rate of 10 percent. The required return on similar-risk bonds is 12 percent.arrow_forward

- Derive the probability distribution of the 1-year HPR on a 30-year U.S. Treasury bond with a 4.0% coupon if it is currently selling at par and the probability distribution of its yield to maturity a year from now is as shown in the table below. (Assume the entire 4.0% coupon is paid at the end of the year rather than every 6 months. Assume a par value of $100.) Note: Leave no cells blank - be certain to enter "0" wherever required. Negative values should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places. Economy Boom Normal Growth Recession Probability 0.25 0.50 0.25 YTM 10.0 % $ 9.0 % 8.0 % Capital Gain 43.44 $ (56.56) Price $ Coupon Interest 4.00 HPR (52.56) % % %arrow_forwardSuppose the redemption value of a 5-year bond is $105. It pays semiannual coupons of $3 each. The annual yield rate is 8% convertible semiannually. Calculate the interest earned on this bond for the first half year. Round the answer to the nearest tenth dollar.arrow_forwardA 20-year government coupon bond has a face value of $1,000 and a coupon rate of 6% paid annually at the end of each year. Assume that the market interest rate is 8% per year. What is the bond’s PV? (You can sum the PVs for each of the coupon payments and the final $1,000, or you can use the annuity formula in the text, at p. 103, to calculate the PV of the coupon payments and save some work. If you use the annuity formula, be sure to add the PV of the final $1,000 payment to the annuity result.) Round your answer to the nearest dollar (XXX). Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.Answer completely.You will get up vote for sure.arrow_forward

- For the following questions, assume the normal case that coupon payments are semi-annual. a. What is the yield to maturity on a 12-year, 6.2% coupon bond if the bond is currently selling for $1,000? b. For the bond above, suppose that immediately after purchase market rates change to 3.60%. If you hold the bond for 4 years and then sell it, what is your effective annual return on this investment? % (enter response rounded to decimal places; i.e., x.xx%) b. Your effective annual return is % (enter response rounded to decimal places; i.e., x.xx%) a. The YTM isarrow_forwardHow much would you pay for a zero coupon bond with a par value of $1000, a maturity of 21 years, if your required rate of return is 6.1%? Assume annual discounting. (Round your answer to the nearest penny.)arrow_forwardAssume the coupon rate is 10% issue at par $1000 and for 15 years. Let say the market interest rate increase to 15% during the life of the bond. a) What is the interest payment for this bond annually b) What is the interest payment on semi-annually c) How much should the investors pay for this bondi.e. the valuearrow_forward

- Derive the probability distribution of the 1-year HPR on a 30-year U.S. Treasury bond with a 3.0% coupon if it is currently selling at par and the probability distribution of its yield to maturity a year from now is as shown in the table below. (Assume the entire 3.0% coupon is paid at the end of the year rather than every 6 months. Assume a par value of $100.) Note: Leave no cells blank - be certain to enter "0" wherever required. Negative values should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places. Economy Boom Normal Growth Recession Probability 0.30 0.60 0.10 YTM 10.0% 8.0 % 7.0 % Price Capital Gain Coupon Interest HPR % % %arrow_forwardDerive the probability distribution of the 1-year HPR on a 30-year U.S. Treasury bond with a 4.0% coupon if it is currently selling at par and the probability distribution of its yield to maturity a year from now is as shown in the table below. (Assume the entire 4.0% coupon is paid at the end of the year rather than every 6 months. Assume a par value of $100.) Note: Leave no cells blank - be certain to enter "0" wherever required. Negative values should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places. Economy Boom Normal Growth Recession Probability 0.35 0.40 0.25 YTM 11.0% 9.0 % 7.0 % Price Capital Gain Coupon Interest HPR % % %arrow_forwardSuppose that 6 - month, 12-month, 18 - month, 24 month, and 30 - month zero rates are 4%, 4.2%, 4.4%, 4.6%, and 4.6% per annum with continuous compounding respectively. Estimate the cash price of a bond with a face value of 100 that will mature in 30 months and pays a coupon of 6% per annum semiannually.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education