Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

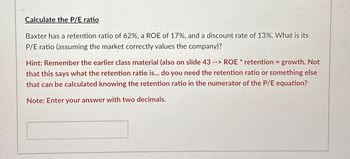

Transcribed Image Text:Calculate the P/E ratio

Baxter has a retention ratio of 62%, a ROE of 17%, and a discount rate of 13%. What is its

P/E ratio (assuming the market correctly values the company)?

Hint: Remember the earlier class material (also on slide 43 --> ROE * retention = growth. Not

that this says what the retention ratio is... do you need the retention ratio or something else

that can be calculated knowing the retention ratio in the numerator of the P/E equation?

Note: Enter your answer with two decimals.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- if a company profit margin is 0.6 and the current ratio is 0.6, is it advisable to invest in the company or not?arrow_forwardYou are considering a new supplier that you estimate would reduce your costs 0.025, increasing overall EBIT margin the same amount, or 250 basis points. Tax burden 0.79 Interest burden 0.8 Operating margin Asset turnover 2.1 Leverage ratio 1.2 Equity 56 Before the changes are made the firm was intrinsically valued at 45.54 After the changes, what would the new value be assuming the new ROE, growth, and EPS1. The firm pays dividends as 0.61 of EPS. The discount rate is 0.15" O 64.88 O 70.24 62.35 O 67.36 0.08 O 73.13arrow_forwardSolve with data given.arrow_forward

- . Using the information in the table below, answer calculate the following: Which company demonstrates the worst leverage ratio? Explain what it depicts. Which company demonstrates the strongest interest coverage ratio? Explain what it depicts. Walmart Inc Target Corp Home Depot Inc/The Lowe's Cos Inc CVS Health Corp 2020 Q2 2020 Q2 2020 Q2 2020 Q2 2020 Q2 Revenue 518 76.8 110 71.8 226.8 EBI TDA 33.7 7 18.3 6.1 14.2 EBI TDA Margin 6% 9% 17% 8% 6% Net Income 12.8 3.2 11.2 2.5 4.3 Return on Capital 11.1 14.1 39.6 13 4.9 Credit Metrics(x) Debt/EBI TDA 2 1.9 1.8 3.4 5.9 EBI TDA/Interest 14 16.2 18.7 16 6.6 FCF Coverage 7.7 14.6 11.1 6.2 6.2 Free Cash Flow to Total Debt 0.3 0.2 0.3 0.2 0.1arrow_forwardNeed answerarrow_forwardGive typing answer with explanation and conclusion _____ 2.) A company has a tax burden ratio of 0.4, a compound leverage factor of 0.6, a return on sales of 0.9, a leverage ratio of 0.7, and an asset turnover of 0.3. What is the ROE for the company? A.) 2.90% B.) 4.54% C.) 6.48% D.) 11.4% E.) None of the abovearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education