Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please give me answer general accounting question

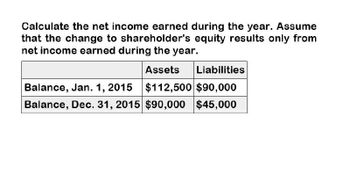

Transcribed Image Text:Calculate the net income earned during the year. Assume

that the change to shareholder's equity results only from

net income earned during the year.

Assets

Liabilities

Balance, Jan. 1, 2015

$112,500 $90,000

Balance, Dec. 31, 2015 $90,000 $45,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Prince Corporations accounts provided the following information at December 31, 2019: What should be the current balance of retained earnings? a. 520,000 b. 580,000 c. 610,000 d. 670,000arrow_forwardConsider the following partial income statements and balance sheets for Lillard Corp. For the year ended December 31, Net income Less income attributable to noncontrolling 5,700 interests Net income attributable to Lillard Corp. 100,400 107,300 Lillard Corp. shareholders' equity Noncontrolling interests Total equity What is Lillard's return on equity for 2024? 11.7% O 11.5% 12.3% 11.9% 2024 2023 108,000 113,000 11.1% 7,600 Dec. 31, 2024 Dec. 31, 2023 861,000 888,000 32,400 30,600 893,400 918,600arrow_forwardThe income statement of a corporation shows the following balance in Sales Revenue for the years 2017, 2016, and 2015. 2017: $676,000 2016: $625,000 2015: $610,000 Performing horizontal analysis on Sales Revenue would result in what percentage change for 2017? (Round to two decimal places.) 8% 108% 2% 11%arrow_forward

- Randall Corporation reported the following revenue data:Year Net revenues (in millions)$$$$6,8007,0046,7327,2762016201720182019Use 2016 as the base year. The trend percentage in 2019 is closest toa. 93%.b. 104%.c. 107%.d. 112%arrow_forwardAssuming that total assets were $8,037,000 at the beginning of the current fiscal year, determine the following: When required, round to one decimal place. a. Ratio of fixed assets to long-term liabilities b. Ratio of liabilities to stockholders' equity c. Asset turnover d. Return on total assets e. Return on stockholders' equity f. Return on common stockholders' equity % % %arrow_forwardPlease givearrow_forward

- For years ended December 31 Equity Investee Financial Summary, $ millions 2018 2017 2016 Net sales... Gross margin Net income.. Cummins' share of net income. $7,352 $7,050 $5,654 1,373 1,422 1,182 647 680 499 $ 336 $ 308 $ 260 Royalty and interest income.. 58 49 41 Total equity, royalty and interest from investees... $ 394 $ 357 $ 301 Current assets $3,401 1,449 $3,416 1,379 Noncurrent assets Current liabilities.. Noncurrent liabilities.. Net assets... (2,669) (218) (2,567) (237) $1,963 $1,991 Cummins' share of net assets $1,144 $1,116 a. What assets and liabilities of unconsolidated affiliates are omitted from Cummins' balance sheet as a result of the equity method of accounting for those investments? b. Do the liabilities of the unconsolidated affiliates affect Cummins directly? Explain. c. How does the equity method impact Cummins' ROE and its RNOA components (net operating asset turnover and net operating profit margin)?arrow_forwardWhat would the net income/loss be for the year using the following information? Please explain your calculations used to get your numbers. Jan. 1, 2017 total assets $150,000 Dec.31, 2017 total assets $175,000 Jan. 1, 2017 total liabilities $35,000 Dec. 31, 2017 total liabilities $145,000 Dividends declared for year $25,000 Dividends paid out for the year $37,500 No Par Common Stock Sold during year $10,000arrow_forwardAssume Metro Company had a net income of $2,100 for the year ending December 2018. Its beginning and ending total assets were $30,000 and $18,000, respectively. Calculate Metro's return on assets (ROA). (Round your percentage answer to two decimal places.) A. 7% B. 11.67% C. 4.38% D. 8.75%arrow_forward

- Determine the Retained Earnings balance on December 31, 2015 based on the following: 2014 Revenues: $1,500,000 2016 Revenues: $1,800,000 Retained Earnings Balance (December 31, 2014): $380,000 2015 Expenses: $1,200,000 Total Liabilities: $285,000 Total Current Asset: $900,000 Dividend rate: 20% of net income. A : $620,000 B : $1,280,000 C : $500,000 D : $860,000arrow_forwardWhat is the year-over-year revenue change percent? Use the attached financial data to calculate the ratios for 2022. Round to the nearest decimal. Abercrombie & Fitch Co (ANF) Financial Data Revenues Cost of Sales Total Operating Expenses Interest Expense Income Tax Expense Diluted Weighted Shares Outstanding Cash + Equivalents Accounts Receivable Inventories Total Current Assets Total Assets Accounts Payable Total Current Liabilities Total Stockholders' Equity ANF Stock Price = $10.30 Select one O A. 5.3% B. 14.4% C. -1.4% O D. -3.5% 2022 $3,659.3 $1,545.9 $2,026.9 $28.5 $37.8 52.8 $257.3 $108.5 $742.0 $1,220.4 $2,694.0 $322.1 $935.5 $656.1 2021 $3,712.8 $1,400.8 $1,968.9 $34.1 $38.9 62.6 $823.1 $69.1 $525.9 $1,507.8 $2,939.5 $374.8 $1,015.2 $826.1arrow_forwardCalculate RETURNED ON INVESTED CAPITAL by referring the pictures of Financial Position and Statement of Profit or Loss given with this question.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning