Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

General accounting

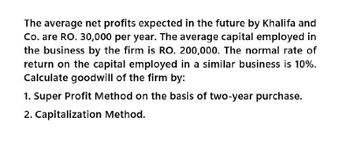

Transcribed Image Text:The average net profits expected in the future by Khalifa and

Co. are RO. 30,000 per year. The average capital employed in

the business by the firm is RO. 200,000. The normal rate of

return on the capital employed in a similar business is 10%.

Calculate goodwill of the firm by:

1. Super Profit Method on the basis of two-year purchase.

2. Capitalization Method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Capitalisation methodarrow_forwardThe following details relate to M/s XYZ, a firm: Average profit of last four years = $7,00,000 Average capital employed by the firm: $55,00,000 Normal rate of return :10% Present value of annuity of $1 for 4 years @ 10% : 3.1699 Determine the value of goodwill on the basis of annuity of super profit.arrow_forwardThe profits of firm for the five years are as follows: Year Profit (Rs.) 2012-13 20,000 2013-14 24,000 2014-15 30.000 2015-16 25.000 2016–17 8,000 Calculate the value of goodwill on the basis of three years' purchase of weighted average profits based on weights 1,2,3,4 and 5 respectively.arrow_forward

- Please help correctly wirh steps and explanation.arrow_forwardWhich of the following two companies creates more value, assuming that they are making the same initial investment? Company A's projected profits Year Last year 1 (forthcoming year) 2 3 4 Profit (£000s) 1,000 1,000 1,100 1,200 1,400 1,600 1,800 5 6 and all subsequent years Company B's projected profits Profit (£000s) Year Last year 1 (forthcoming year) 2 3 4 5 6 and all subsequent years 1,000 1,000 1,080 1,160 1,350 1,500 1,700 Profits for both companies are 20% of sales in each year. With company A, for every £1 increase in sales 7p has to be devoted to additional debtors because of the generous credit terms granted to customers. For B, only 1p is needed for additional investment in debtors for every £1 increase in sales. Higher sales also mean greater inventory levels at each firm. This is 6p and 2p for every extra £1 in sales for A and B respectively. Apart from the debtor and inventory adjustments, the profit figures of both firms reflect their cash flows. The cost of capital for…arrow_forwardA company is thinking of investing in one of two potential new products for sale. The projections are as follows: Year Revenue/cost £ (Product A) Revenue/cost £ (Product B)0 (150,000) outlay (150,000) outlay 1 24,000 12,0002 24,000 25,3333 44,000 52,0004 84,000 63,333 Calculate NPV of both products (to 1 d.p.) assuming a discount rate of 7%. Which product should be chosen and why?arrow_forward

- Use the following information to answer the next question. Total Asset = $40 million Basic earning power (BEP) ratio is 20% Times-interest-earned (TIE) Principal payments = 4 million ratio is 6.55 $1.35 million; $0.37 million What is the company's EBIT? The company's interest expense? $3.33 million; $0.83 million $8.0 million; $0.62 million Depreciation = $1.0 million. $7.5 million; $0.75 million Lease payments = 0.6 million $8.0 million; $1.22 millionarrow_forwardCan you provide this accounting question answer?arrow_forwardBased on the profit maximization goal, the financial manager would choose Asset D. Asset B. Asset A. Asset C.arrow_forward

- A company is considering a $184,000 investment in machinery with the following net cash flows. The company requires a 10% return on its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Net Cash Flow (a) Compute the net present value of this investment. (b) Should the machinery be purchased? Required A Required B Year 1 $11,000 Year Year 2 $31,000 Complete this question by entering your answers in the tabs below. Year 1 Year 2 Year 3 Net Cash Flows Year 3 $61,000 Compute the net present value of this investment. (Round your present value factor to 4 decimals. Round your final answers to the nearest whole dollar.) Present Value Factor Year 4 $46,000 Present Value of Net Cash Flows Year 5 $123,000arrow_forwardA firm has the following investment alternatives (refer to image): Each investment costs $3,000; investments B and C are mutually exclusive, and the firm’s cost of capital is 8 percent. a.) What is the net present value of each investment? b.) According to the net present values, which investment(s) should the firm make? Why? c.) What is the internal rate of return on each investment?arrow_forwardCalculate the Payback period (PBP) and Profitability Index (PI) of the investment and state the Pro’s and Cons of this method The annual incremental profits/ (losses) relating to the investment are estimated as follows: Years CF’s (000) Year 0 -175,000 Year 1 K11,000 Year 2 K3,000 Year 3 K34,000 Year 4 K47,000 Year 5 K8,000 Investment at the start of the project would be K175, 000,000.the investment sum assuming nil disposal value after five years, would be written off using the equal instalment method. The depreciation has been included in the profit estimates above, which should be assumed to arise at each year end. Assume the cost of Capital is 12% Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 D.f 1.00 0.893 0.797 0.712 0.636 0.567arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning