Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ezto.mi

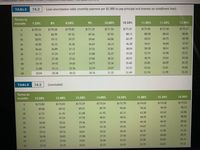

Calculate the monthly payment by table lookup and formula. (Answers will not be exact due to rounding of percents in table lookup.).

(Use 13% for table lookup.). (Use the loan amortization table) (Round your answers to the nearest cent.)

Number of

Total of monthly

payments

$5,849.76

Total finance

monthly

payments

Amount

Purchase price

of a used car

$5,793

Down

charge

$1,339.76

financed

APR

payment

$1, 283

48

$4,510

13%

Monthly Payment

es

By table

By formula

Transcribed Image Text:a.mhéducation.com/

TABLE

14.2

Loan amortization table (monthly payment per $1.000 to pay principal and interest on installment loan)

Terms in

months

7.50%

8%

8.50%

9%

10.00%

10.50%

11.00%

11.50%

12.00%

6.

$170.34

$170.58

$170.83

$171.20

$171.6

$171.81

S172.05

$172.30

$172.55

12

86.76

86.99

87.22

87.46

87.92

88.15

88.38

88.62

88.85

18

58.92

59.15

59.37

59.60

60.06

60.29

60.52

60.75

60.98

24

45.00

45.23

45.46

45.69

46.14

46.38

46.61

46.84

47.07

30

36.66

36.89

37.12.

37.35

37.81

38.04

38.28

38.51

38.75

36

31.11

31.34

31.57

31.80

32.27

32.50

32.74

32.98

33.21

42

27.15

27.38

27.62

27.85

28.32

28.55

28.79

29.03

29.28

48

24.18

24.42

24.65

24.77

25.36

25.60

25.85

26.09

26.33

54

21.88

22.12

22.36

22.59

23.07

23.32

23.56

23.81

24.06

60

20.04

20.28

20.52

20.76

21.25

21.49

21.74

21.99

22.24

TABLE

14.2

(concluded)

Terms in

months

12.50%

13.00%

13.50%

14.00%

14.50%

15.00%

15.50%

16.00%

$172.80

$173.04

$173.29

$173.54

$173.79

$174.03

$174.28

$174.53

9.

12

89.08

89.32

89.55

89.79

90.02

90.26

90.49

90.73

18

61.21

61.45

61.68

61.92

62.15

62.38

62.62

62.86

24

47.54

47.78

48.01

48.25

48.49

48.72

48.96

47.31

30

38.98

39.22

39.46

39.70

39.94

40.18

40.42

40.66

36

33.45

33.69

33.94

34.18

34.42

34.67

34.91

35.16

42

29.52

29.76

30.01

30.25

30.50

30.75

31.00

31.25

26.58

26.83

27.08

27.33

27.58

27.83

28.08

28.34

48

54

24.31

24.56

24.81

25.06

25.32

25.58

25.84

26.10

60

22.50

22.75

23.01

23.27

23.53

23.79

24.05

24.32

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- See picturesarrow_forwardVijayarrow_forwardFor the Questions 3-5 assume you want to finance (borrow) $12,000 for your next car and your interest rate will be 6%. 3. What will be your monthly payment and the total amount paid over the life of the loan if you finance for 48 months? Provide the car payment and the TVM inputs you used to calculate the payment. Рayment Total of all payments PV FV RATE/INTEREST PERIODS/N (See next page for Questions 4 and 5)arrow_forward

- Need hood explanation, don’t use excel please. Tsinoor takes out a loan of $6800. He will repay the loan over 5-years with semi-annual payments of $816 (first payment due in 6-months). Using linear interpolation, what rate of interest, j2 is being charged on the loan?arrow_forwardYour education loan balance is currently $1800. It is charging you interest at 5.4% compoundedmonthly. Assuming you make no payments on it, how long will it take for the balance to reach$1900? (Please help on how to solve in TI-84 plus calculator)arrow_forwardComplete the following table: (Use Table 15.1.) (Do not round intermediate calculations. Round your answers to the nearest cent.) First Payment Broken Down Into— Selling price Down payment Amount mortgage Rate Years Monthly payment Interest Principal Balance at end of month $221,000 $44,200 7.00 % 15arrow_forward

- Calculate the amount financed, the finance charge, and the monthly payments (in $) for the add-on interest loan. (Round your answers to the nearest cent.) Purchase (Cash) Price Monthly Payment Down Amount Add-on Number of Finance Payment Financed Interest Payments Charge $50,900 $ | $ 25% 11.6% 60arrow_forwardPlease helparrow_forwardCalculate the amount financed, the finance charge, and the total deferred payment price for the following installment loan. Round your answers to the nearest cent. Total Purchase Deferred (Cash) Down Amount Monthly Number of Finance Payment Price Payment Financed Payment Payments Charge Price $2,800 0% $190.35 24arrow_forward

- Calculate Loan Amount Enter the cost of the potential car, down payment, and fees below. Press calculate when you're ready. Cost of Potential Car 7,000 Down Payment 500 Taxes and Fees 340 Calculate Incorrect Correct Correct First, we need to figure out how much you want to borrow. You said you wanted to spend $5,000, and you will put $500 down. Based on that, we can estimate your taxes to be $340. Put those numbers into the calculator and press calculate to see how much money you will need for your loan.arrow_forwardCalculate the table factor, the finance charge, and the monthly payment (in $) for the loan by using the APR table, Table 13-1. (Round your answers to the nearest cent.) Monthly Payment Amount Number of Table Finance APR Financed Payments Factor Charge $800 18 16% $ 15.91 $ 50.29 $ 105.22arrow_forwardNeed only handwritten solution only (not typed one).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education