Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

infoPractice Pack

Question

thumb_up100%

infoPractice Pack

Calculate the firm's :

1) Current ratio

2) Quick Ratio

3) Days sales outstanding. Assume a 365 day per year for this calculation.

4) Total Assets turnover

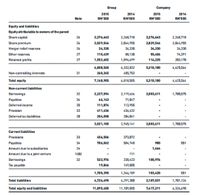

Transcribed Image Text:STATEMENTS OF

FINANCIAL POSITION

AS AT 31 DECEMBER 2015

Group

Company

2015

2014

2015

2014

Note

RM'000

RM'000

RM'000

RM'000

Assets

Non-current assets

Property, plant and equipment

11

234,067

218,173

Investment properties

12

640,975

570,143

Land held for property development

13

3,269,275

2,631,999

Investment in subsidiaries

14

4,530,910

3,738,094

Interests in associates

15

487,835

149,251

1,170

Interests in joint ventures

16la

1,143,774

928,327

419,517

444,645

Amount due from a joint venture

16|b)

72,697

62,536

Other investments

17

Goodwill

18

621,409

621,409

Non-current deposits

19

3

De ferred tax a sset

20

221,044

170,009

169

Long term receivables

23

54,849

59,105

6,745,925

5,410,955

4,951,766

4,182,739

Current assets

Property development co sts

21

2,281,634

1,578,583

Inventories

22

403,099

176,622

Receivables

23

1,219,500

2,761,535

387,694

421,134

Amount due from subsidiaries

24

1,940,833

1,564,035

Amount due from joint ventures

16|b)

239,635

240,284

130,348

154,662

Short terminvestments

25

202,635

Short term deposits

19

30,373

70,942

2,000

Cash and bank balances

19

975,227

668,329

6,570

2,120

5,149,475

5,698,930

2,465,445

2,143,951

Total assets

11,895,400

11,109,885

7,417,211

6,326,690

Transcribed Image Text:Group

Company

2014

RM'000

2015

2014

2015

RM'000

Note

RM'0

RM'000

Equity and liabilities

Equity attributable to owners of the parent

Share capital

26

2,276,643

2,268,718

2,276,643

2,268,718

Share premium

26

2,829,546

2,044,955

2,829,546

2,044,955

Merger relief reserves

26

34,330

34,330

34,330

34,330

Other reserves

27

115,439

88 130

55,406

74,391

Retained profits

27

1,552,602

1,896,699

114,225

203,170

6,808,560

6,332,832

5,310,180

4,625,564

Non-controlling interests

31

360,345

485,753

Total equity

7,168,905

6,818,585

5,310,180

4,625,564

Non-current liabilities

Borrowings

32

2,227,594

2,119,666

2,003,611

1,700,575

Payables

34

66,143

71,047

Deferred income

35

111,874

113,955

Provision

33

411,436

436,432

Deferred tax lia bilities

20

204,058

204,041

3,021,105

2,945, 141

2,003,611

1,700,575

Current liabilities

Provisions

33

456,506

373,072

Payables

34

706,062

584,748

980

551

Amount due to subsidiaries

24

1,464

Amount due to a joint venture

16|b)

111

Borrowings

32

522,976

238,423

100,976

Tax payable

19,846

149,805

1,705,390

1,346, 159

103,420

551

Total liabilities

4,726,495

4,291,300

2,107,031

1,701,126

Total equity and liabilities

11,895,400

11,109,885

7417,211

6,326,690

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Includes step-by-step video

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Margin, Turnover, Return on Investment Pelak Company had sales of $4,974,000, expenses of $4,566,000, and average operating assets of $4,380,000. Required: 1. Compute the operating income.$fill in the blank 1 2. Compute the margin (as a percent) and turnover ratio. If required, round your answers to one decimal place. Margin fill in the blank 2 % Turnover fill in the blank 3 3. Compute the ROI as a percent. Use the part 2 final answers in these calculations and round the final answer to two decimal places.fill in the blank 4 %arrow_forwardAMT. Inc.'s net income for this quarter is $500,000. The publicized return on assets (ROA) is 34.5 % . Estimate the firm's total asset to the closet possible. a. $1,500,000 c. $2,450,000 b. $ 1,450,000 d. $2,005,500arrow_forwardBottlebrush Company has operating income of $77,805, invested assets of $117,000, and sales of $409,500. Use the DuPont formula to compute the return on investment, and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment Round answers to one decimal place. a. Profit margin b. Investment turnover c. Return on investment % %arrow_forward

- Book rences Required: a. Firm D has net income of $64,296, sales of $1,368,000, and average total assets of $760,000. Calculate the firm's margin, turnover, and ROI. b. Firm E has net income of $120,218, sales of $1,939,000, and ROI of 8.68%. Calculate the firm's turnover and average total assets. c. Firm F has ROI of 12.40%, average total assets of $1,540,000, and turnover of 0.8. Calculate the firm's sales, margin, and net income. Complete this question by entering your answers in the tabs below. Required A Required B Required C Firm D has net income of $64,296, sales of $1,368,000, and average total assets of $760,000. Calculate the firm's margin, turnover, and ROI. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Margin Turnover ROI % % Required B >arrow_forwardProfit Margin, Investment Turnover, and ROI Briggs Company has income from operations of $132,756, invested assets of $299,000, and sales of $1,106,300. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin % b. Investment turnover c. Return on investment %arrow_forwardNeed Answer pleasearrow_forward

- Margin, Turnover, Return on Investment Pelak Company had sales of $4,945,000, expenses of $4,566,000, and average operating assets of $3,690,000. Required: 1. Compute the operating income. $ 2. Compute the margin (as a percent) and turnover ratio. If required, round your answers to one decimal place. Margin Turnover % 3. Compute the ROI as a percent. Use the part 2 final answers in these calculations and round the final answer to two decimal places. %arrow_forwardFind the firm's asset turnover ratio & ROA.arrow_forwardAn electric company must decide between two options for managing the blowdown water from its cooling tower. Option 1 is to continue the lease on 50 acres of land for another 5-year period and dispose of the water by spray irrigation. The landowner will move the pipe around as necessary and maintain the spray nozzles and valves. The previous lease cost $125,000 per year with payments due midway through each year. Now the landowner will require beginning of year payments of $180,000 each year. Option 2, which releases the 50 acre tract of land, involves purchasing a treatment system that will allow the recycling of most of the blowdown water. This system will have an initial cost of $1,600,000 and an AOC of $58,000 per year. However, the company will save $220,000 per year because it will not have to purchase as much make-up water as with option 1. At the end of 5 years, the company will be able to sell the equipment back to the local equipment supplier for 30% of the first cost. If the…arrow_forward

- A company reports the following: Sales $8,782,430 Average total assets (excluding long-term investments) 1,111,700 Determine the asset turnover ratio. Round your answer to one decimal place.fill in the blank 1arrow_forwardFollowing is information from Skyway Inc. for the year (in thousands). Total annual revenue $3,206,980 Total revenue growth rate 5.0% Terminal revenue growth rate 2% Net operating profit margin (NOPM) 8.2% Net operating asset turnover (NOAT) 3.42 Projected total revenue for the following year would be: Select one: a. $3,469,952 b. None of these are correct c. $3,316,659 d. $3,271,120 e. $3,367,329arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education