FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

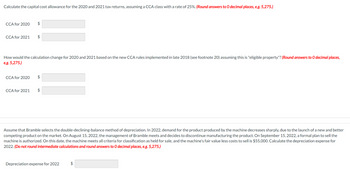

Transcribed Image Text:Calculate the capital cost allowance for the 2020 and 2021 tax returns, assuming a CCA class with a rate of 25%. (Round answers to O decimal places, e.g. 5,275.)

CCA for 2020 $

CCA for 2021

$

How would the calculation change for 2020 and 2021 based on the new CCA rules implemented in late 2018 (see footnote 20) assuming this is "eligible property"? (Round answers to O decimal places,

e.g. 5,275.)

CCA for 2020 $

CCA for 2021

$

Assume that Bramble selects the double-declining-balance method of depreciation. In 2022, demand for the product produced by the machine decreases sharply, due to the launch of a new and better

competing product on the market. On August 15, 2022, the management of Bramble meets and decides to discontinue manufacturing the product. On September 15, 2022, a formal plan to sell the

machine is authorized. On this date, the machine meets all criteria for classification as held for sale, and the machine's fair value less costs to sell is $55,000. Calculate the depreciation expense for

2022. (Do not round intermediate calculations and round answers to O decimal places, e.g. 5,275.)

Depreciation expense for 2022

$

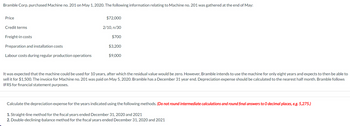

Transcribed Image Text:Bramble Corp. purchased Machine no. 201 on May 1, 2020. The following information relating to Machine no. 201 was gathered at the end of May:

Price

Credit terms

Freight-in costs

Preparation and installation costs

Labour costs during regular production operations

$72,000

2/10, n/30

$700

$3,200

$9,000

It was expected that the machine could be used for 10 years, after which the residual value would be zero. However, Bramble intends to use the machine for only eight years and expects to then be able to

sell it for $1,500. The invoice for Machine no. 201 was paid on May 5, 2020. Bramble has a December 31 year end. Depreciation expense should be calculated to the nearest half month. Bramble follows

IFRS for financial statement purposes.

Calculate the depreciation expense for the years indicated using the following methods. (Do not round intermediate calculations and round final answers to O decimal places, e.g. 5,275.)

1. Straight-line method for the fiscal years ended December 31, 2020 and 2021

2. Double-declining-balance method for the fiscal years ended December 31, 2020 and 2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The T-accounts for Equipment and the related Accumulated Depreciation—Equipment for Luo Company at the end of 2020 are shown here. Equipment Beg. bal. 80,600 Disposals 23,800 Acquisitions 40,000 End. bal. 96,800 Accumulated Depreciation—Equipment Disposals 8,700 Beg. bal. 47,800 Depr. exp. 13,300 End. bal. 52,400 In addition, Luo’s income statement reported a loss on the disposal of plant assets of $6,100. What amount was reported on the statement of cash flows as “cash flow from sale of equipment”? (Show amount that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Cash flow from sale of equipment $arrow_forwardBonita Industries Ltd., a public company, presents you with the following information: (a) Complete the table for the year ended December 31, 2027. The company depreciates all assets for a half year in the year of acquisition and the year of disposal. (Round answers to O decimal places, e.g. 5,275.) Description Machine A Machine B Machine C Date Purchased Dec. 2, 2025 Aug. 15, 2024 July 21, 2023 Cost $140,000 72,000 (3) Residual Value $12,000 15,000 22,000 Life in Years 10 5 8 Depreciation Method Straight-line Double-declining-balance (1)arrow_forwardBased upon the provided information, how would I be able to calculate the Amortization of prior service costs and expected return on the plan assets? Additionally, would you be able to please help me understand what formula to use in these two calculations and why you use those. Thank you!arrow_forward

- Company B's December 31 Year-End Balance Sheet reveals the following: • December 31, 2020 net PPE of $865 • December 31, 2020 Accumulated Depreciation of $250 • December 31, 2021 net PPE of $770 • December 31, 2021 Accumulated Depreciation of $230 • Annual 2021 Depreciation Expense was $100 • During 2021, PPE was purchased for $560; all PPE purchases are made in cash. • During 2021, the gain of the sale of PPE was $20 What is the journal entry Company B recorded to recognize 2021 depreciation expense? Dr. Accumulated Depreciation $20 Cr. Depreciation Expense $20 Dr. Depreciation Expense $100 Cr. Accumulated Depreciation $100 Dr. Depreciation Expense $20 Cr. Accumulated Depreciation $20 Dr. Depreciation Expense $100 Cr. PPE $100arrow_forwardPlease do not give solution in image format thankuarrow_forwardCalculate the amount of revenue and gross profit (loss) to be recognized in each of the three years assuming the following costs incurred and costs to complete information. (Do not round intermediate calculations and round your final answers to the nearest whole dollar amount. Loss amounts should be indicated with a minus sign.)arrow_forward

- The Annual Depreciation Expense be using straight-line depreciation will be $6250, the accounts would be used in the adjusting entry for a full year of depreciation will be Debit - Depreciation Expense, Truck</> Credit - Accumulated Depreciation, Truck. 13) Under the Fixed assets section of the balance sheet, what number would we put in the "Accumulated Depreciation, Truck" section for Year # 4 if depreciation is calculated ANNUALLY (assume Jan 1st, 2019 to Dec 31st, 2019 is Year #1).arrow_forwardComputing Depreciation Using Various Depreciation Methods To demonstrate the computations involved in several methods of depreciating a fixed asset, the following data are used for equipment purchased on January 1, 2020. Cost and residual value Estimated service life: Acquisition cost $26,250 Years 5 Residual value $1,050 Service hours 21,000 Productive output (units) 50,400 e. Double-declining-balance method: Compute the depreciation amount for each year. 2020 2021 2022 2023 2024 Answer Answer Answer Answer Answerarrow_forward1. Determine the annual depreciation expense for each of the estimated 5 years of use, the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year by (a) the straight-line method and (b) the double-declining-balance method. a. Straight-line method Additional Instruction Accumulated Depreciation, Year Depreciation Expense End of Year Book Value, End of Year 1 2 3 4 5 b. Double-declining-balance method Accumulated Depreciation, Year Depreciation Expense End of Year Book Value, End of Year 1 2 3 4 5 New lithographic equipment, acquired at a cost of $859,200 on March 1 at the beginning of a fiscal year, has an estimated useful life of 5 years and an estimated residual value of $96,660. The manager requested…arrow_forward

- Your staff person has provided you with the following journal entry for January 20x1 depreciation. The monthly deprecation is supposed to be $100.00. What is wrong with this entry?arrow_forwardPrepare the journal entry; to record depreciation expense for 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Datearrow_forwardplease need help with must must explanation , narrations , computation for each entry and for each calculation , parts answer in text formarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education