Now that operations for outdoor clinics and TEAM events are running smoothly, Suzie thinks of another area for business expansion. She notices that a few clinic participants wear multiuse (MU) watches. Beyond the normal timekeeping features of most watches, MU watches are able to report temperature, altitude, and barometric pressure. MU watches are waterproof, so moisture from kayaking, rain, fishing, or even diving up to 100 feet won’t damage them. Suzie decides to have MU watches available for sale at the start of each clinic. The following transactions relate to purchases and sales of watches during the second half of 2025. All watches are sold for $491 each.

| July 17 | Purchased 41 watches for $5,781 ($141 per watch) on account. |

|---|---|

| July 31 | Sold 31 watches for $15,221 cash. |

| August 12 | Purchased 31 watches for $4,681 ($151 per watch) cash. |

| August 22 | Sold 21 watches for $10,311 on account. |

| September 19 | Paid for watches purchased on July 17. |

| September 27 | Receive cash of $20,400 for watches sold on account on August 22. |

| October 27 | Purchased 71 watches for $11,431 ($161 per watch) cash. |

| November 20 | Sold 81 watches for $39,771 cash. |

| December 4 | Purchased 102 watches for $17,442 ($171 per watch) on account. |

| December 8 | Sold 31 watches for $15,221 on account. |

Required:

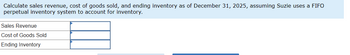

1-a. Calculate sales revenue, cost of goods sold, and ending inventory as of December 31, 2025, assuming Suzie uses a FIFO perpetual inventory system to account for inventory.

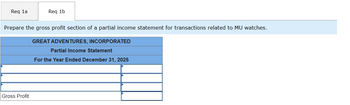

1-b. Prepare the gross profit section of a partial income statement for transactions related to MU watches.

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

- When June and Jerry started their business, Kingbird Inc., their mission was simple: to provide a quiet, round-trip ride to hundreds of office workers so they could work during the commute. At the beginning, they had enough capacity to accommodate all interested customers. But as this idea gained popularity, there was demand they couldn't meet-and not just by commuters, but also by travelers heading to and from the airport. June and Jerry organized their growing business into geographical segments, evaluating each on its operating income and profit margin. The two owners retained control of asset purchases. June and Jerry still intended for their segment managers to work together, helping each other with capacity needs when required. Such participation was left up to the segment managers, though. All three segments had the same variable and absorption cost for an average two-way trip, at $16 and $24 per customer, respectively. Since the culture in this company was very open, each…arrow_forwardThe owner of Barb’s Burgers has suggested the firm should invest in more moderntechnology and created a list of potential changes she thinks may be helpful as aninvestment. She has asked you to analyze the four potential choices and comment onwhat this would change in terms of cost: Allow Barb’s Burgers to be delivered via the pre-existing food delivery systems.For example, allow people from Doordash/Uber Eats to pick-up orders and deliverthem. This would require the firm to make some minor changes and result in fewerparking spaces for customers dining at the restaurant. • Question: Argue how each of these is likely to change the cost of the firm once implemented (i.e. are any of these a fixed cost or a variable cost). How this adjust the amount of labour and/or capital currently necessary for the firm? Would the technology be a general technology, labour-saving, or capital-saving? Also mention the parking space.arrow_forwardA country club wants to exam the effects of a new marketing campaign that attempts to get more people within the community to become members. In many communities, when people buy a house in the area, they receive a “Welcome Wagon” gift basket containing coupons to local restaurants. The idea of the marketing campaign is to include a free two month membership to the country club in the gift basket with the hope that once “new” residents try the country club then at least a certain proportion will want to become real members. One member of the Club’s Executive Council believes that at least 81% of the people who receive the coupons for the free membership will use the coupon. In a sample of 192 new residents who received the coupon for the two month free membership, there were 138 people who actually took advantage of the free two month membership. When testing the hypothesis that at least 81% of the people that receive the coupon actually use it, what is the test statistic?arrow_forward

- Required information [The following information applies to the questions displayed below.] Now that operations for outdoor clinics and TEAM events are running smoothly, Suzie thinks of another area for business expansion. She notices that a few clinic participants wear multiuse (MU) watches. Beyond the normal timekeeping features of most watches, MU watches are able to report temperature, altitude, and barometric pressure. MU watches are waterproof, so moisture from kayaking, rain, fishing, or even diving up to 100 feet won't damage them. Suzie decides to have MU watches available for sale at the start of each clinic. The following transactions relate to purchases and sales of watches during the second half of 2025. All watches are sold for $509 each. July 17 July 31 August 12 August 22 Purchased 59 watches for $9,381 ($159 per watch) on account. Sold 49 watches for $24,941 cash. Purchased 49 watches for $8,281 ($169 per watch) cash. Sold 39 watches for $19,851 on account. September 19…arrow_forwardThe Cloud Burst Sprinkler Company of Benicia, California has been manufacturing and selling a water efficient sprinkler exclusively to Home Depot for the last two years. Although there is not a binding contract that gives Home Depot exclusive rights to buy and stock the sprinkler in their network of locations, Cloud Burst has placed a great deal of importance on keeping Home Depot locations across the country and Canada fully stocked with their water efficient sprinkler. ACE Hardware has approached Cloudburst indicating they would like to stock the water efficient sprinkler in their 4,192 stores across the United States. The initial proposal submitted by ACE is to purchase 50,304 sprinklers which will result in a dozen sprinklers stocked in every store. The proposal received from ACE will NOT affect fixed costs, however, ACE has requested a special onetime quantity wholesale discount price of $5.80 per sprinkler For the first 6 months of 2022, Cloud Burst Sprinkler Company achieved the…arrow_forwardThe Elberta Fruit Farm of Ontario has always hired transient workers to pick its annual cherry crop. Janessa Wright, the farm manager, just received information on a cherry picking machine that is being purchased by many fruit farms. The machine is a motorized device that shakes the cherry tree, causing the cherries to fall onto plastic tarps that funnel the cherries into bins. Ms. Wright has gathered the following information to decide whether a cherry picker would be a profitable investment for the Elberta Fruit Farm: Currently, the farm is paying an average of $200,000 per year to transient workers to pick the cherries. The cherry picker would cost $250,000. It would be depreciated using the straight-line method and it would have no salvage value at the end of its 8-year useful life. Annual out-of-pocket costs associated with the cherry picker would be: cost of an operator and an assistant, $98,000; insurance, $5,000; fuel, $15,000; and a maintenance contract, $20,000. Compute the…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education