FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

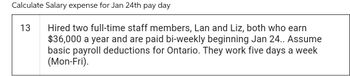

Transcribed Image Text:Calculate Salary expense for Jan 24th pay day

13

Hired two full-time staff members, Lan and Liz, both who earn

$36,000 a year and are paid bi-weekly beginning Jan 24.. Assume

basic payroll deductions for Ontario. They work five days a week

(Mon-Fri).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate Payroll Breakin Away Company has three employees-a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee: Consultant Computer Programmer $28 per hour Administrator $42 per hour 1.5 times hourly rate 2 times hourly rate 2 Regular earnings rate Overtime earnings rate Number of withholding allowances Gross pay Net pay $3,210 per week Not applicable 3 For the current pay period, the computer programmer worked 60 hours and the administrator worked 50 hours. The federal income tax withheld for all three employees, who are single, can be determined by adding $356.90 to 28% of the difference between the employee's amount subject to withholding and $1,796.00. Assume further that the social security tax rate was 6%, the Medicare tax rate was 1.5%, and one withholding allowance is $70. Determine the gross pay and the net pay for each of the three employees for the current pay period. Assume the normal working hours in a…arrow_forwardJournallze employer payroll taxes. No employee has reached the Social Security limit of $128,400 or the FUTA/SUTA limit of $7,000. (Round answers to 2 decimal places, es. 15.25. Credit account titles are qutomatically indented when amount is entered. Do not indent manually) Date Account Titles and Explanation Debit Credit Mar. 15 eTextbook and Media List of Accounts Journalize the payment on March 31 of the FICA taxes and federal income taxes payable only. (Round answers to 2 decimal places, es 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually) Date Account Titles and Explanation Debit Credit Mar. 31arrow_forwardCalculate Payroll Breakin Away Company has three employees-a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee: Consultant Computer Programmer Administrator Regular earnings rate $3,210 per week $32 per hour $42 per hour Overtime earnings rate Not applicable 1.5 times hourly rate 2 times hourly rate Number of withholding allowances 3 2 1 For the current pay period, the computer programmer worked 60 hours and the administrator worked 50 hours. The federal income tax withheld for all three employees, who are single, can be determined by adding $356.90 to 28% of the difference between the employee's amount subject to withholding and $1,796.00. Assume further that the social security tax rate was 6%, the Medicare tax rate was 1.5%, and one withholding allowance is $70. Determine the gross pay and the net pay for each of the three employees for the current pay period. Assume the normal…arrow_forward

- Take me to the text An employee had $24,300 in gross earnings up to February 20, 2021. She has the following information for her pay for the week ending February 27, 2021. Her employer contributes 100% toward CPP and 140 % toward El. Vacation pay is accrued at 4% of gross pay. Workers' Compensation is 1% of gross pay. Item Amount Hours 36 Hourly Rate $16.20 Income Tax $116.64 Canada Pension Plan $28.12 Employment Insurance $9.21 Union Dues $10.00 Charitable Donations $20.00 Do not enter dollar signs or commas in the input boxes. Round your answers to 2 decimal places. For transactions with more than one debit or more than one credit, enter the debit accounts in alphabetical order followed by credit accounts in alphabetical order.arrow_forwardCompute Payroll Floatin Away Company has three employees—a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee: Consultant Computer Programmer Administrator Regular earnings rate $2,710 per week $34 per hour $44 per hour Overtime earnings rate* Not applicable 1.5 times hourly rate 2 times hourly rate Number of withholding allowances 3 2 1 *For hourly employees, overtime is paid for hours worked in excess of 40 hours per week. For the current pay period, the computer programmer worked 60 hours and the administrator worked 50 hours. The federal income tax withheld for all three employees, who are single, can be determined by adding $276.54 to 24% of the difference between the employee's amount subject to withholding and $1,692.00. Assume further that the social security tax rate was 6.0%, the Medicare tax rate was 1.5%, and one withholding allowance is $81. Determine the gross pay and the net pay for each of the three…arrow_forwardEmployee Earnings Record Mary’s Luxury Travel uses a weekly federal income tax withholding table. Refer to Figure 8-4 in the text. The payroll data for each employee for the week ended March 22, 20—, are given. Employees are paid 1½ times the regular rate for working over 40 hours a week. Name No. ofAllowances MaritalStatus Total HoursWorked Mar. 16–22 Rate Total EarningsJan. 1–Mar. 15 Bacon, Andrea 4 M 44 $14.00 $6,300.00 Cole, Andrew 1 S 40 15.00 6,150.00 Hicks, Melvin 3 M 44 13.50 5,805.00 Leung, Cara 1 S 36 14.00 5,600.00 Melling, Melissa 2 M 40 14.50 5,945.00 Social Security tax is withheld from the first $128,400 of earnings at the rate of 6.2%. Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of 1%, both applied to gross pay. Bacon and Leung have $15 withheld and Cole and Hicks have $10 withheld for health insurance. Bacon and Leung have $20 withheld to be invested in the travel agency’s credit union. Cole has $38.75…arrow_forward

- Calculate Payroll K. Mello Company has three employees-a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee: Consultant Computer Programmer Administrator Regular earnings rate $2,210 per week $28 per hour $40 per hour Overtime earnings rate Not applicable 2 times hourly rate 1.5 times hourly rate Federal income tax withheld $925 $246 $510 For hourly employees, overtime is paid for hours worked in excess of 40 hours per week. For the current pay period, the computer programmer worked 54 hours and the administrator worked 62 hours. Assume further that the social security tax rate was 6%, and the Medicare tax rate was 1.5%. Determine the gross pay and the net pay for each of the three employees for the current pay period. Assume the normal working hours in a week are 40 hours. If required, round your answers to two decimal places. Consultant Computer Programmer Administrator Gross…arrow_forwardComputing Overtime Rate of Pay and Gross Weekly Pay Marcos Putnam receives a regular salary of $3,120 a month and is paid 12 times the regular hourly rate for hours worked in excess of 40 per week. a. Calculate Putnam's overtime rate of pay. overtime pay per hour b. Calculate Putnam's total gross weekly pay if he works 45 hours during the week. %24 %24arrow_forwardCalculate payrollK. Mello Company has three employees—a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee: Consultant ComputerProgrammer Administrator Regular earnings rate $5,000 perweek $50 per hour $60 per hour Overtime earnings rate Not applicable 2 times hourly rate 1.5 times hourlyrate Federal income taxwithheld $1,150 $428 $572 For the current pay period, the computer programmer worked 48 hours and the administrator worked 51 hours. Assume that the social security tax rate was 6.0%, and the Medicare tax rate was 1.5%.Determine the gross pay and the net pay for each of the three employees for the current pay period.arrow_forward

- Compute payroll K. Mello Company has three employees-a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee: Consultant Computer Programmer Administrator $55 per hour Regular earnings rate Overtime earnings rate 2 times hourly rate Federal income tax withheld $452 For hourly employees, overtime is paid for hours worked in excess of 40 hours per week. For the current pay period, the computer programmer worked 46 hours and the administrator worked 50 hours. Assume that the social security tax rate was 6.0%, and the Medicare tax rate was 1.5%. Determine the gross pay and the net pay for each of the three employees for the current pay period. When required round intermediate calculations and final answers to two decimal places. Computer Programmer Consultant Gross pay Net pay $6,000 per week Not applicable $1,380 $70 per hour 1.5 times hourly rate $642 Administratorarrow_forwardCompute payroll K. Mello Company has three employees-a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee: Computer Programmer $30 per hour Administrator $48 per hour Regular earnings rate Overtime earnings rate 2 times hourly rate $253 1.5 times hourly rate $515 Federal income tax withheld For hourly employees, overtime is paid for hours worked in excess of 40 hours per week. For the current pay period, the computer programmer worked 52 hours and the administrator worked 62 hours. Assume that the social security tax rate was 6.0%, and the Medicare tax rate was 1.5%. Consultant $3,010 per week Not applicable $925 Determine the gross pay and the net pay for each of the three employees for the current pay period. Assume the normal working hours in a week are 40 hours. When required round intermediate calculations and final answers to two decimal places. Consultant Computer Programmer Gross pay Net pay Administratorarrow_forwardSunland Company has the following data for the weekly payroll ending January 31. Hours Employee M T W T F S Hourly Rate Federal Income Tax Withholding Health Insurance L. Helton 8 8 10 8 10 3 $10 $34 $10 R. Kenseth 8 8 8 8 8 3 16 37 25 D. Tavaras 9 10 8 8 9 0 13 58 25 Employees are paid 1½ times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes are 7.65% (the 7.65% FICA tax rate consists of the Social Security tax rate of 6.2% on salaries and wages up to $128,400 and the Medicare tax rate of 1.45% on all salaries and wages). Sunland Company is subject to 5.4% state unemployment taxes and 0.6% federal unemployment taxes on the first $7,000 of gross earnings.Prepare the journal entry to record Sunland’s payroll tax expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education