Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

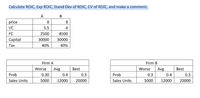

Transcribed Image Text:Calculate ROIC, Exp ROIC, Stand Dev of ROIC, CV of ROIC, and make a comment.

B

price

8

8

VC

5.5

4

FC

2500

8500

Capital

30000

30000

Таx

40%

40%

Firm A

Firm B

Worse

Avg

Best

Worse

Avg

Best

Prob

0.30

0.4

0.3

Prob

0.3

0.4

0.3

Sales Units

5000

12000

20000

Sales Units

5000

12000

20000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 0 O Value Analysis 1016 Price Analysis O Spend Analysis Question 3 Which statement is FALSE: O Price analysis is used for strategic buy O Life cycle cost of ownership is used with critical buy 4 O Spend analysis is based on three main categories of spending costs O Price analysis uses an external benchmark to compare prices Question 4 Cost breakdown problem: A supplier indicates a 20% increase in labor costs and demands a 20% increase in purchasing What is the current purchasing.price? bould be the new purchasing price?arrow_forwardGive typing answer with explanation and conclusion You are given the following information on a Company - ROAop = 10%, tc = 30% and rd = 5% if D/EV = 30%, what is ROE = ? Question 21 options: 8.05% 8.50% 10.00% 15.00% the answer is 8.5% but i dont understand how to get there can someone show me the work and break it downarrow_forward(Related to Checkpoint 8.3) (Systematic risk and expected rates of return) The following table,, contains beta coefficient estimates for six firms. Calculate the expected increase in the value of each firm's shares if the market portfolio were to increase by 10 percent. Perform the same calculation where the market drops by 10 percent. Which set of firms has the most variable or volatile stock returns? Input the expected increase in the value of each firm's shares if the market portfolio were to increase by 10%. (Round each answer to two decimal places.)arrow_forward

- V1. Hello After reading "Awesome Bits Games: Managing a Controversial Pricing Scheme Case" Please answer the below questions. Thank you. 5. Consider the options available to ABG at the time of the emergency meeting (do nothing; do nothing but explain; open the USD 310 pledge level to an unlimited number; roll the price back to USD 250). Perform appropriate financial analysis for each option. Examine the role of the company, competition, and customers in this decision. Which option should ABG choose? Explain the answerarrow_forwardnot use ai pleasearrow_forwardAs you can see, in the answer it says $1,000 unfavorable. I know how to figure out if it’s favorable or not from drawing a chart. But how do we know it’s unfavorable from this solution right here? Please explain. Thank youarrow_forward

- Q7. Calculate A and B in the table based on the value-based methods introduced in textbook and lecture slides. Incremental Benefits Improved Valuo Bonolit Weight Weighted Factor Clarity 20% Range A Security 10% Battery life 5% Ease of use 30% Overall 0.40 0.20 0.10 0.20 0.10 1.00 8% 8% 1% 1% 3% Barrow_forwardA 32" LCD Television with a cost of 23,900 has a markup rate of 28%.Find the selling price and the markuparrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education