Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial accounting

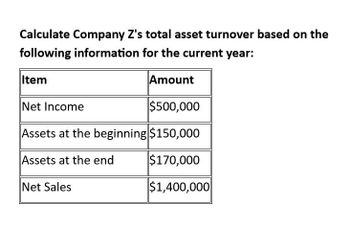

Transcribed Image Text:Calculate Company Z's total asset turnover based on the

following information for the current year:

Item

Net Income

Amount

$500,000

Assets at the beginning $150,000

Assets at the end

Net Sales

$170,000

$1,400,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Asset turnover A company reports the following: Sales $1,284,150 Average total assets (excluding long-term investments) 611,500 Determine the asset turnover ratio. If required, round your answer to one decimal place.arrow_forwardAsset turnover A company reports the following: Sales $858,000Average total assets (excluding long-term investments) 572,000Determine the asset turnover ratio. If required, round your answer to one decimal place.fill in the blank 1arrow_forwardAsset turnover A company reports the following: Sales $6,480,000 Average total assets 2,400,000 Determine the asset turnover ratio. Round your answer to one decimal place.arrow_forward

- Asset turnover A company reports the following: Sales $1,189,650 Average total assets (excluding long-term investments) 566,500 Determine the asset turnover ratio. If required, round your answer to one decimal place.fill in the blank 1arrow_forwardAsset turnover Financial statement data for years ending December 31, 2019 and 2018, for Edison Company follow: 2019 2018 Sales $1,491,000 $1,196,000 Total assets: beginning of year 590,000 450,000 end of year 830,000 590,000 a. Determine the asset turnover for 2019 and 2018. Round your answers to one decimal place. 2019 2018 Ratio of sales to assets b. Does the change in the asset turnover from 2018 to 2019 indicate a favorable or an unfavorable trend?arrow_forwardPlease solve with general accountingarrow_forward

- A company reports the following: Sales $10,975,200Average total assets $1,371,900 Determine the asset turnover ratio. Round your answer to one decimal place.arrow_forwardUsing the following data for Marigold, Inc., compute its asset turnover and the return on assets ratio. Net Income 2026 $165,040 Total Assets 12/31/26 2,243,000 Total Assets 12/31/25 1,883,000 Net Sales 2026 2,166,150 Asset turnover (Round to 2 decimal places, e.g. 15.35.) 1.05 times Return on assets (Round to 1 decimal place, e.g. 15.3%.) 8 %arrow_forwardUse the following dataarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT