EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

calculate the asset turnover.

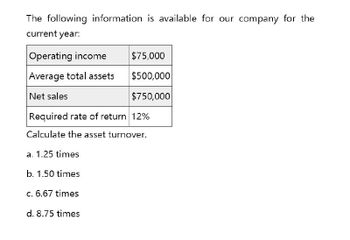

Transcribed Image Text:The following information is available for our company for the

current year:

Operating income

$75,000

Average total assets

$500,000

Net sales

$750,000

Required rate of return 12%

Calculate the asset turnover.

a. 1.25 times

b. 1.50 times

c. 6.67 times

d. 8.75 times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- General Accountingarrow_forwardYour company has net sales revenue of $43 million during the year. At the beginning of the year, fixed assets are $15 million. At the end of the year, fixed assets are $17 million. What the fixed asset turnover ratio? Multiple Choice 2.87 1.34 2.53 269arrow_forwardNeed help this questionarrow_forward

- Given the following data:arrow_forwardWhat is the fixed assets turnover ratio?arrow_forwardAsset turnover A company reports the following: Sales $820,800 Average total assets (excluding long-term investments) 456,000 Determine the asset turnover ratio. If required, round your answer to one decimal place.arrow_forward

- H6. BDU Company has net income of $500,000 and average assets of $2,000,000 for the current year. If its asset turnover is 1.25 times, what is its profit margin? Show proper step by step calculationarrow_forwardCompute the following the financial data for the year. 4. Average sale period 5. Operating cycle 6. Total asset turnoverarrow_forwardMCQarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning