FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

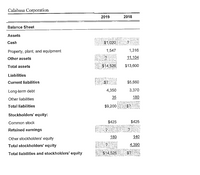

Transcribed Image Text:Calabasa Corporation

2019

2018

Balance Sheet

Assets

Cash

$1,020

Property, plant, and equipment

1,547

1,316

Other assets

11,104

Total assets

$14,526

$13,600

Liabilities

Current liabilities

$?

$5,660

Long-term debt

4,350

3,370

35

180

Other liabilities

Total liabilities

$9,200

$?

Stockholders' equity:

Common stock

$425

$425

Retained earnings

Other stockholders' equity

180

140

Total stockholders' equity

4,390

Total liabilities and stockholders' equity

$14,526

$?

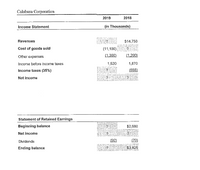

Transcribed Image Text:Calabasa Corporation

2019

2018

Income Statement

(in Thousands)

Revenues

$14,750

Cost of goods sold

(11,100)

Other expenses

(1,300)

(1,200)

Income before income taxes

1,520

1,870

Income taxes (35%)

(655)

Net income

Statemont of Retained Earnings

Beginning balance

$2,680

Net income

Dividends

(92)

(70)

Ending balance

$3,825

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Income Statement Bullseye, Incorporated's 2021 income statement lists the following income and expenses: EBIT = $701,000, Interest expense = has no preferred stock outstanding and 310, 000 shares of common stock outstanding. What are the 2021 earnings per share? $51, 500, and Taxes = $218,000. Bullseye'sarrow_forwardPrince Corporation's accounts provided the following information at December 31, 2019: Total income since incorporation $840,000 Total cash dividends paid 260,000 Total value of stock dividends distributed 60,000 Additional paid-in capital from treasury stock 140,000 What should be the current balance of retained earnings? a.$670,000 b.$580,000 c.$610,000 d.$520,000arrow_forwardPresented below are data for Caracas Corp. 2017 2018 Assets, January 1 $6,840 ? Liabilities, January 1 ? $4,104 Stockholders' Equity, Jan. 1 ? $4,125 Dividends 855 969 Common Stock 912 975 Stockholders' Equity, Dec. 31 ? 3,399 Net Income 1,026 ? Net income for 2018 is... $243 loss. $726 income. $180 income. $726 loss. Please show work.arrow_forward

- Evaluate the company's perfomance and position using financial ratio analysisarrow_forwardHolland Corporation's annual report is as follows. March 31, 2023 March 31, 2024 Net Income $359,000 $438,500 Preferred Dividends 0 0 Total Stockholders' Equity $4,230,000 $5,252,000 Stockholders' Equity attributable to Preferred Stock 0 0 Number of Common Shares Outstanding 288,000 202,000 Based on the information provided, find the rate of return on common stockholders' equity on March 31, 2024. (Round your final answer two decimal places.)arrow_forwardThe balance sheet for Tactex Controls Inc., provincially incorporated in 2018, reported the following components of equity on December 31, 2019. Tactex Controls Inc. Equity Section of the Balance Sheet December 31, 2019 Contributed capital: Preferred shares, $2.3 cumulative, unlimited shares authorized; 22,000 shares issued and outstanding Common shares, unlimited shares authorized; 77,000 shares issued and outstanding Total contributed capital Retained earnings Total equity 394,000 737,000 $1,131,000 380,000 $1,511,000 2020 Jan. 1 Sold 32,000 common shares at $10.84 per share. 5 $ In 2020 and 2021, the company had the following transactions affecting shareholders and the equity accounts: The directors declared a total cash dividend of $233,000 payable on Feb. 28 to the Feb. 5 shareholders of record. Dividends had not been declared for the years 2018. and 2019. All of the preferred shares had been issued during 2018. Feb. 28 Paid the dividends declared on January 5. July 1 Sold…arrow_forward

- Drake Co. summarized select account balances on December 31, 2020, and activity for 2020 in the following table. Retained earnings, beginning balance $60,000 Common stock, $1 par, 100,000 shares authorized, 50,000 shares issued 40,000 Treasury stock, 1,000 shares 10,500 Paid-in capital in excess of par 440,000 Accumulated other comprehensive income 25,000 Investment in stock 100,000 Bonds payable 50,000 Net income for 2020 (not included in retained earnings above) 12,000 Dividends declared and paid during 2020 (not included in retained earnings above) 5,000 Noncontrolling interests 2,500 Based on the information provided, what is total stockholders’ equity on December 31, 2020? Select one: a. $559,000 b. $585,000 c. $564,000 d. $574,000arrow_forwardRancho Cucamonga, Inc. presents the following excerpts from its December 31, 2020 balance sheet: Long-Term Liabilities: Note payable, 8% $200,000 Bonds payable, 10% 1,000,000 Shareholders’ Equity Common stock, par 50,000 Additional paid-in-capital, common stock 350,000 Total contributed capital 400,000 Retained earnings 250,000 Total shareholders’ equity 650,000 The accounting department also conveys the following information: Risk-free rate of return - 3% Risk premium - 4.05% Tax rate – 30% Requirement: Compute Rancho Cucamonga’s weighted average cost of capital.arrow_forwardBalance Sheet Nicole Corporation's year-end 2019 balance sheet lists current assets of $753,000, fixed assets of $603,000, current liabilities of $542,000, and long-term debt of $697,000. What is Nicole's total stockholders' equity? Multiple Choice О о $117,000 $1,356,000 There is not enough information to calculate total stockholder's equity. $1,239,000arrow_forward

- Blabla Grocery Inc., reported the following financial information on December 31, 2019: Common shares issued and outstanding throughout 2019 700,000 shares 6% nonconvertible cumulative preferred shares capital $450,000 Retained Earnings on January 1. 2019 $3,500,000 Basic EPS for 2019 $0.99 per share In addition, the company did not declare any dividends for either 2018 or 2019. The amount which the company would report as Retained Earnings on December 31, 2019 would be: Select one: a. $673,000. b. $693,000. c. $4,220,000. d. $4,173,000. e. $4,166,000.arrow_forwardCYCLONE, INC. Statement of Stockholders' Equity Year ended Dec. 31, 2021 Common Stock Total Stockholders' Retained Earnings Equity Beginning balance Issuances of stock Add: Net income Less: Dividends 2$ 13,000 $ 6,000 $ 19,000 4,000 4,000 Ending balance 2$ 15,000 $ 7,000 $ 22,000arrow_forwardHeerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education