FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

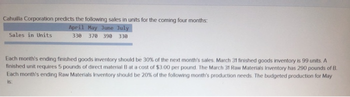

Transcribed Image Text:Cahuilla Corporation predicts the following sales in units for the coming four months:

April May June July

330 370 398 330

Sales in Units

Each month's ending finished goods inventory should be 30% of the next month's sales. March 31 finished goods inventory is 99 units. A

finished unit requires 5 pounds of direct material B at a cost of $3.00 per pound. The March 31 Raw Materials Inventory has 290 pounds of B.

Each month's ending Raw Materials Inventory should be 20% of the following month's production needs. The budgeted production for May

is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- pos Ibie Furniture, Inc., estimates the following number of mattress sales for the first four months of 2019: Month Sales January February 22,000 39,800 March 28,600 April 44,200 Finished goods inventory at the end of December is 6,900 units. Target ending finished goods inventory is 10% of the next month's sales. How many mattresses should be produced in the first quarter of 2019? A. 92,340 mattresses B. 68,840 mattresses TE O C. 87,920 mattresses 1 a O D. 57,760 mattresses Mi F Ju fir https: Cha The es sales 4 Missing Calculator Next http://mi tho ?3 O O O Oarrow_forwardFiarrow_forwardShadee Corporation expects to sell 630 sun shades in May and 420 in June. Each shades sells for $18. Shadee's beginning and ending finished goods inventories for May are 85 and 60 shades, respectively. Ending finished goods inventory for June will be 55 shades. It expects the following unit sales for the third quarter. July August September 530 480 440 Sixty percent of Shadee's sales are cash. Of the credit sales, 52 percent is collected in the month of the sale, 38 percent is collected during the following month, and 10 percent is never collected. Required: Calculate Shadee's total cash receipts for August and September. Note: Do not round your intermediate calculations. Round your answers to the nearest whole dollar. Total Cash Receipts August Septemberarrow_forward

- Valley's managers have made the following additional assumptions and estimates: Estimated sales for July and August are $345,000 and $315,000 respectively Each month's sales are 20% cash sales and 80% credit sales. Each month's credit sales are collected 30% in the month of the sale and 70% in the month following the sale. All of the accounts receivable at June 30 will be collected in July Each month's ending inventory must equal 20% of the cost of the next month's sales. The Cost of Goods Sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following the purchase. All of the accounts payable at June 30 will be paid in July Monthly selling and administrative expenses are always $75,000. Each month $10,000 of this total amount is depreciation expense and the remaining $65,000 relates to expenses that are paid in the month they are incurred The company does not plan to buy or…arrow_forwardNyanza, Incorporated anticipates sales of 55,000 units, 53,000 units, and 56,000 units in July, August, and September, respectively. Company policy is to maintain an ending finished-goods inventory equal to 30% of the following month's sales. On the basis of this information, how many units would the company plan to produce in July?arrow_forwardOne Device makes universal remote controls and expects to sell 526 units in January, 575 in February, 922 in March, 420 in April, and 590 in May. The required ending inventory is 19% of the next month’s sales. Calculate the total production for the first four months (January, February, March and April). Round to the nearest hundreth, two decimal places.arrow_forward

- Wright Lighting Fixtures forecasts its sales in units for the next four months as follows: 20,000 22,000 19,500 18,000 March April May June Wright maintains an ending inventory for each month in the amount of two and one-half times the expected sales in the following month. The ending inventory for February (March's beginning inventory) reflects this policy. Materials cost $7 per unit and are paid for in the month after production. Labor cost is $11 per unit and is paid for in the month incurred. Fixed overhead is $19,000 per month. Dividends of $21,400 are to be paid in May. The firm produced 19,000 units in February. Complete a production schedule and a summary of cash payments for March, April, and May. Remember that production in any one month is equal to sales plus desired ending inventory minus beginning inventory. Note: Input all amounts as positive values except Beginning inventory values under Production Schedule which should be entered with a minus sign. Leave no cells blank…arrow_forwardEarrow_forwardCousin Eddy provides you with his sales forecast for the next four months: April May 750 June July 790 Sales (Units) 670 The company wants to end each month with ending finished goods Inventory equal to 40% of next month's forecasted sales. Finished goods inventory on April 1 is 268 units. Assume July's budgeted production is 700 units. In addition, each finished unit requires four pounds of raw materials and the company wants to end each month with raw materials inventory equal to 30% of next month's production needs. Beginning raw materials inventory for April was 842 pounds. Assume direct materials cost $5 per pound. Required: For May, how many units must be produced? (Hint: This is your production budget) Submit your answer below 700 with all work submitted via email.arrow_forward

- Garza Electronics expects to sell 500 units in January, 250 units in February, and 1,000 units in March. January's beginning inventory is 700 units. Expected sales for the whole year are 7,200 units. Garza has decided on a level monthly production schedule of 600 units (7,200 units/12 months = 600 units per month). What is the expected end- of-month inventory for January, February, and March?arrow_forwardFurniture, Inc., estimates the following number of mattress sales for the first four months of 2024: Month Sales January 10,000 February 14,000 March 13,000 April 16,000 Finished goods inventory at the end of December is 3,000 units. Target ending finished goods inventory is 30% of the next month's sales. How many mattresses need to be produced in January 2024? A) 8,800 mattresses B) 11,200 mattresses C) 13,000 mattresses D) 14,200 mattressesarrow_forwardValley's managers have made the following additional assumptions and estimates: Estimated sales for July and August are $345,000 and $315,000 respectively Each month's sales are 20% cash sales and 80% credit sales. Each month's credit sales are collected 30% in the month of the sale and 70% in the month following the sale. All of the accounts receivable at June 30 will be collected in July Each month's ending inventory must equal 20% of the cost of the next month's sales. The Cost of Goods Sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following the purchase. All of the accounts payable at June 30 will be paid in July Monthly selling and administrative expenses are always $75,000. Each month $10,000 of this total amount is depreciation expense and the remaining $65,000 relates to expenses that are paid in the month they are incurred The company does not plan to buy or sell any plant and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education