FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:pos

Ibie

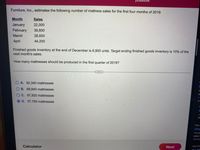

Furniture, Inc., estimates the following number of mattress sales for the first four months of 2019:

Month

Sales

January

February

22,000

39,800

March

28,600

April

44,200

Finished goods inventory at the end of December is 6,900 units. Target ending finished goods inventory is 10% of the

next month's sales.

How many mattresses should be produced in the first quarter of 2019?

A. 92,340 mattresses

B. 68,840 mattresses

TE

O C. 87,920 mattresses

1 a

O D. 57,760 mattresses

Mi

F

Ju

fir

https:

Cha

The es

sales 4

Missing

Calculator

Next

http://mi

tho ?3

O O O O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bonita Industries makes an investment today (January 1, 2020). They will receive $15500 every December 31st for the next six years (2020 – 2025). If Bonita wants to earn 11% on the investment, what is the most they should invest on January 1, 2020?arrow_forwardYou have $14,484.85 in a brokerage account, and you plan to deposit an additional $5,000 at the end of every future year until your account totals $240,000. You expect to earn 14% annually on the account. How many years will it take to reach your goal? Round your answer to the nearest whole number. yearsarrow_forwardA 15-year annuity of thirty $10,000 semiannual payments will begin 11 years from now, with the first payment coming 11.5 years from now. A. if the discount rate is 10 percent compounded monthly, what is the value of this annuity 8 years from now? B. What is the current value of the annuity?arrow_forward

- Starting next month, I plan to invest $500 per month for 10 years to reach my goal of $100,000. What annual rate must I earn to achieve this goal?arrow_forwardWhat will be the future value on December 31, 2023, of 5 annual $60,000 deposits starting on December 31, 2019, if the amounts earn 8% compounded annually? (Click here to access the PV and FV tables to use with this problem.) Round your answer to two decimal places. $ _________arrow_forwardIf the inflation rate is expected to be 3% for the next 10 years, what annual income will be needed 10 years from now in order to have the same purchasing power as $25,000 today?arrow_forward

- An investor plans to invest $500 a year and expects to get a 10.5% return. If the investor makes these contributions at the end of the next 20 years, what is the present value of this investment today?arrow_forwardYou decided to deposit $300 each month starting next month for the next 10 years. If your account will grow to be $100,000 by year 10, what rate of return per month are you earning on your deposits?arrow_forward2. You plan to purchase an office space in Chamblee's Chinatown for $50,000 at the end of year 2021. You estimate that by renting out that office space, you will receive a stream of rental income for the coming eight years at the end of each year as shown in below. After eight years, you estimate that you can still sell the office space for $45,000 at the end of the eighth year. Is this project a good investment if you project that the normal rate of return in this line of business is 12%? How about if the general rate of return is 15% ? 8%? Year 1 $6,000 Year 5 $7,500 Year 2 $6,500 Year 6 $8,500 Year 3 $7,000 Year 7 $8,500 Year 4 $7,500 Year 8 $8,500 3. Based on the information provided in Step 2 above, compute the Internal Rate of Return for the investment. 4. While you were waiting for your first job interview results to come, you spent several dollars to buy a Georgia Educational Lotto and were lucky enough to win a $1 million prize. The prize is to be awarded in 20 annual payments…arrow_forward

- Your retiring will be in 2036. You need to invest some money so that you can earn 10,000 per year for the next 20 years. If the rate of interest is 8% compounded annually, what is the amount of the current investment? $98,181 $90,181 $88,181 $80,181arrow_forwardHow much would you be willing to pay today for an investment that will return $6,800 to you eight years from today if your required rate of return is 12 percent?arrow_forwardA perpetuity with a present value of $80,000 today yields cash flows of $2,500 per quarter. The first cash flow comes in one quarter from today. What is the required return for the perpetuity in APR?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education