Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

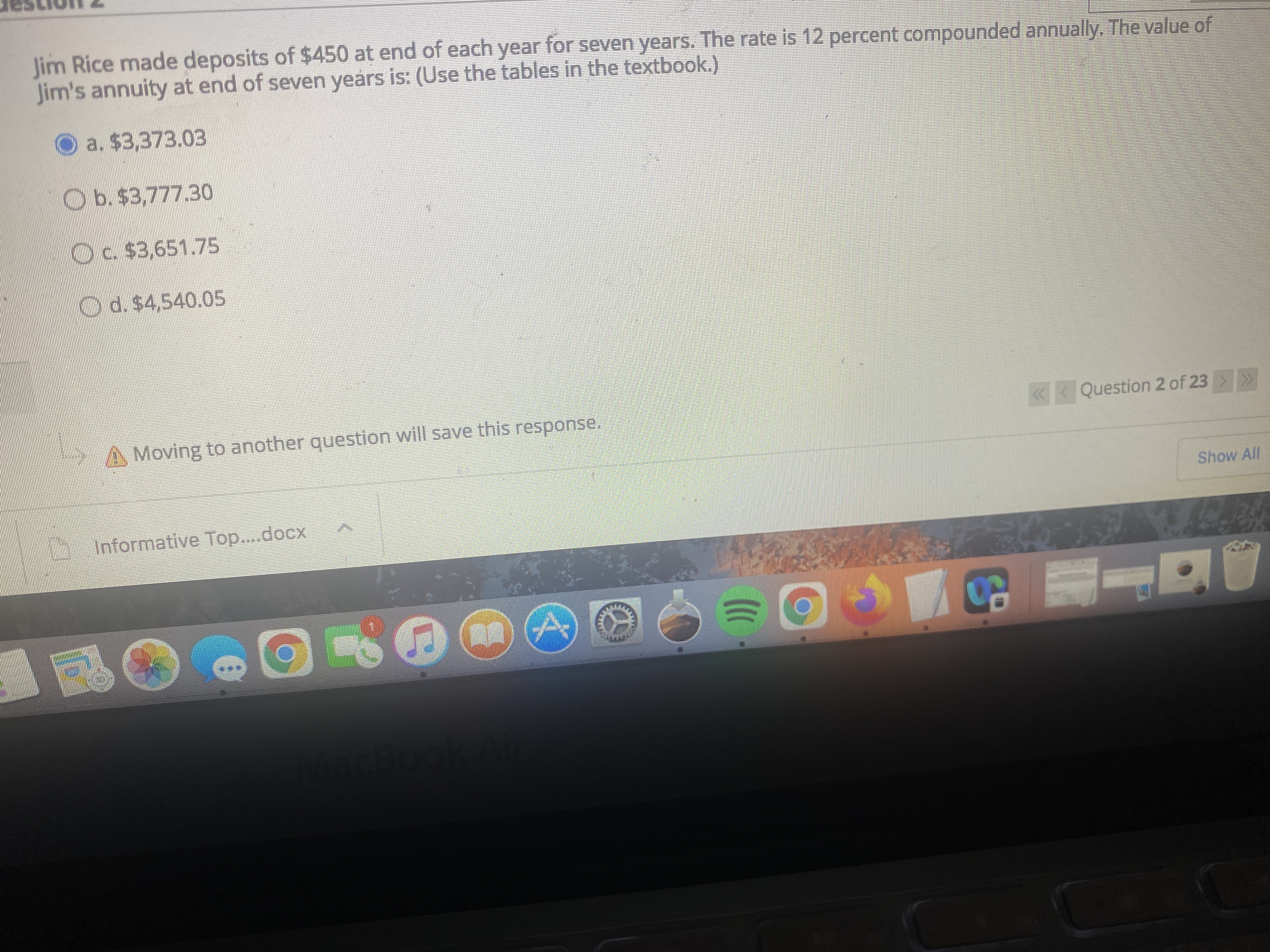

Transcribed Image Text:Jim Rice made deposits of $450 at end of each year for seven years. The rate is 12 percent compounded annually. The value of

Jim's annuity at end of seven years is: (Use the tables in the textbook.)

O a. $3,373.03

Ob.$3,777.30

Oc $3,651.75

Od.$4,540.05

Moving to another question will save this response.

«< Question 2 of 23 >

Show All

Informative Top....docx

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Neelon Corporation has two divisions: Southern Division and Northern Division. The following data are for the most recent operating period: Southern Northern Division Division $ 212,300 $ 129,400 $ 72,182 $ 46,584 $70,300 $ 98,100 $ 42,460 $ 25,880 Total Company $ 341,700 $ 118,766 $ 168,400 $ 68,340 Sales Variable expenses Traceable fixed expenses Common fixed expense The common fixed expenses have been allocated to the divisions on the basis of sales. The Northern Division's break-even sales is closest to:arrow_forwardSnavely, Incorporated, manufactures and sells two products: Product E1 and Product A7. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Product E1 Product A7 Total direct labor-hours Product E1 Product A7 The direct labor rate is $24.10 per DLH. The direct materials cost per unit for each product is given below: Direct Materials Cost per Unit $ 282.00 $ 204.00 Activity Cost Pools Labor-related Machine setups Order size Expected Production 900 600 The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Direct Labor- Total Direct Hours Per Unit Labor-Hours 1,800 2.0 1.0 600 2,400 Activity Measures DLHs setups MHS Estimated Overhead Cost $ 132,400 62,430 976,450 $ 1,171,280 Expected Activity Product E1 Product A7 1,800 1,000 3,700 600 600 3,400 Total 2,400 1,600 7,100 The total overhead applied to Product E1 under…arrow_forwardOver But not over Tax is: Of amount over: $0 $50,000 15% $0 $50,000 $75,000 $7,500 + 25% $50,000 $75,000 $100,000 $13,750 + 34% $75,000 $100,000 $335,000 $22,250 + 39% $100,000 $335,000 $10,000,000 $113,900 + 34% $335,000 $10,000,000 $15,000,000 $3,400,000 + 35% $10,000,000 $15,000,000 $18,333,333 $5,150,000 + 38% $15,000,000 $18,333,333 _______ 35% $0 Refer to the table above: A firm has $12,000,000 in taxable income. What is the firm’s average tax rate?arrow_forward

- Spang Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data: Total machine-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Recently, Job P505 was completed with the following characteristics: Total machine-hours Direct materials Direct labor cost $ The total job cost for Job P505 is closest to: 200 $ 540 7,200 20,000 $ 176,000 $ 2.20arrow_forwardKurtulus Corporation uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month are listed below: Beginning work in process inventory: Units in beginning work in process inventory Materials costs Conversion costs Percent complete with respect to materials Percent complete with respect to conversion Units started into production during the month Units transferred to the next department during the month Materials costs added during the month Conversion costs added during the month Ending work in process inventory: Units in ending work in process inventory Percent complete with respect to materials Percent complete with respect to conversion 700 $ 7,100 $ 2,400 55% 25% 6,600 5,800 $ 110,200 $ 83,300 1,500 70% 55% The cost of ending work in process inventory in the first processing department according to the company's cost system is closest to: (Round "Cost per equivalent unit" to 3 decimal places. Round "Cost…arrow_forwardMarwick Corporation issues 12%, 5 year bonds with a par value of $1,030,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 10%. Wwhat is the bond's issue (selling) price, assuming the following Present Value factors: Present Value of an Annuity (series of payments) Present value of 1 1n= i= (single sum) 12% 3.6048 0.5674 10 6% 7.3601 0.5584 5. 10% 3.7908 0.6209 10 5% 7.7217 0.6139 Multiple Choice $1,030,000 $819,244 $1,507,201 Mc Graw Hill O Type here to search 9:11 PM 96% 3/21/2022 PriSc Insert దుటపర్ F6 FB F9 F10 FIL F12arrow_forward

- Shade Company adopted a standard cost system several years ago. The standard costs for direct labor and direct materials for its single product are as follows: Materials (5 kilograms × $12 per kilogram) = $60 per unit; direct labor (3.5 hours per unit × $20 per hour) = $70 per unit. All materials are issued at the beginning of processing. The operating data shown below were taken from the records for December: In-process beginning inventory In-process ending inventory-80% complete as to labor Units completed during the period Budgeted output Purchases of materials (in kilograms) Total actual direct labor cost incurred Direct labor hours worked (AQ) Materials purchase-price variance Increase in materials inventory in December The direct labor rate variance for December was: Multiple Choice O $3,822 favorable. $7.882 favorable. None 1,040 units 6,860 units 7,440 units 44,000 $ 542,178 27,300 hours $5,280 favorable 3,550 kilogramsarrow_forwardChavez Corporation reported the following data for the month of July: Inventories: Raw materials Work in process Finished goods Additional information: Raw materials purchases Direct labor cost Beginning Ending $40,000 $36,500 $22,500 $30,000 $38,500 $53,500 $72,500 $97,500 $65,500 Manufacturing overhead cost incurred Indirect materials included in manufacturing overhead cost incurred Manufacturing overhead cost applied to Work in Process Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold. The cost of goods manufactured for July is: $10,600 $64,500arrow_forwardgeb 13 slabintice 5:00 er. Enn 1904 190 e Susbried atsioon ²000-0TR and to en 7. Jaja invested P6,700 for one year, part at 8%, part at 10% and the remainder at 12%. The total annual incomes from these investments was P716. The amount of money invested at 12% was P300 more than the amount invested at 8% and 10% combined. Find the amount invested at each ratearrow_forward

- RelyaTech Corporation makes an extra large part to use in one its fabulous products. A total of 19,000 units of this extra large part are produced and used every year. The company's costs of producing the extra large part at this level of activity are below. Direct materials Direct labor Variable manufacturing overhead Supervisor's salary Depreciation of special equipment Allocated general overhead Per Unit $4.10 $8.70 $9.20 $4.60 $3.00 $8.20 (ID#32835) An outside supplier has offered to make the extra large part and sell it to RelyaTech for $29.50 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including the direct labor, can be avoided. The special equipment used to make the extra large part has no salvage value or other use. The allocated general overhead represents fixed costs of the entire RelyaTech company, none of which would be avoided if the part were purchased instead of produced internally. In addition, the space used to make the extra…arrow_forwardOn November 1, Jasper Company loaned another company $230,000 at a 12.0% interest rate. The note receivable plus interest will not be collected until March 1 of the following year. The company's annual accounting period ends on December 31. The amount of interest revenue that should be reported in the first year is: Multiple Choice $4,600. $6,675. $0. here to search 8:01 PM 100% 2/21/2022arrow_forwardRefer to the following selected financlal Information from Texas Electronics. Compute the company's working capital for Year 2 Year 2 Year Cash $ 38,500 $ 33,250 65,000 84,500 Short-term investments 100,000 receivable, Merchandise inventory Accounts net 90,500 126,000 130,000 Prepaid expenses 13,100 393,000 10,700 Plant assets 343,000 108,400 716,000 112,800 Accounts payable Net Cost sales 681,000 of goods sold 395,000 380,000 Multiple Choice $159,700. $259,700.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education