FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

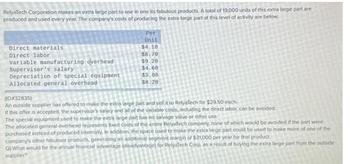

Transcribed Image Text:RelyaTech Corporation makes an extra large part to use in one its fabulous products. A total of 19,000 units of this extra large part are

produced and used every year. The company's costs of producing the extra large part at this level of activity are below.

Direct materials

Direct labor

Variable manufacturing overhead

Supervisor's salary

Depreciation of special equipment

Allocated general overhead

Per

Unit

$4.10

$8.70

$9.20

$4.60

$3.00

$8.20

(ID#32835)

An outside supplier has offered to make the extra large part and sell it to RelyaTech for $29.50 each.

If this offer is accepted, the supervisor's salary and all of the variable costs, including the direct labor, can be avoided.

The special equipment used to make the extra large part has no salvage value or other use.

The allocated general overhead represents fixed costs of the entire RelyaTech company, none of which would be avoided if the part were

purchased instead of produced internally. In addition, the space used to make the extra large part could be used to make more of one of the

company's other fabulous products, generating an additional segment margin of $31,000 per year for that product

O) What would be the annual financial advantage (disadvantage) for RelyaTech Corp, as a result of buying the extra large part from the outside

supplier?

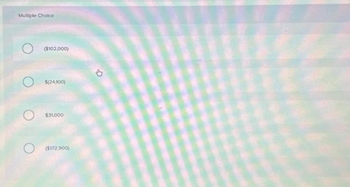

Transcribed Image Text:Multiple Choice

($102,000)

$(24,100)

$31,000

($172,900)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Part "Mendes" is used in one of Shawn's products. The company's Accounting Department reports the following costs of producing the 12,000 units of the part that are needed every year. Direct Materials $4.79 Direct labor $1.16 Variable overhead $2.68 Supervisor's salary $3.38 Depreciation of special equipment $2.67 Allocated general overhead $1.54 An outside supplier has offered to make the part and sell it to the company for $14.86 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $5651 of these allocated general overhead costs would be avoided. What would be the impact on total net income if Shawn accepted the supplier's offer? Round only your final answer to the nearest…arrow_forwardshow answers for letters A and Barrow_forwardI need need help with this one thank you!arrow_forward

- A5arrow_forwardam. 100.arrow_forwardRequired information [The following information applies to the questions displayed below.] Kubin Company's relevant range of production is 18,000 to 22,000 units. When it produces and sells 20,000 units, its average costs per unit are as follows: Average Cost per Unit $ 7.00 $ 4.00 $ 1.50 $ 5.00 $ 3.50 $ 2.50 $ 1.00 $ 0.50 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expensearrow_forward

- Sheridan Company produces 5000 units of part A12E. The following costs were incurred for that level of production: Direct materials $ 65000 Direct labor 170000 Variable overhead 85000 Fixed overhead 175000 If Sheridan buys the part from an outside supplier, $30000 of the fixed overhead is avoidable.What is the relevant cost per unit of part A12E? $99 $70 $93 $64arrow_forwardCost of Services Sold Jean and Tom Perritz own and manage Happy Home Helpers, Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The following total costs are associated with the total cleanings: Direct materials Direct labor Variable overhead Fixed overhead ? $472,500 15,000 18,000 Next year, HHH expects to purchase $25,600 of direct materials. Projected beginning and ending inventories for direct materials are as follows: Direct Materials Inventory Required: Beginning $4,000 2,600 Ending There is no work-in-process inventory and no finished goods inventory; in other words, a cleaning is started and completed on the same day. 1. Prepare a statement of cost of services sold in good form. If an amount is zero, enter "0". Happy Home Helpers, Inc. Statement of Cost of Services Sold For the Coming Year 2. How does this cost of services sold…arrow_forwardNeed help with a practice question from the last unitarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education