FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

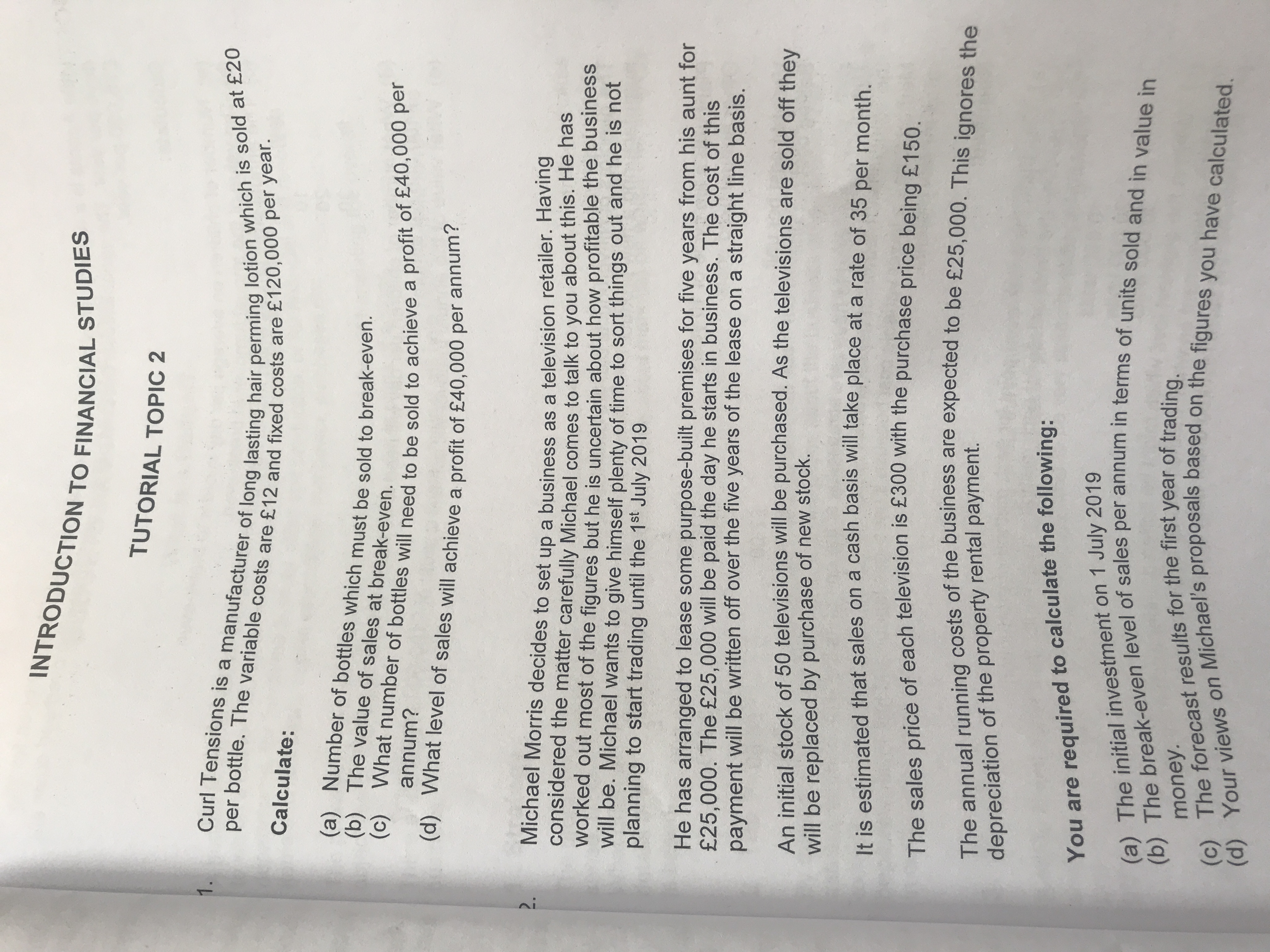

Transcribed Image Text:You are to following:

(c) The results for the of trading.

TUTORIAL TOPIC 2

1.

Calculate:

(b) The value of sales at break-even.

annum?

(d) What level of sales will achieve a profit of £40,000 per annun

Michael Morris decides to set up a business as a television retailer. Having

considered the matter carefully Michael comes to talk to you about this. He has

worked out most of the figures but he is uncertain about how profitable the business

will be. Michael wants to give himself plenty of time to sort things out and he is not

planning to start trading until the 1st July 2019

He has arranged to lease some purpose-built premises for five years from his aunt for

£25,000. The £25,000 will be paid the day he starts in business. The cost of this

payment will be written off over the five years of the lease on a straight line basis.

An initial stock of 50 televisions will be purchased. As the televisions are sold off thev

will be replaced by purchase of new stock.

It is estimated that sales on a cash basis Will take place at a rate of 35 per month

The sales price of each television is £300 with the purchase price being£150

depreciation of the property rental payment.

(a) The initial investment on 1 July 2019

money.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- New information suggests that Holliday Ltd’s monthly fixed costs will rise to £230,000. Marginal cost per unit will remain at £76 and expected demand is still 5,000 units. If at least £60,000 of profit is required by shareholders per month, what is the minimum selling price the company will have to charge per unit? a. £134 b. £143 c. £116 d. £58arrow_forwardA company requires $1400000 is sales to meet its net income target. Its contribution margin is 50% and fixed costs are $300000. What is the company's target net income?arrow_forwardE3 Doni is a self-manufactured, he wants to calculate how much the price for their new product if the targeted initial margin is 65%; given all-in production cost is $15, transport & logistic cost is 5.8% from the production cost, and revenue sharing cost would be 12% from landing cost (production + transport + logistic).arrow_forward

- If the objective of the firm is to get 25% profit, how many units does the firm need to sell if the price per unit is $250? Given information: Annual fixed costs are 114,000, CTO is .65, breakeven point is 175,384.62.arrow_forward= Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.93 million per year Your upfront setup costs to be ready to produce the part would be $7.97 million Your discount rate for this contract is 7.7% a. What is the IRR? b. The NPV is $4.80 million, which is positive, so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? a. What is the IRR? The IRR is (Round to two decimal places)arrow_forward?arrow_forward

- Sinclair Company's product has a selling price of £25 per unit. Last year the company reported a profit of £20,000 and variable expenses totalling £180,000. The product has a 40% contribution margin ratio. Because of competition, Sinclair Company will be forced in the current year to reduce its selling price by £2.00 per unit. How many units must be sold in the current year to earn the same profit as was earned last year? Select one: O A. 15,000 units O B. 12,000 units O C. 16,500 units O D. 12,960 unitsarrow_forward?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education