Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:=

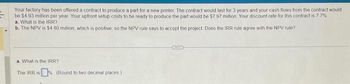

Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would

be $4.93 million per year Your upfront setup costs to be ready to produce the part would be $7.97 million Your discount rate for this contract is 7.7%

a. What is the IRR?

b. The NPV is $4.80 million, which is positive, so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule?

a. What is the IRR?

The IRR is (Round to two decimal places)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- 4arrow_forwardYour firm needs to purchase 1,200 traffic cones from a supplier. One supplier demands apayment of $1,000.00 today plus $10.59 per cone payable in one year. Another supplier willask for no payment today and $11.59 per cone, also payable in one year. If the discountrate is 8.200% per year compounded annually, how much does your firm save (in terms oftoday’s dollars) by taking the less expensive offer compared to the more expensive offer?arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $5.17 million per year. Your upfront setup costs to be ready to produce the part would be $7.81 million. Your discount rate for this contract is 8.4%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm?arrow_forward

- Deutsche Transport can lease a truck for four years at a cost of €38,000 annually. It can instead buy a truck at a cost of €88,000, with annual maintenance expenses of €18,000. The truck will be sold at the end of four years for €24,500. Ignore taxes. a. What is the equivalent annual cost of buying and maintaining the truck if the discount rate is 12%? Note: Do not round intermediate calculations. Enter your answer in euros. Round your answer to the nearest whole number. b. Which is the better option: leasing or buying? a. Equivalent annual cost b. Better optionarrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.93 million per year. Your upfront setup costs to be ready to produce the part would be $7.95 million. Your discount rate for this contract is 7.9%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm? a. What does the NPV rule say you should do? The NPV of the project is $ million. (Round to two decimal places.)arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.06 million per year. Your upfront setup costs to be ready to produce the part would be $7.97 million. Your discount rate for this contract is 8.1%. a. What is the IRR? b. The NPV is $5.05 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule?arrow_forward

- A firm can lease a truck for 4 years at a cost of $35,000 annually. It can instead buy a truck at a cost of $85,000, with annual maintenance expenses of $15,000. The truck will be sold at the end of 4 years for $25,000. a. What is the equivalent annual cost of buying and maintaining the truck if the discount rate is 12%? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Equivalent annual cost b. Which is the better option? Lease O Buyarrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $5.00 million per year. Your upfront setup costs to be ready to produce the part would be $8.00 million. Your discount rate for this contract is 8.0%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm? Question content area bottom Part 1 a. What does the NPV rule say you should do? The NPV of the project is $ enter your response here XX million. (Round to two decimal places.)arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.02 million per year. Your upfront setup costs to be ready to produce the part would be $7.99 million. Your discount rate for this contract is 7.6%. a. What is the IRR? b. The NPV is $5.04 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? a. What is the IRR? The IRR is %. (Round to two decimal places.)arrow_forward

- You have just been offered a contract worth $ 1.15 million per year for 7 years. However, to take the contract, you will need to purchase some new equipment. Your discount rate for this project is 12.4%. You are still negotiating the purchase price of the equipment. What is the most you can pay for the equipment and still have a positive NPV? Question content area bottom Part 1 The most you can pay for the equipment and achieve the 12.4% annual return is $ enter your response here million. Round to two decimal places.)arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.83 million per year. Your upfront setup costs to be ready to produce the part would be $8.13 million. Your discount rate for this contract is 7.9%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm?arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.09 million per year. Your upfront setup costs to be ready to produce the part would be $7.92 million. Your discount rate for this contract is 8.3%. a. What is the IRR? b. The NPV is $5.13 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? a. What is the IRR? The IRR is %. (Round to two decimal places.) b. The NPV is $5.13 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? (Select from the drop-down menu.) The IRR rule with the NPV rule.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education